Sears 2012 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2012 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30

the gain on sales of assets included a gain of $21 million recognized on the sale of two stores operated under The

Great Indoors format and $12 million recognized on the sale of a store operated under the Kmart format.

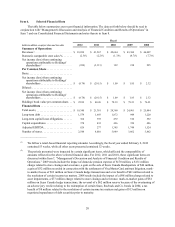

Operating Loss

We recorded an operating loss of $838 million and $1.5 billion in 2012 and 2011, respectively. Operating loss

for 2012 included non-cash charges related to pension settlements and the impairment of Sears Canada goodwill

balances, expenses related to domestic pension plans, store closings and store impairments and severance and

transaction costs, as well as the gains on sales of assets which aggregated to $705 million. Operating loss for 2011

included a non-cash charge of $551 million related to goodwill balances of certain reporting units, expenses related

to domestic pension plans, store closings, severance and hurricane losses and a net gain on the sales of assets which

aggregated to $964 million. Excluding these items, operating loss improved $404 million primarily due to the

improvement in gross margin rate and a decrease in selling and administrative expenses, which were partially offset

by a decline in gross margin dollars, given lower sales.

Interest Expense

We incurred $267 million and $289 million in interest expense during 2012 and 2011, respectively. The

decrease is due to lower average outstanding borrowings.

Income Taxes

Our income tax effective rate was 4.4% in 2012 and 78.2% in 2011. The 2012 tax rate continues to reflect the

effect of not recognizing the benefit of current period losses in certain domestic jurisdictions where it is not more

likely than not that such benefits will be realized. The prior year tax rate is the result of significant tax matters in

2011 which included a non-cash charge of $1.8 billion to establish a valuation allowance against certain deferred

income tax assets.

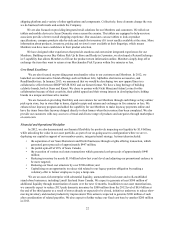

2011 Compared to 2010

Net Income (Loss) from Continuing Operations Attributable to Holdings' Shareholders

We recorded a net loss from continuing operations attributable to Holdings' shareholders of $3.1 billion

($29.15 loss per diluted share from continuing operations) for 2011, as compared to net income from continuing

operations of $122 million ($1.09 per diluted share from continuing operations) in 2010. Our results for 2011 and

2010 were affected by a number of significant items, including a $1.8 billion non-cash charge to establish a

valuation allowance against our domestic deferred tax assets in 2011. Our net loss from continuing operations as

adjusted for these significant items was $482 million ($4.52 loss per diluted share from continuing operations) for

2011 and our net income from continuing operations adjusted for these similar significant items was $220 million

($1.97 per diluted share from continuing operations) for 2010. The decrease in net income for the year reflected a

decrease in operating income of $1.9 billion, including the impact of non-cash impairment charges and charges

related to store closures. Excluding these items, operating income declined $1.1 billion, primarily related to a

decline in our gross margin dollars, given lower sales, and a decline in gross margin rate of 180 basis points, and an

increase in selling and administrative expenses.

Revenues and Comparable Store Sales

Revenues decreased $1.1 billion, or 2.6%, to $41.6 billion in 2011, as compared to revenues of $42.7 billion in

2010. The decline in revenues was primarily a result of a 2.2% decrease in domestic comparable stores sales and the

effect of having fewer Kmart and Sears Full-line stores in operation. Additionally, Sears Canada had a 7.7% decline

in comparable store sales, which was partially offset by an increase of $171 million due to changes in the Canadian

foreign exchange rate.

For the year, domestic comparable store sales declined 2.2%, with declines of 3.0% at Sears Domestic and

1.4% at Kmart. Decreases in sales at Sears Domestic were driven by appliances and consumer electronics, and were

partially offset by increases in the home category. The Kmart declines in comparable store sales included decreases