Sears 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

Sears Canada Facility is determined pursuant to a borrowing base formula based on inventory and credit card

receivables, subject to certain limitations. At February 2, 2013 we had no borrowings outstanding under the Sears

Canada Facility. At January 28, 2012, we had approximately $101 million ($101 million Canadian) of borrowings

outstanding under the Sears Canada Facility. Availability under this agreement was approximately $503 million

($502 million Canadian) and $415 million ($415 million Canadian), respectively, at February 2, 2013 and

January 28, 2012. The current availability may be reduced by reserves currently estimated by the Company to be

approximately $300 million, which may be applied by the lenders at their discretion pursuant to the Credit Facility

agreement. As a result of judicial developments relating to the priorities of pension liability relative to certain

secured obligations, Sears Canada has executed an amendment to the Sears Canada Credit Facility which would

provide additional security to lenders, with respect to the Company's unfunded pension liability by pledging certain

real estate assets as collateral thereby partially reducing the potential reserve amounts by up to $150 million the

lenders could apply. The potential additional reserve amount may increase or decrease in the future based on

estimated net pension liabilities.

Letters of Credit Facility

Effective March 15, 2013, we agreed to terminate our $500 million uncommitted letter of credit facility dated

January 20, 2011 with Wells Fargo Bank, National Association ("Wells Fargo") in advance of the scheduled

termination date of January 20, 2014, as no letters of credit have been issued and outstanding under the facility since

May 2011. The facility was secured by a first priority lien on cash placed on deposit at Wells Fargo in an amount

equal to 103% of the face value of all issued and outstanding letters of credit.

Debt Repurchase Authorization

In 2005, our Finance Committee of the Board of Directors authorized the repurchase, subject to market

conditions and other factors, of up to $500 million of our outstanding indebtedness in open market or privately

negotiated transactions. Our wholly owned finance subsidiary, Sears Roebuck Acceptance Corp. (“SRAC”), has

repurchased $215 million of its outstanding notes. In 2011, Sears Holdings repurchased $10 million of senior

secured notes, recognizing a gain of $2 million. The unused balance of this authorization is $275 million

Unsecured Commercial Paper

We borrow through the commercial paper markets. At February 2, 2013 and January 28, 2012 , we had

outstanding commercial paper borrowings of $345 million and $337 million, respectively. ESL held $285 million

and $250 million, respectively, of our commercial paper at February 2, 2013 and January 28, 2012, including $169

million and $130 million, respectively, held by Edward S. Lampert. See Note 15 for further discussion of these

borrowings.

Debt Ratings

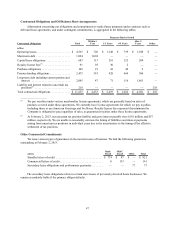

Our corporate family debt ratings at February 2, 2013 appear in the table below:

Moody’s

Investors Service Standard & Poor’s

Ratings Services Fitch Ratings

B3 CCC+ CCC

Domestic Pension Plan Funding

Contributions to our pension plans remain a significant use of our cash on an annual basis. While the

Company's pension plan is frozen, and thus associates do not currently earn pension benefits, the company has a

legacy pension obligation for past service performed by Kmart and Sears associates. During 2012, we contributed

$516 million to our domestic pension plans. We estimate that the domestic pension contribution will be $352 million

in 2013 and approximately $510 million in 2014, though the ultimate amount of pension contributions could be

affected by changes in the applicable regulations as well as financial market and investment performance.