Samsung 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 71

2013 SAMSUNG ELECTRONICS ANNUAL REPORT

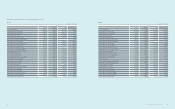

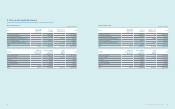

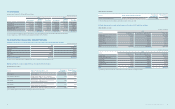

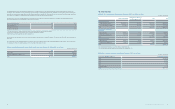

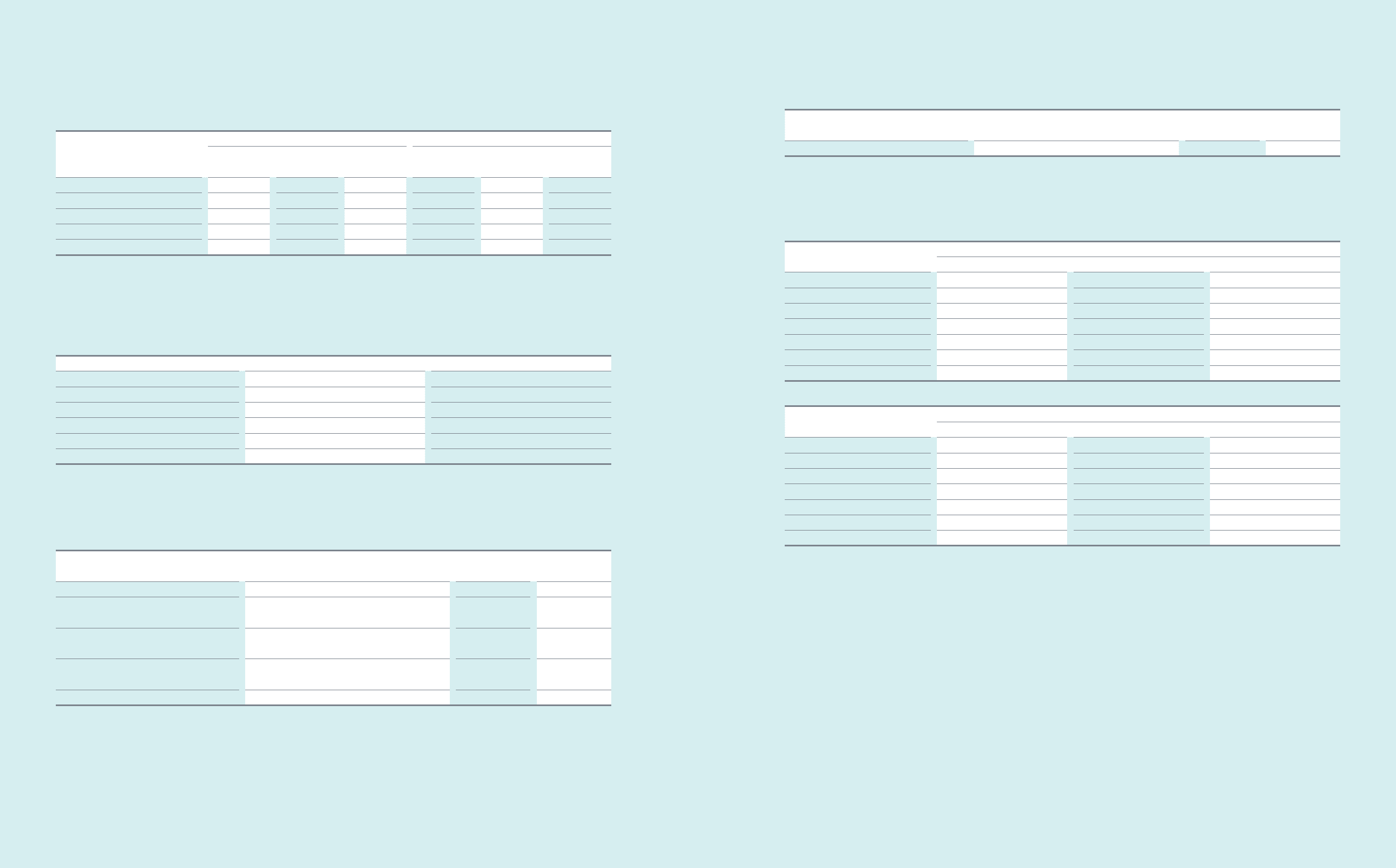

11. Inventories

Inventories as of December 31, 2013 and 2012, are as follows:

(In millions of Korean won)

2013 2012

Gross Amount Valuation

Allowance Book Value Gross Amount Valuation

Allowance Book Value

Finished goods ₩7,597,391 ₩(168,041) ₩7,429,350 ₩7,003,826 ₩(166,576) ₩6,837,250

Work in process 4,466,028 (395,762) 4,070,266 3,623,572 (392,996) 3,230,576

Raw materials and supplies 6,960,985 (151,873) 6,809,112 5,239,262 (157,866) 5,081,396

Materials in transit 826,140 - 826,140 2,598,191 - 2,598,191

₩19,850,544 ₩(715,676) ₩19,134,868 ₩18,464,851 ₩(717,438) ₩17,747,413

The cost of inventories recognized as expense and included in ‘cost of sales’ amounts to ₩136,755,644 million (2012: ₩125,746,083 million).

Inventory valuation loss of ₩435,607 million was recognized in 2013 (2012: ₩367,279 million).

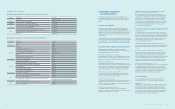

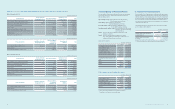

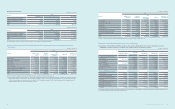

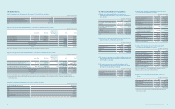

12. Investments in Associates and Joint Ventures

(A) Changes in investments in associates and joint ventures for the years ended December 31, 2013 and 2012, are as follows:

(In millions of Korean won)

2013 2012

Balance as of January 1 ₩8,785,489 ₩9,204,169

Acquisition 181,307 279,022

Disposal (240) (21,891)

Share of prot 504,063 986,611

Others (*) (3,048,327) (1,662,422)

Balance as of December 31 ₩6,422,292 ₩8,785,489

(*) Others consist of dividends, business combination, and effects of changes in foreign exchange rates, etc.

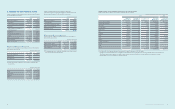

(B) Major investments in associates and joint ventures as of December 31, 2013, are as follows:

(1) Investments in associates

Investee Nature of Relationship with Associate Percentage of

Ownership (*)(%)

Principal Business

Location

Samsung Card Business alliance 37.5 Korea

Samsung Electro-Mechanics Manufacture and supply electronic components

including passive component, circuit board, and module 23.7 Korea

Samsung SDI Manufacture and supply electronic devices including PDP

and secondary (rechargeable) batteries 20.4 Korea

Samsung SDS Provide IT services including computer programming,

system integration and management 22.6 Korea

Samsung Techwin Manufacture and supply engine and precision machines 25.5 Korea

(*) The ownership represents the Company’s ownership of common stock in each entity.

2) Investments in joint ventures

Investee Nature of Relationship with Joint Venture Percentage of

Ownership (*)(%)

Principal Business

Location

Samsung Corning Advanced Glass Manufacture and supply other industrial glass devices 50.0 Korea

(*) The ownership represents the Company’s ownership of common stock in each entity.

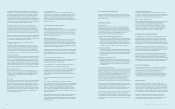

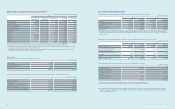

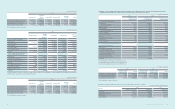

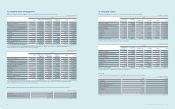

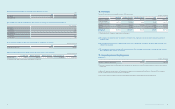

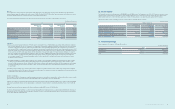

(C) Details of investments in associates and joint ventures as of December 31, 2013 and 2012, are as follows:

(1) Investments in associates

(In millions of Korean won)

Investee

2013

Acquisition cost Net asset value of equity shares (*) Book value

Samsung Card ₩1,538,540 ₩2,322,897 ₩2,340,009

Samsung Electro-Mechanics 359,237 951,693 954,496

Samsung SDI 423,722 1,451,770 1,175,204

Samsung SDS 147,963 858,671 879,956

Samsung Techwin 174,531 433,624 402,745

Others 582,646 375,959 548,553

Total ₩3,226,639 ₩6,394,614 ₩6,300,963

(In millions of Korean won)

Investee

2012

Acquisition cost Net asset value of equity shares (*) Book value

Samsung Card ₩1,538,540 ₩2,221,201 ₩2,238,073

Samsung Electro-Mechanics 359,237 887,933 890,460

Samsung SDI 423,722 1,450,811 1,174,183

Samsung SDS 17,967 689,874 701,808

Samsung Techwin 174,531 401,146 360,739

Others 461,599 513,580 457,016

Total ₩2,975,596 ₩6,164,545 ₩5,822,279

(*) Company’s portion of net asset value of associates based on the Company’s ownership percentage.