Samsung 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 75

2013 SAMSUNG ELECTRONICS ANNUAL REPORT

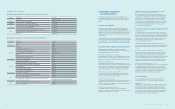

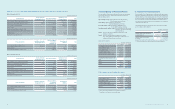

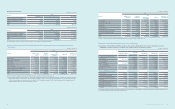

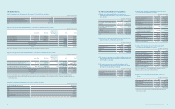

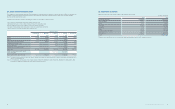

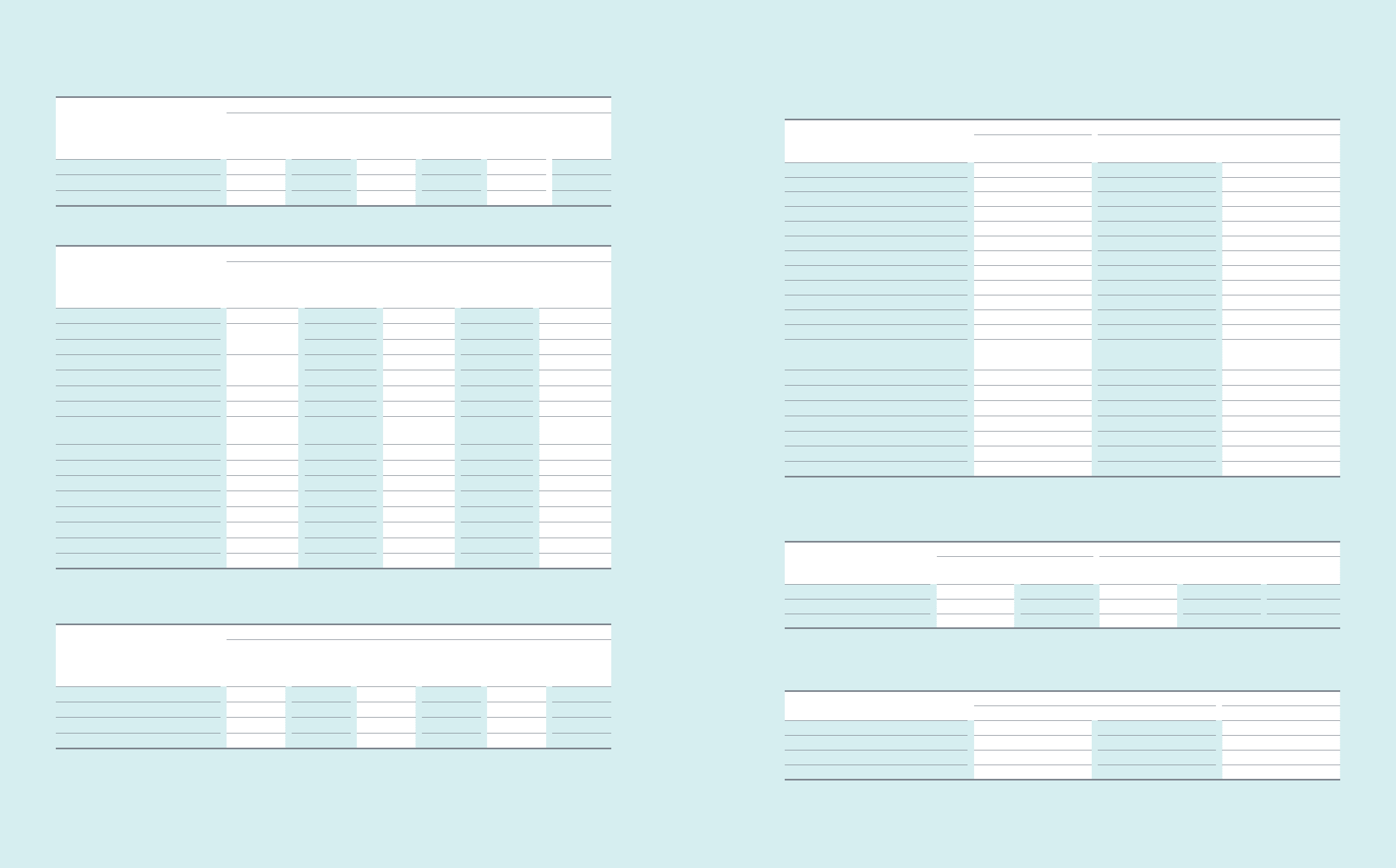

(2) Summary of condensed nancial information of major joint ventures, details of adjustments from the book value of investments in joint ventures,

and dividends from joint ventures as of and for the years ended December 31, 2013 and 2012, are as follows:

(In millions of Korean won)

2013 2012

Samsung Corning

Advanced Glass

Samsung Corning

Precision Materials

Samsung Corning

Advanced Glass

1. Condensed nancial information

Current assets ₩171,353 ₩3,429,581 ₩187,684

- Cash and cash equivalent 64,113 1,707,998 10,887

Non-current assets 95,310 3,731,710 51,669

Current liabilities 42,674 431,475 10,702

- Current nancial liabilities (*1) 40,575 148,492 10,393

Non-current liabilities 67 80,507 103

Non-controlling interests - 8,442 -

Revenue 68,803 3,245,243 30,288

Depreciation and amortization 283 390,091 35

Interest income 4,618 109,710 4,600

Income tax expense (567) 299,996 (178)

2. Details of adjustments from the book value of

investments in joint ventures

Net assets (a) 223,922 6,640,867 228,548

Ownership percentage (*2)(b) 50.0% 42.5% 50.0%

Net assets of equity shares (a x b) 111,961 2,825,104 114,274

Intercompany transactions, etc. (*3) - (30,487) -

Book value of joint ventures 111,961 2,794,617 114,274

3. Dividends from joint ventures

Dividends ₩ -₩927,984 ₩ -

(*1) Account payables, other payables, provisions are excluded.

(*2) Ownership percentage includes common and preferred stocks.

(*3) Consist of unrealized gains and losses, and other differences.

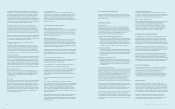

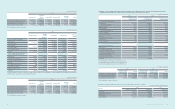

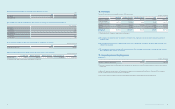

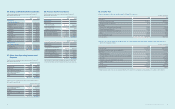

(In millions of Korean won)

2013 2012

Samsung Corning

Advanced Glass Others Samsung Corning

Precision Materials

Samsung Corning

Advanced Glass Others

Prot (loss) from continuing operations (*) ₩(4,604) ₩(166,310) ₩1,353,460 ₩(1,452) ₩(129,202)

Other comprehensive income (loss)(*) (21) (1,942) (9,536) - (12,901)

Total comprehensive income (loss)(*) ₩(4,625) ₩(168,252) ₩1,343,924 ₩(1,452) ₩(142,103)

(*) Prot attributable to owners of the parent.

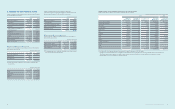

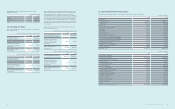

(F) Fair value of marketable investments in associates as of December 31, 2013 and 2012, is as follows:

(In millions of Korean won and number of shares)

Investee

2013 2012

Number of shares held Market value Market value

Samsung SDI 9,282,753 ₩1,503,806 ₩1,401,696

Samsung Electro-Mechanics 17,693,084 1,291,595 1,755,154

Samsung Card 43,393,170 1,622,905 1,583,851

Samsung Techwin 13,526,935 ₩735,865 ₩807,558

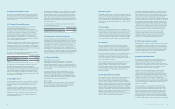

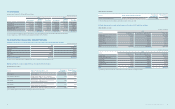

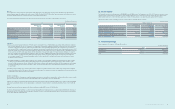

(In millions of Korean won)

2013

Samsung Card

Samsung

Electro-

Mechanics

Samsung SDI Samsung SDS Samsung

Techwin Others

Prot (loss) from continuing operations (*) ₩273,232 ₩330,240 ₩130,599 ₩312,372 ₩132,493 ₩(139,194)

Other comprehensive income (loss) (*) 84,153 26,676 (63,211) (88,703) 21,596 (11,862)

Total comprehensive income (loss) (*) ₩357,385 ₩356,916 ₩67,388 ₩223,669 ₩154,089 ₩(151,056)

(*) Prot attributable to owners of the parent.

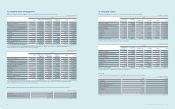

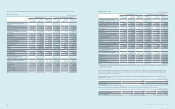

(In millions of Korean won)

2012

Samsung Card (*1)

Samsung

Electro-

Mechanics

Samsung SDI Samsung SDS Samsung

Techwin

1. Condensed nancial information

Current assets

₩16,287,816

₩2,631,235 ₩2,414,856 ₩2,283,331 ₩1,386,237

Non-current assets 4,260,230 8,480,231 2,182,077 1,854,702

Current liabilities

10,357,253

1,959,072 2,004,041 1,067,256 1,019,550

Non-current liabilities 966,744 1,326,564 153,211 643,713

Non-controlling interests - 71,252 191,257 60,909 2,094

Revenue 3,817,670 7,912,830 5,771,185 6,105,858 2,934,702

2. Details of adjustments from the book

value of investments in associates

Net assets (a) 5,930,563 3,894,397 7,373,225 3,184,032 1,575,582

Ownership percentage (*2)(b) 37.5% 22.8% 19.7% 21.7% 25.5%

Net assets of equity shares (a x b) 2,221,201 887,933 1,450,811 689,874 401,146

Goodwill 17,181 - - 19,597 -

Intercompany transactions, etc. (309) 2,527 (276,628) (7,663) (40,407)

Book value of associates 2,238,073 890,460 1,174,183 701,808 360,739

3. Dividends from associates

Dividends ₩30,375 ₩13,270 ₩13,924 ₩3,914 ₩6,763

(*1) Samsung Card does not present current and non-current assets, and current and non-current liabilities, as separate classications in its statement of nancial position.

(*2) Ownership percentage includes common and preferred stocks.

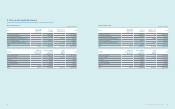

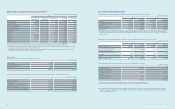

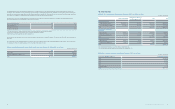

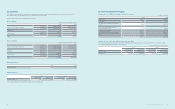

(In millions of Korean won)

2012

Samsung Card

Samsung

Electro-

Mechanics

Samsung SDI Samsung SDS Samsung

Techwin Others

Prot (loss) from continuing operations (*) ₩749,875 ₩411,299 ₩1,471,502 ₩395,805 ₩131,030 ₩(84,072)

Post-tax prot from discontinued operations (*) - 29,503 - - - -

Other comprehensive income (loss)(*) (570,471) 1,009 (150,859) (34,303) (118,743) (34,316)

Total comprehensive income (loss)(*) ₩179,404 ₩441,811 ₩1,320,643 ₩361,502 ₩12,287 ₩(118,388)

(*) Prot attributable to owners of the parent.