Sears 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

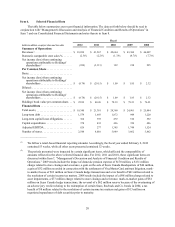

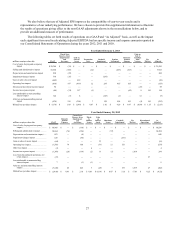

We also believe that use of Adjusted EPS improves the comparability of year-to-year results and is

representative of our underlying performance. We have chosen to provide this supplemental information to illustrate

the results of operations giving effect to the non-GAAP adjustments shown in the reconciliations below, and to

provide an additional measure of performance.

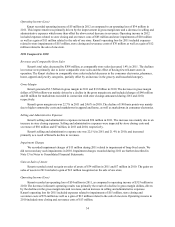

The following tables set forth results of operations on a GAAP and “As Adjusted” basis, as well as the impact

each significant item used in calculating Adjusted EBITDA had on specific income and expense amounts reported in

our Consolidated Statements of Operations during the years 2012, 2011 and 2010.

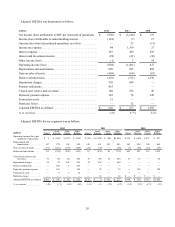

Year Ended February 2, 2013

millions, except per share data GAAP

Closed Store

Reserve, Store

Impairments

and

Severance

Gain on

Sales of

Assets Transaction

Costs Goodwill

Impairment Pension

Settlements

Domestic

Pension

Expense

Gain on

Sale of

Canadian

Joint

Venture Tax

Matters As

Adjusted

Cost of sales, buying and occupancy

impact $ 29,340 $ (35) $ — $ — $ — $ — $ — $ — $ — $ 29,305

Selling and administrative impact 10,660 (105) — (12) — (455)(165) — — 9,923

Depreciation and amortization impact 830 (22) — — — — — — — 808

Impairment charges impact 330 (35) — — (295) — — — — —

Gain on sales of assets impact (468) — 419 — — — — — — (49)

Operating loss impact (838) 197 (419) 12 295 455 165 — — (133)

Interest and investment income impact 94 — — — — — — (25) — 69

Income tax expense impact (44) (74) 157 (5) — — (62) 9 143 124

Loss attributable to noncontrolling

interest impact 124 (7) 8 — (145)(1) — 12 — (9)

After tax and noncontrolling interest

impact (930) 116 (254) 7 150 454 103 (4) 143 (215)

Diluted loss per share impact $ (8.78) $ 1.09 $ (2.40) $ 0.07 $ 1.42 $ 4.29 $ 0.97 $ (0.04) $ 1.35 $ (2.03)

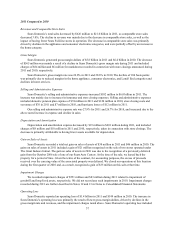

Year Ended January 28, 2012

millions, except per share data GAAP

Domestic

Pension

Expense

Closed Store

Reserve, Store

Impairments

and

Severance

Mark-

to-

Market

Losses

Gain

on

Sales of

Assets Hurricane

Losses Goodwill

Impairment Tax

Matters Discontinued

Operations As

Adjusted

Cost of sales, buying and occupancy

impact . . . . . . . . . . . . . . . . . . . . . . . . $ 30,966 $ — $ (130) $ — $ — $ — $ — $ — $ — $ 30,836

Selling and administrative impact . . . . . . 10,664 (74) (124) — — (12) — — — 10,454

Depreciation and amortization impact . . . 853 — (8) — — — — — — 845

Impairment charges impact . . . . . . . . . . . 649 — (98) — — — (551) — — —

Gain on sales of assets impact . . . . . . . . . (64) — — — 33 — — — — (31)

Operating loss impact. . . . . . . . . . . . . . . . (1,501) 74 360 — (33) 12 551 — — (537)

Other loss impact . . . . . . . . . . . . . . . . . . . (2) — — 6 — — — — — 4

Income tax expense impact . . . . . . . . . . . (1,369) (28) (134) (2) 13 (5) — 1,819 — 294

Loss from discontinued operations, net

of tax impact. . . . . . . . . . . . . . . . . . . (27) — — — — — — — 27 —

Loss attributable to noncontrolling

interest impact . . . . . . . . . . . . . . . . . 7 — (1) (1) — — — — — 5

After tax and noncontrolling interest

impact . . . . . . . . . . . . . . . . . . . . . . . . (3,140) 46 225 3 (20) 7 551 1,819 27 (482)

Diluted loss per share impact. . . . . . . . . . $ (29.40) $ 0.43 $ 2.10 $ 0.03 $ (0.19) $ 0.07 $ 5.16 $ 17.03 $ 0.25 $ (4.52)