Sears 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

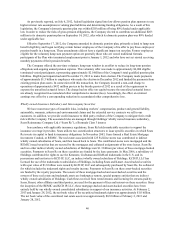

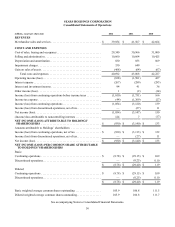

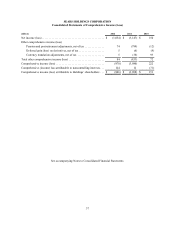

SEARS HOLDINGS CORPORATION

Consolidated Statements of Operations

millions, except per share data 2012 2011 2010

REVENUES

Merchandise sales and services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 39,854 $ 41,567 $ 42,664

COSTS AND EXPENSES

Cost of sales, buying and occupancy. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29,340 30,966 31,000

Selling and administrative . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,660 10,664 10,425

Depreciation and amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 830 853 869

Impairment charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 330 649 —

Gain on sales of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (468)(64)(67)

Total costs and expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40,692 43,068 42,227

Operating income (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (838)(1,501) 437

Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (267)(289)(293)

Interest and investment income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94 41 36

Other income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1(2)(14)

Income (loss) from continuing operations before income taxes . . . . . . . . . . (1,010)(1,751) 166

Income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (44)(1,369)(27)

Income (loss) from continuing operations. . . . . . . . . . . . . . . . . . . . . . . . . . . (1,054)(3,120) 139

Income (loss) from discontinued operations, net of tax. . . . . . . . . . . . . . . . . —(27) 11

Net income (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,054)(3,147) 150

(Income) loss attributable to noncontrolling interests . . . . . . . . . . . . . . . . . . 124 7 (17)

NET INCOME (LOSS) ATTRIBUTABLE TO HOLDINGS’

SHAREHOLDERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(930) $ (3,140) $ 133

Amounts attributable to Holdings’ shareholders: . . . . . . . . . . . . . . . . . . . . .

Income (loss) from continuing operations, net of tax . . . . . . . . . . . . . . . . . . $(930) $ (3,113) $ 122

Income (loss) from discontinued operations, net of tax. . . . . . . . . . . . . . . . . —(27) 11

Net income (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(930) $ (3,140) $ 133

NET INCOME (LOSS) PER COMMON SHARE ATTRIBUTABLE

TO HOLDINGS’ SHAREHOLDERS

Basic:

Continuing operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(8.78) $ (29.15) $ 1.09

Discontinued operations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —(0.25) 0.10

$(8.78) $ (29.40) $ 1.19

Diluted:

Continuing operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(8.78) $ (29.15) $ 1.09

Discontinued operations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —(0.25) 0.10

$(8.78) $ (29.40) $ 1.19

Basic weighted average common shares outstanding . . . . . . . . . . . . . . . . . . 105.9 106.8 111.5

Diluted weighted average common shares outstanding. . . . . . . . . . . . . . . . . 105.9 106.8 111.7

See accompanying Notes to Consolidated Financial Statements.