Sears 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

93

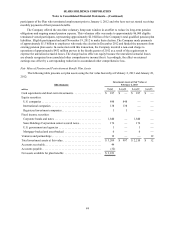

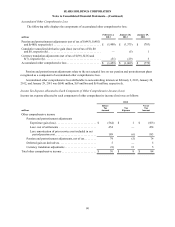

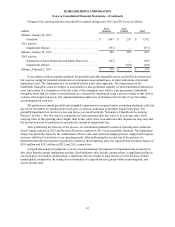

millions February 2,

2013 January 28,

2012

Deferred tax assets and liabilities:

Deferred tax assets:

Federal benefit for state and foreign taxes . . . . . . . . . . . . . . . . . . . . . . . . . . $ 151 $ 151

Accruals and other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 179 188

Capital leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 114 125

NOL carryforwards. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 722 672

Postretirement benefit plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78 134

Pension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,208 818

Deferred revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 202 236

Credit carryforwards. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 605 385

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 163 216

Total deferred tax assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,422 2,925

Valuation allowance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,743)(2,268)

Net deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 679 657

Deferred tax liabilities:

Trade names/Intangibles. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,071 1,097

Property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 156 166

Inventory. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 453 378

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 117 104

Total deferred tax liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,797 1,745

Net deferred tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(1,118) $ (1,088)

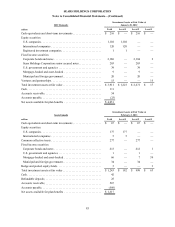

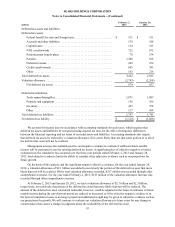

We account for income taxes in accordance with accounting standards for such taxes, which requires that

deferred tax assets and liabilities be recognized using enacted tax rates for the effect of temporary differences

between the financial reporting and tax bases of recorded assets and liabilities. Accounting standards also require

that deferred tax assets be reduced by a valuation allowance if it is more likely than not that some portion of or all of

the deferred tax asset will not be realized.

Management assesses the available positive and negative evidence to estimate if sufficient future taxable

income will be generated to use the existing deferred tax assets. A significant piece of objective negative evidence

evaluated was the cumulative loss incurred over the three-year periods ended February 2, 2013 and January 28,

2012. Such objective evidence limits the ability to consider other subjective evidence such as our projections for

future growth.

On the basis of this analysis and the significant negative objective evidence, for the year ended January 28,

2012, a valuation allowance of $2.1 billion was added to record only the portion of the deferred tax asset that more

likely than not will be realized. Of the total valuation allowance recorded, $317 million was recorded through other

comprehensive income. For the year ended February 2, 2013, $213 million of the valuation allowance increase was

recorded through other comprehensive income.

At February 2, 2013 and January 28, 2012, we had a valuation allowance of $2.7 billion and $2.3 billion,

respectively, to record only the portion of the deferred tax asset that more likely than not will be realized. The

amount of the deferred tax asset considered realizable, however, could be adjusted in the future if estimates of future

taxable income during the carryforward period are reduced or increased, or if the objective negative evidence is in

the form of cumulative losses is no longer present and additional weight may be given to subjective evidence such as

our projections for growth. We will continue to evaluate our valuation allowance in future years for any change in

circumstances that causes a change in judgment about the realizability of the deferred tax asset.