Sears 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

104

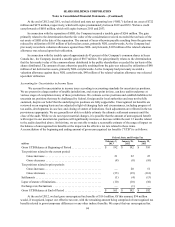

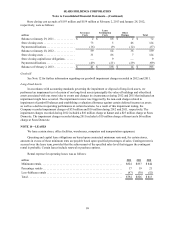

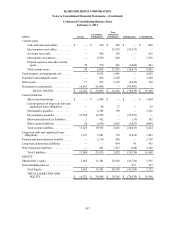

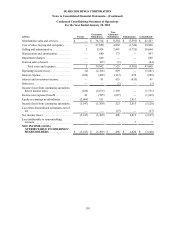

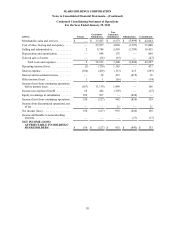

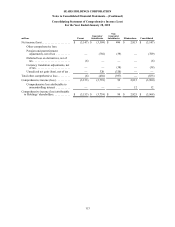

2010

millions Kmart Sears

Domestic Sears

Canada Sears

Holdings

Merchandise sales and services:

Hardlines . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,879 $ 13,692 $ 2,440 $ 21,011

Apparel and Soft Home. . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,809 5,454 2,088 12,351

Food and Drug. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,810 38 — 5,848

Service and Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95 3,091 268 3,454

Total merchandise sales and services. . . . . . . . . . . . . . 15,593 22,275 4,796 42,664

Costs and expenses:

Cost of sales, buying and occupancy. . . . . . . . . . . . . . . . . . 11,757 15,910 3,333 31,000

Selling and administrative. . . . . . . . . . . . . . . . . . . . . . . . . . 3,341 5,940 1,144 10,425

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . 149 620 100 869

Gain on sales of assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7)(46)(14)(67)

Total costs and expenses. . . . . . . . . . . . . . . . . . . . . . . . 15,240 22,424 4,563 42,227

Operating income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 353 $ (149) $ 233 $ 437

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,085 $ 15,299 $ 2,976 $ 24,360

Capital expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 153 $ 216 $ 57 $ 426

NOTE 18—LEGAL PROCEEDINGS

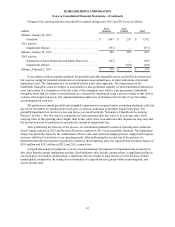

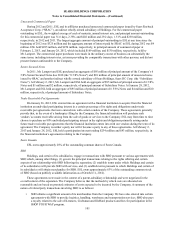

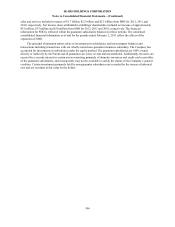

We are a defendant in several lawsuits containing class or collective action allegations in which the plaintiffs

are current and former hourly and salaried associates who allege violations of various wage and hour laws, rules and

regulations pertaining to alleged misclassification of certain of our employees and the failure to pay overtime and/or

the failure to pay for missed meal and rest periods. The complaints generally seek unspecified monetary damages,

injunctive relief, or both. Further, certain of these proceedings are in jurisdictions with reputations for aggressive

application of laws and procedures against corporate defendants. We also are a defendant in several putative or

certified class action lawsuits in California relating to alleged failure to comply with California laws pertaining to

certain operational, marketing and payroll practices. The California laws alleged to have been violated in each of

these lawsuits provide the potential for significant statutory penalties. At this time, the Company is not able to either

predict the outcome of these lawsuits or reasonably estimate a potential range of loss with respect to the lawsuits.

We are subject to various other legal and governmental proceedings and investigations, including some

involving the practices and procedures in our more highly regulated businesses and many involving litigation

incidental to those and other businesses. Some matters contain class action allegations, environmental and asbestos

exposure allegations and other consumer-based, regulatory or qui tam claims, each of which may seek

compensatory, punitive or treble damage claims (potentially in large amounts), as well as other types of relief.

In accordance with accounting standards regarding loss contingencies, we accrue an undiscounted liability for

those contingencies where the incurrence of a loss is probable and the amount can be reasonably estimated, and we

disclose the amount accrued and the amount of a reasonably possible loss in excess of the amount accrued, if such

disclosure is necessary for our financial statements to not be misleading. We do not record liabilities when the

likelihood that the liability has been incurred is probable but the amount cannot be reasonably estimated, or when

the liability is believed to be only reasonably possible or remote.

Because litigation outcomes are inherently unpredictable, our evaluation of legal proceedings often involves a

series of complex assessments by management about future events and can rely heavily on estimates and

assumptions. If the assessments indicate that loss contingencies that could be material to any one of our financial

statements are not probable, but are reasonably possible, or are probable, but cannot be estimated, then we disclose

the nature of the loss contingencies, together with an estimate of the range of possible loss or a statement that such

loss is not reasonably estimable. While the consequences of certain unresolved proceedings are not presently