Samsung 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 65

2013 SAMSUNG ELECTRONICS ANNUAL REPORT

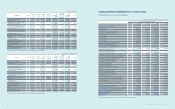

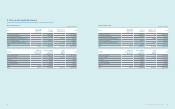

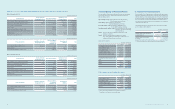

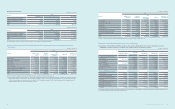

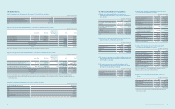

7. Credit Quality of Financial Assets

The credit quality of nancial assets that are neither past due nor impaired

is assessed by reference to external credit ratings as of December 31,

2013 and 2012, as follows:

Superior ability to repay - Aaa~Aa (Moody’s), AAA~AA (S&P, Fitch),

A1 (Credit rating agencies in Korea)

Strong ability to repay - A (Moody’s), A (S&P, Fitch),

A2 (Credit rating agencies in Korea)

Acceptable ability to repay - Baa (Moody’s), BBB (S&P, Fitch),

A3 (Credit rating agencies in Korea)

Currently having the ability to repay - Ba or below (Moody’s), BB or below

(S&P, Fitch), B or below (Creditrating

agencies in Korea)

Group 1 - Customers with the trade payables guaranteed by credit

insurance or collateral

Group 2 - Customers having experienced impairment of capital.

As the trade payables are guaranteed by credit insurance or

collateral, all default risk has been relieved

(A) Accounts receivables

(In millions of Korean won)

2013 2012

Counterparties with external credit rating

Superior ability to repay ₩3,414,467 ₩1,818,158

Strong ability to repay 2,796,881 3,742,515

Acceptable ability to repay 2,491,635 3,217,663

Currently having the ability to repay 4,370,114 3,834,957

13,073,097 12,613,293

Counterparties without external credit

rating

Group 1 9,429,612 8,680,397

Group 2 153,770 50,160

9,583,382 8,730,557

₩22,656,479 ₩21,343,850

(B) Cash equivalents and short-term nancial instruments

(In millions of Korean won)

2013 2012

Superior ability to repay ₩2,584,121 ₩2,850,476

Strong ability to repay 49,891,037 32,675,712

Acceptable ability to repay 493,383 505,631

Currently having the ability to repay 1,111 12,896

Others (*) 23,376 131,782

₩52,993,028 ₩36,176,497

(*) Short-term nancial instruments held at nancial institutions

(Credit union, etc.) without external credit rating.

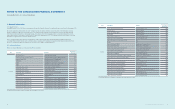

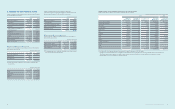

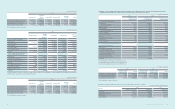

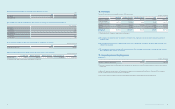

8. Transfer of Financial Assets

Trade receivables of the Company have been discounted through factoring

agreements with banks in 2013 and 2012. Collaterals (trade receivables and

other) provided in such factoring transactions do not meet the requirements

for asset derecognition as risks and rewards are not substantially transferred

in the event the debtor defaults. Financial liabilities recognized in relation to

these transactions are included as short-term borrowings on the statements

of nancial position (Note 15).

The following table presents a breakdown of discounted trade receivables

as of December 31, 2013 and 2012:

(In millions of Korean won)

2013 2012

Carrying amount of the discounted

trade receivables (*) ₩3,256,935 ₩4,328,503

Carrying amount of the related

borrowings 3,256,935 4,328,503

(*) The discounted trade receivables include intercompany balances.

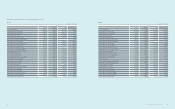

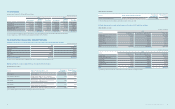

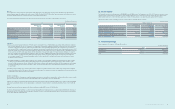

(B) Net gains or net losses on each category of nancial instruments for the years ended December 31, 2013 and 2012, are as follows:

(1) As of December 31, 2013

(In millions of Korean won)

Financial Assets Assets at fair value

through prot or loss Loans and receivables Available-for-sale

nancial assets Total

Gain on valuation (other comprehensive income) ₩ -₩ -₩1,271,817 ₩1,271,817

Gain/(loss) on valuation/disposal (prot or loss) (32,867) (33,518) 1,079,393 1,013,008

Loss on valuation (reclassication) - - (1,000,260) (1,000,260)

Interest income - 1,342,394 9,215 1,351,609

Foreign exchange differences (prot or loss) - (393,407) - (393,407)

Foreign exchange differences (other comprehensive income) - - 939 939

Dividend income - - 112,159 112,159

Impairment/reversal (prot or loss) - (18,681) (5,177) (23,858)

(In millions of Korean won)

Financial Liabilities Liabilities at fair value

through prot or loss

Financial liabilities

measured at

amortized cost

Other nancial

liabilities Total

Loss on valuation/disposal (prot or loss) ₩(216,236) ₩ -₩ -₩(216,236)

Interest expense 319,342 190,316 509,658

Foreign exchange differences (prot or loss) (230,212) 43,836 (186,376)

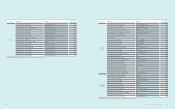

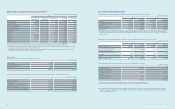

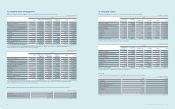

(2) As of December 31, 2012

(In millions of Korean won)

Financial Assets Assets at fair value

through prot or loss Loans and receivables Available-for-sale

nancial assets Total

Gain on valuation (other comprehensive income) ₩ -₩ -₩1,185,256 ₩1,185,256

Gain/(loss) on valuation/disposal (prot or loss) (74,609) 28,915 105,192 59,498

Gain on valuation (reclassication) - - 23,072 23,072

Interest income - 840,150 5,281 845,431

Foreign exchange differences (prot or loss) - (355,989) - (355,989)

Foreign exchange differences (other comprehensive income) - - (19,302) (19,302)

Dividend income - - 106,181 106,181

Impairment/reversal (prot or loss) - (76,231) (94,466) (170,697)

(In millions of Korean won)

Financial Liabilities Liabilities at fair value

through prot or loss

Financial liabilities

measured at

amortized cost

Other nancial

liabilities Total

Loss on valuation/disposal (prot or loss) ₩(125,553) ₩ -₩ -₩(125,553)

Interest expense - 277,512 321,494 599,006

Foreign exchange differences (prot or loss) - 17,938 43,909 61,847