Sears 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

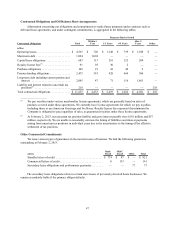

percentage-point change in the assumed health care cost trend rate would have the following effects on the

postretirement liability:

millions 1 percentage-point

Increase 1 percentage-point

Decrease

Effect on total service and interest cost components. . . . . . . . . . . . . $ 1 $ (1)

Effect on postretirement benefit obligation . . . . . . . . . . . . . . . . . . . . $ 31 $ (27)

Income Taxes

We account for income taxes according to accounting standards for such taxes. Deferred tax assets and

liabilities are recognized for the future tax consequences attributable to differences between the book basis and tax

basis of assets and liabilities. Deferred tax assets and liabilities are measured using enacted tax rates expected to

apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. If

future utilization of deferred tax assets is uncertain, the Company may record a valuation allowance against certain

deferred tax assets. In evaluating our ability to recover our deferred tax assets within the jurisdiction from which

they arise, we consider all available positive and negative evidence, including scheduled reversals of deferred tax

liabilities, projected future taxable income, tax planning strategies, and results of recent operations. In projecting

future taxable income, we begin with historical results adjusted for the results of discontinued operations and

changes in accounting policies and incorporate assumptions including the amount of future state, federal and foreign

pre-tax operating income, the reversal of temporary differences, and the implementation of feasible and prudent tax

planning strategies. In evaluating the objective evidence that historical results provide, we consider cumulative

operating income (loss) over the past several years. These assumptions require significant judgment about the

forecasts of future taxable income. After consideration of evidence regarding the ability to realize our deferred tax

assets, we established a valuation allowance against certain deferred income tax assets in 2012 and 2011. The

Company continues to monitor its operating performance and evaluate the likelihood of the future realization of

these deferred tax assets. At the end of 2012, we had a state separate entity deferred tax asset of $145 million. In the

event the Company does not achieve its forecasted results for 2013, an additional valuation allowance may be

required.

In accordance with accounting standards for uncertain tax positions, we record unrecognized tax benefits for

positions taken or expected to be taken on tax returns, including the decision to exclude certain income or

transactions from a return, when a more-likely-than-not threshold is met for a tax position and management believes

that the position will be sustained upon examination by the taxing authorities. Further, we record the largest amount

of the unrecognized tax benefit that is greater than 50% likely of being realized upon settlement. Management

evaluates each position based solely on the technical merits and facts and circumstances of the position, assuming

the position will be examined by a taxing authority having full knowledge of all relevant information. Significant

management judgment is required to determine whether the recognition threshold has been met and, if so, the

appropriate amount of unrecognized tax benefits to be recorded in the Consolidated Financial Statements.

Management reevaluates tax positions each period in which new information about recognition or measurement

becomes available.

Significant management judgment is required in determining our provision for income taxes, deferred tax

assets and liabilities and the valuation allowance recorded against our net deferred tax assets, if any. As further

described above, management considers estimates of the amount and character of future taxable income in assessing

the likelihood of realization of deferred tax assets. Our actual effective tax rate and income tax expense could vary

from estimated amounts due to the future impacts of various items, including changes in income tax laws, tax

planning and the Company's forecasted financial condition and results of operations in future periods. Although

management believes current estimates are reasonable, actual results could differ from these estimates.

Domestic and foreign tax authorities periodically audit our income tax returns. These audits include questions

regarding our tax filing positions, including the timing and amount of deductions and the allocation of income

among various tax jurisdictions. In evaluating the exposures associated with our various tax filing positions, we

record reserves in accordance with accounting standards for uncertain tax positions. A number of years may elapse

before a particular matter, for which we have established a reserve, is audited and fully resolved. Management's