Sears 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Operating Income (Loss)

We recorded an operating loss of $1.5 billion in 2011, as compared to operating income of $437 million in

2010. Operating loss for 2011 included a $551 million non-cash impairment charge related to goodwill balances of

certain reporting units, expenses related to domestic pension plans, store closings, severance and hurricane losses,

and a net gain on sales of assets, which aggregated to $964 million. Operating income for 2010 included expenses

related to domestic pension plans, store closings and severance and a gain on sale of assets, which aggregated to

$121 million. The decline in operating income of $1.9 billion was primarily the result of a decline in our gross

margin dollars, given lower overall sales, and a decline in our gross margin rate of 180 basis points and an increase

in the above noted charges.

Other Loss

Other loss is primarily comprised of mark-to-market and settlement gains and losses on Sears Canada hedge

transactions. Total net mark-to-market and settlement losses of $1 million and $15 million were recorded on these

transactions in 2011 and 2010, respectively. See Notes 4 and 5 to the Consolidated Financial Statements for further

information regarding these transactions.

Income Taxes

Our income tax expense effective tax rate for the year was 78.2% in 2011 and 16.3% in 2010. The increase in

our tax rate was primarily due to several significant tax matters, which included a non-cash charge of $1.8 billion to

establish a valuation allowance against certain deferred income tax assets and the nondeductible nature of our

goodwill impairment.

Business Segment Results

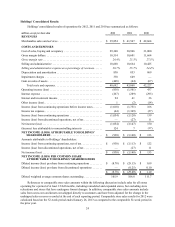

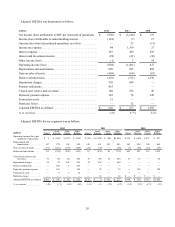

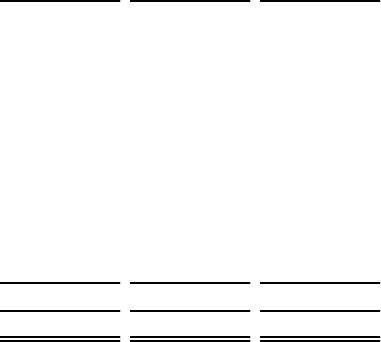

Kmart

Kmart results and key statistics were as follows:

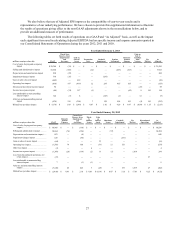

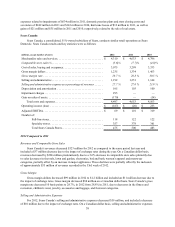

millions, except number of stores 2012 2011 2010

Merchandise sales and services. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 14,567 $ 15,285 $ 15,593

Comparable store sales %. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3.7)% (1.4)% 0.8%

Cost of sales, buying and occupancy. . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,158 11,818 11,757

Gross margin dollars . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,409 3,467 3,836

Gross margin rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23.4 % 22.7 % 24.6%

Selling and administrative. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,284 3,371 3,341

Selling and administrative expense as a percentage of revenues . . . . . . 22.5 % 22.1 % 21.4%

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 147 149 149

Impairment charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 15 —

Gain on sales of assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (37) (34) (7)

Total costs and expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,562 15,319 15,240

Operating income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5 $ (34) $ 353

Adjusted EBITDA. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 201 $ 172 $ 508

Total Kmart stores . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,221 1,305 1,307