Sears 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements

61

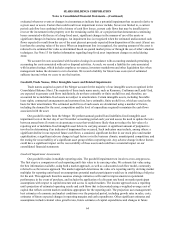

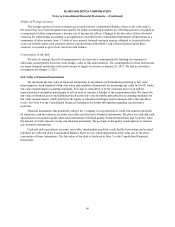

NOTE 1—SUMMARY OF SIGNFICANT ACCOUNTING POLICIES

Nature of Operations, Consolidation and Basis of Presentation

Sears Holdings Corporation (“Holdings”) is the parent company of Kmart Holding Corporation (“Kmart”) and

Sears, Roebuck and Co. (“Sears”). Holdings (together with its subsidiaries, “we,” “us,” “our,” or the “Company”)

was formed as a Delaware corporation in 2004 in connection with the merger of Kmart and Sears (the “Merger”), on

March 24, 2005. We are an integrated retailer with 2,019 full-line and 54 specialty retail stores in the United States,

operating through Kmart and Sears, and 475 full-line and specialty retail stores in Canada operating through Sears

Canada Inc. (“Sears Canada”), a 51%-owned subsidiary. We have three reportable segments: Kmart, Sears Domestic

and Sears Canada.

The consolidated financial statements include all majority-owned subsidiaries in which Holdings exercises

control. Investments in companies in which Holdings exercises significant influence, but which we do not control

(generally 20% to 50% ownership interest), are accounted for under the equity method of accounting. Investments in

companies in which we have less than a 20% ownership interest and do not exercise significant influence are

accounted for at cost. All intercompany transactions and balances have been eliminated.

Separation of Sears Hometown and Outlet Businesses

On October 11, 2012, we completed the separation of our Sears Hometown and Outlet businesses through a

rights offering transaction. Holdings received gross proceeds of $446.5 million with respect to the transaction,

consisting of $346.5 million for the sale of Sears Hometown and Outlet Stores, Inc. ("SHO") common shares and

$100 million through a dividend from SHO prior to the separation. Prior to the separation, SHO entered into an

asset-based senior secured revolving credit facility with a group of financial institutions to provide (subject to

availability under a borrowing base) for aggregate maximum borrowings of $250 million. Borrowings of $100

million from this revolving credit facility were used to fund the dividend paid to Holdings. We accounted for this

separation in accordance with accounting standards applicable to common control transactions as ESL Investments,

Inc. (together with its affiliated fund, "ESL") is a majority shareholder of Holdings and became a majority

shareholder of SHO as a result of exercising subscription rights pursuant to the rights offering. Accordingly, we

classified the difference between the proceeds received and the carrying value of net assets contributed to SHO as a

reduction of capital in excess of par value in the Consolidated Statement of Equity for the period ended February 2,

2013.

In connection with the separation, Holdings and certain of its subsidiaries entered into various agreements with

SHO under the terms described in Note 15. Because of the various agreements with SHO, the Company has

determined that it has significant continuing cash flows with SHO. Accordingly, the operating results for SHO

through the date of the separation are presented within the consolidated continuing operations of Holdings and the

Sears Domestic segment in the accompanying Consolidated Financial Statements. See Note 15 to the Consolidated

Financial Statements for further information related to the agreements with SHO.

Spin-Off of Orchard Supply Hardware Stores Corporation

On December 30, 2011, we completed the spin-off to our shareholders of all the capital stock of Orchard

Supply Hardware Stores Corporation (“Orchard”) that was owned by Holdings immediately prior to the spin-off,

consisting of common stock that represented approximately 80% of the voting power of Orchard's outstanding

capital stock and preferred stock that represented 100% of Orchard's outstanding nonvoting capital stock. In

connection with the spin-off, Holdings and certain of its subsidiaries entered into various agreements with Orchard,

including a distribution agreement, a transition services agreement, an appliance sale and consignment agreement

and brand license agreements. In addition, certain tax matters between Holdings and Orchard are governed by a tax

sharing agreement entered into in 2005.

Holdings has no significant continuing involvement in the operations of Orchard. Accordingly, the operating

results for Orchard are presented as discontinued operations in the accompanying Consolidated Statements of

Operations for the years ended January 28, 2012 and January 29, 2011. In addition, the cash flows from operating,

investing and financing activities for Orchard have been separately stated as discontinued operations in the