Sears 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

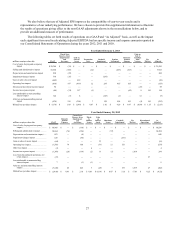

in the consumer electronics, pharmacy, home, apparel and jewelry categories, partially offset by an increase in the

grocery and household category.

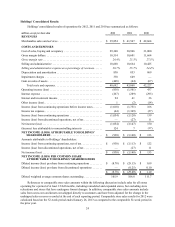

Gross Margin

We generated gross margin of $10.6 billion in 2011 and $11.7 billion in 2010. The total decline in gross

margin dollars of $1.1 billion was primarily driven by decreases in the gross margin rate across all of our segments,

and included charges of $130 million and $12 million in 2011 and 2010, respectively, related to store closures and an

increase of $51 million related to the impact of foreign currency exchange rates on gross margin at Sears Canada.

Kmart's gross margin rate declined 190 basis points in 2011 mainly due to higher commodity costs and

markdowns in apparel and home, markdowns in consumer electronics, as well as declines in most other categories.

Sears Domestic's gross margin rate declined 180 basis points in 2011 primarily due to reduced margins in the home

appliance, consumer electronics, and Lands' End categories and declines in home services. Sears Canada's gross

margin rate declined 170 basis points in 2011 as a result of clearing inventory, due to an enhanced focus on

improving inventory productivity.

Selling and Administrative Expenses

Our selling and administrative expenses increased $239 million in 2011 to $10.7 billion. Domestic selling and

administrative expenses increased $132 million from last year predominately due to increases in insurance and store

closing expenses. Selling and administrative expenses at Sears Canada for 2011 increased $107 million from last

year, and included an increase of $42 million related to the impact of foreign currency exchange rates. On a

Canadian dollar basis, selling and administrative expenses increased by $65 million primarily due to increased

investment in strategic projects and severance expense.

Selling and administrative expenses for 2011 included domestic pension plan expense of $74 million, store

closing costs and severance of $124 million and $12 million of hurricane losses. Selling and administrative expenses

for 2010 included domestic pension plan expense of $120 million and store closing costs and severance of $14

million.

Selling and administrative expenses as a percentage of revenues (“selling and administrative expense rate”)

were 25.7% for 2011 and 24.4% for 2010, and increased as a result of the above noted increase in selling and

administrative expenses, as well as the decline in revenues.

Depreciation and Amortization

Depreciation and amortization expense decreased by $16 million during 2011 to $853 million and included

charges of $8 million and $10 million in 2011 and 2010, respectively, taken in connection with store closings. The

decrease is primarily attributable to having fewer assets available for depreciation.

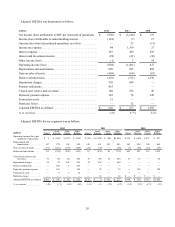

Impairment Charges

We recorded impairment charges of $551 million and $98 million during 2011 related to impairment of

goodwill and long-lived assets, respectively. We did not record any such impairments in 2010. Impairment charges

recorded during 2011 are further described in Notes 12 and 13 in Notes to Consolidated Financial Statements.

Gain on Sales of Assets

We recorded a gain on the sales of assets of $64 million during 2011 and $67 million in 2010. Gain on sales of

assets for 2011 included a gain of $21 million recognized on the sale of two stores operated under The Great Indoors

format and $12 million recognized on the sale of a store operated under the Kmart format. Gain on sales of assets for

2010 was impacted by the recognition of previously deferred gains on sales of assets. We sold a Sears Auto Center

in October 2006, at which time we leased back the property for a period of time. Given the terms of the contract, for

accounting purposes, the excess of proceeds received over the carrying value of the associated property was

deferred. We closed our operations at this location during the first quarter of 2010 and, as a result, recognized a gain

of $35 million on this sale at that time.