Sears 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

90

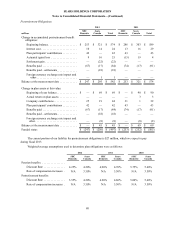

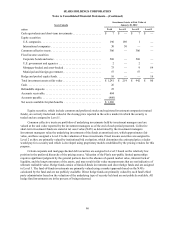

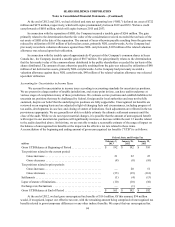

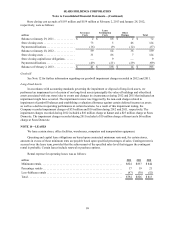

Accumulated Other Comprehensive Loss

The following table displays the components of accumulated other comprehensive loss:

millions February 2,

2013 January 28,

2012 January 29,

2011

Pension and postretirement adjustments (net of tax of $(443), $(492)

and $(480), respectively) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(1,408) $ (1,575) $ (783)

Cumulative unrealized derivative gain (loss) (net of tax of $0, $0

and $0, respectively). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —(5) 1

Currency translation adjustments (net of tax of $(39), $(26) and

$(7), respectively). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (51)(29) 3

Accumulated other comprehensive loss. . . . . . . . . . . . . . . . . . . . . . . . $(1,459) $ (1,609) $ (779)

Pension and postretirement adjustments relate to the net actuarial loss on our pension and postretirement plans

recognized as a component of accumulated other comprehensive loss.

Accumulated other comprehensive loss attributable to noncontrolling interests at February 2, 2013, January 28,

2012, and January 29, 2011 was $(64) million, $(9) million and $(4) million, respectively.

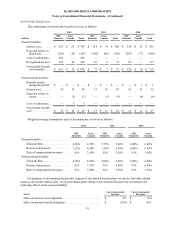

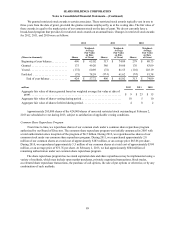

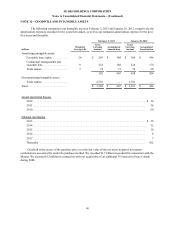

Income Tax Expense Allocated to Each Component of Other Comprehensive Income (Loss)

Income tax expense allocated to each component of other comprehensive income (loss) was as follows:

2012

millions

Before

Tax

Amount Tax

Expense

Net of

Tax

Amount

Other comprehensive income

Pension and postretirement adjustments

Experience gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(564) $ 1 $ (563)

Less: cost of settlements . . . . . . . . . . . . . . . . . . . . . . . . . . 454 — 454

Less: amortization of prior service cost included in net

period pension cost. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 189 (6) 183

Pension and postretirement adjustments, net of tax . . . . . . . . 79 (5) 74

Deferred gain on derivatives. . . . . . . . . . . . . . . . . . . . . . . . . . 5 — 5

Currency translation adjustments . . . . . . . . . . . . . . . . . . . . . . (8) 13 5

Total other comprehensive income . . . . . . . . . . . . . . . . . . . . . . . . $ 76 $ 8 $ 84