Samsung 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

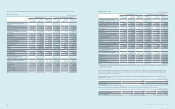

106 107

2013 SAMSUNG ELECTRONICS ANNUAL REPORT

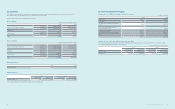

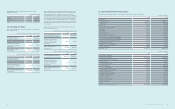

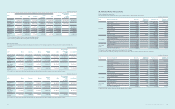

(2) Summarized consolidated statements of comprehensive income

(In millions of Korean won)

Samsung Display and its subsidiaries

2013 2012

Sales 29,478,707 21,737,347

Net income 2,669,623 2,329,078

Other comprehensive income (26,415) (82,279)

Total comprehensive income attributable to: 2,643,208 2,246,799

Owners of the parent 2,631,672 2,252,282

Non-controlling interests 11,536 (5,483)

(3) Summarized consolidated statements of cash ows

(In millions of Korean won)

Samsung Display and its subsidiaries

2013 2012

Cash ows from operating activities 7,748,974 6,073,334

Cash ows from investing activities (10,321,562) (3,659,543)

Cash ows from nancing activities (1,339,815) 1,004,134

Exchange rate effect on foreign currency (cash) 13,546 (7,152)

Increase (decrease) in cash and cash equivalents (3,898,857) 3,410,773

Cash and cash equivalents at beginning of period 5,341,713 1,930,940

Cash and cash equivalents at end of period 1,442,856 5,341,713

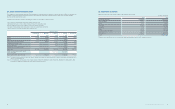

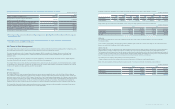

36. Business Combination

Samsung Electronics America, the Company’s subsidiary, acquired 100% of

equity shares of NeuroLogica, with a closing date of January 28, 2013 and

the entity became part of the consolidation as of the same date.

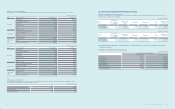

(A) Overview of the acquired company

Name of the acquired company NeuroLogica

Headquarters location Danvers, MA. USA

Representative director Eric Bailey

Classication of

the acquired company Non-listed company

Current relationship with

the Company Subsidiary

(B) Purchase price allocation

The following table summarizes the consideration paid for NeuroLogica,

the amounts of the assets acquired and liabilities assumed as of

the acquisition date.

(In millions of Korean won)

Amount

Ⅰ. Consideration transferred ₩167,819

Ⅱ. Identiable assets and liabilities

Cash and cash equivalents 664

Trade and other receivables 7,301

Inventories 8,576

Property, plant and equipment 1,052

Intangible assets 51,222

Trade and other payables (8,265)

Deferred income tax liabilities (8,630)

Total net identiable assets 51,920

Ⅲ. Goodwill ₩115,899

Had NeuroLogica been consolidated on January 1, 2013, revenue would

increase by ₩1,043 million and net loss would increase by ₩403 million on

the consolidated statement of income. Revenue and net loss contributed

by NeuroLogica after the consolidation date of January 28, 2013 amount to

₩38,646 million and ₩385 million, respectively.

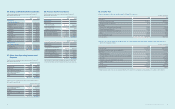

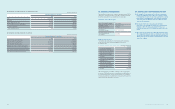

37. Events after the Reporting Period

(A) On January 1, 2014, an amendment to local income tax laws was

promulgated in Republic of Korea, where the controlling Company

is domiciled. This is expected to affect the measurements of current

tax for annual periods beginning on or after January 1, 2014 and of

deferred tax assets resulting from the decline in future tax effects

on tax credit carryforwards.

(B) On January 15, 2014, the Company disposed of all shares

(percentage of ownership: 42.54%) of Samsung Corning Precision

Materials for USD 1,902 million and acquired 2,300 shares of

convertible preferred stocks of Corning Incorporated for USD 2,300

million.

(C) Based on the Board of Directors resolution dated January 24, 2014,

the Company decided to participate in a capital increase (investment

amount: ₩301,000 million) to expand the production capacity and to

fund the development of biosimilars of Samsung Biologics, a related

party of the Company.