Sears 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

102

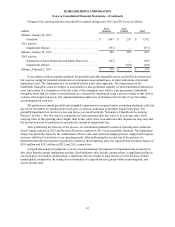

• SHO receives commissions from the Company for the sale of merchandise made through www.sears.com,

extended service agreements, delivery and handling services and credit revenues.

• The Company provides SHO with shared corporate services. These services include accounting and

finance, legal, human resources, information technology and real estate.

Amounts due to or from SHO are non-interest bearing, settled on a net basis, and have payment terms of 10

days after the invoice date. The Company invoices SHO on a weekly basis. At February 2, 2013, Holdings reported

a net amount receivable from SHO of $79 million in the Accounts receivable line of the Consolidated Balance Sheet.

Amounts related to the sale of inventory and related services, royalties, and corporate shared services was $513

million, and the net amounts SHO earned related to commissions was $60 million during the period following the

separation of SHO from October 12, 2012 through February 2, 2013. Additionally, the Company has guaranteed

lease obligations for certain SHO store leases that were assigned as a result of the separation. See Note 4 for further

information related to these guarantees.

Also in connection with the separation, the Company entered into an agreement with SHO and the agent under

SHO's secured credit facility, whereby the Company committed to continue to provide services to SHO in

connection with a realization on the lender's collateral after default under the secured credit facility, notwithstanding

SHO's default under the underlying agreement with us, and to provide certain notices and services to the agent, for

so long as any obligations remain outstanding under the secured credit facility.

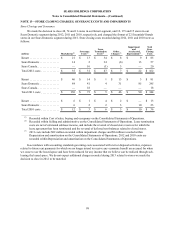

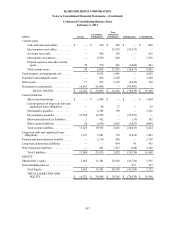

NOTE 16—SUPPLEMENTAL FINANCIAL INFORMATION

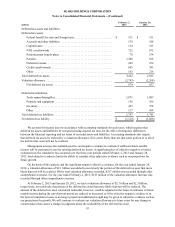

Other long-term liabilities at February 2, 2013 and January 28, 2012 consisted of the following:

millions February 2,

2013 January 28,

2012

Unearned revenues. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 843 $ 778

Self-insurance reserves . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 714 743

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 569 665

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,126 $ 2,186

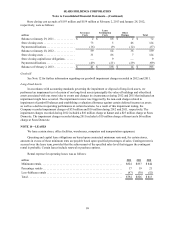

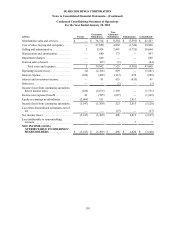

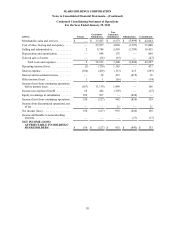

NOTE 17—SUMMARY OF SEGMENT DATA

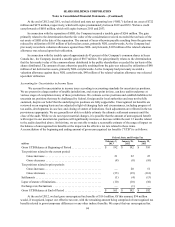

These reportable segment classifications are based on our business formats, as described in Note 1. The Kmart

and Sears Canada formats each represent both an operating and reportable segment. The Sears Domestic reportable

segment consists of the aggregation of several business formats. These formats are evaluated by our Chief Operating

Decision Maker ("CODM") to make decisions about resource allocation and to assess performance.

On February 1, 2013, Mr. Lampert became Chief Executive Officer in addition to his role as Chairman of the

Board. We will assess any potential impact on the business segment information used by our CODM to operate the

Company on an ongoing basis.

Each of these segments derives its revenues from the sale of merchandise and related services to customers,

primarily in the United States and Canada. The merchandise and service categories are as follows:

(i) Hardlines—consists of appliances, consumer electronics, lawn and garden, tools and hardware,

automotive parts, household goods, toys, housewares and sporting goods;

(ii) Apparel and Soft Home—includes women’s, men’s, kids, footwear, jewelry, accessories and soft home;

(iii) Food and Drug—consists of grocery and household, pharmacy and drugstore; and

(iv) Service and Other—includes repair, installation and automotive service and extended contract revenue as

well as revenues earned in connection with our agreements with SHO.