Sears 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

88

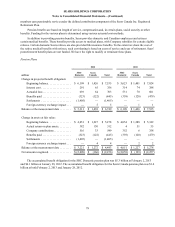

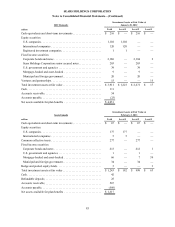

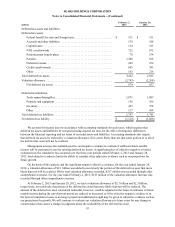

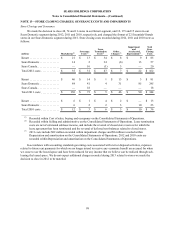

Sears Canada

January 29,

2011

Balance

Net Realized and

Unrealized

Gains/(Losses) Purchases Sales and

Settlements

Net Transfers

Into/(Out of)

Level 3

January 28,

2012

Balance

millions

Fixed income securities:

Corporate bonds and

notes . . . . . . . . . . . . . . . $ 2 $ — $ — $ — $ (2) $ —

Mortgage backed-and

asset-backed . . . . . . . . . 69 5 — (10) — 64

Hedge and pooled equity

funds . . . . . . . . . . . . . . . . 113 (3) — (94) — 16

Total Level 3 investments. . $ 184 $ 2 $ — $ (104) $ (2) $ 80

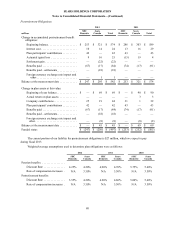

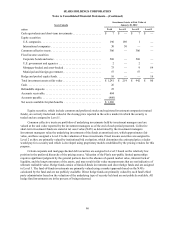

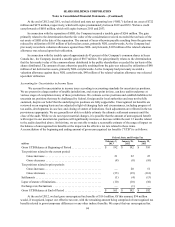

NOTE 8—EARNINGS PER SHARE

The following tables set forth the components used to calculate basic and diluted earnings (loss) per share from

continuing operations attributable to Holdings' shareholders. Restricted stock awards for 2012 and 2011 were not

included in the computation of diluted loss per share from continuing operations attributable to Holdings'

shareholders because the effect of their inclusion would have been antidilutive.

millions, except earnings per share 2012 2011 2010

Basic weighted average shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105.9 106.8 111.5

Dilutive effect of restricted stock and stock options . . . . . . . . . . . . . . . . . . . . — — 0.2

Diluted weighted average shares. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105.9 106.8 111.7

Net income (loss) from continuing operations attributable to Holdings'

shareholders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(930) $ (3,113) $ 122

Earnings (loss) per share from continuing operations attributable to

Holdings' shareholders:

Basic. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(8.78) $ (29.15) $ 1.09

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(8.78) $ (29.15) $ 1.09

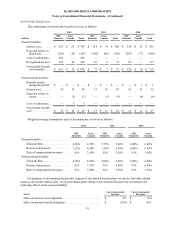

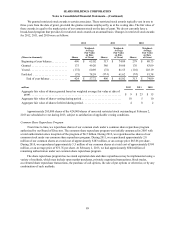

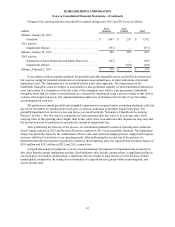

NOTE 9—EQUITY

Stock-based Compensation

We account for stock-based compensation using the fair value method in accordance with accounting

standards regarding share-based payment transactions. We recorded $15 million, $14 million and $9 million in total

compensation expense relative to stock-based compensation arrangements during 2012, 2011, and 2010,

respectively. At February 2, 2013, we had $10 million in total compensation cost related to nonvested awards, which

is expected to be recognized over approximately the next three years.

We do not currently have an employee stock option plan and at February 2, 2013, there are no outstanding

options.