Sears 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129

|

|

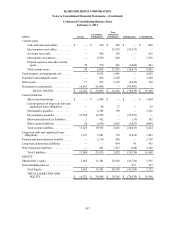

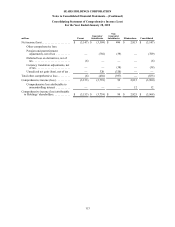

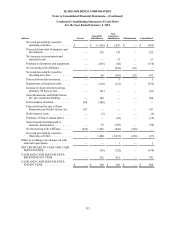

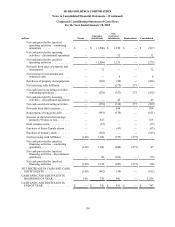

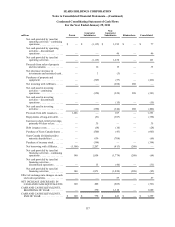

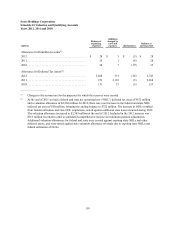

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

114

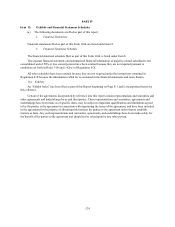

Consolidating Statement of Comprehensive Income (Loss)

For the Year Ended January 29, 2011

millions Parent Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Net income (loss). . . . . . . . . . . . . . . . . . . . $ 150 $ (127) $ 953 $ (826) $ 150

Other comprehensive income (loss):

Pension and postretirement

adjustments, net of tax . . . . . . . . . . — 38 (50) — (12)

Deferred loss on derivatives, net of

tax . . . . . . . . . . . . . . . . . . . . . . . . . . (9) — — — (9)

Currency translation adjustments, net

of tax . . . . . . . . . . . . . . . . . . . . . . . . (3) — 96 — 93

Unrealized net gain (loss), net of tax .— 62 (62) — —

Total other comprehensive income (loss) .(12) 100 (16) — 72

Comprehensive income (loss) . . . . . . . . . . 138 (27) 937 (826) 222

Comprehensive income attributable

to noncontrolling interest . . . . . . . . — — — (71)(71)

Comprehensive income (loss) attributable

to Holdings’ shareholders. . . . . . . . . . . . $ 138 $ (27) $ 937 $ (897) $ 151