Samsung 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84 85

2013 SAMSUNG ELECTRONICS ANNUAL REPORT

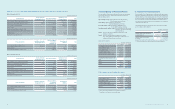

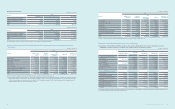

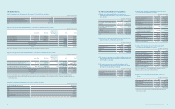

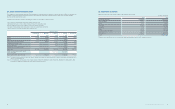

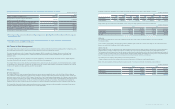

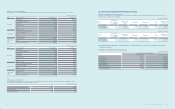

20. Share Capital

The Company’s total number of authorized shares is 500,000,000 shares (₩5,000 per share). The Company has issued 147,299,337 shares of common stock and

22,833,427 shares of preferred stock as of December 31, 2013, excluding retired shares. Due to retirement of shares, the total par value of the shares issued is

₩850,664 million (common stock ₩736,497 million, preferred stock ₩114,167 million), which does not agree with paid-in capital of ₩897,514 million.

Changes in the number of shares outstanding for the years ended December 31, 2013 and 2012, are as follows:

(In number of shares)

Number of shares of

Preferred stock Common stock Total

Balance as of January 1, 2012 19,853,734 130,386,723 150,240,457

Disposal of treasury stock through exercise of stock option - 191,309 191,309

Other disposal of treasury stock - 269,867 269,867

Balance as of December 31, 2012 19,853,734 130,847,899 150,701,633

Disposal of treasury stock through exercise of stock option - 67,222 67,222

Balance as of December 31, 2013 19,853,734 130,915,121 150,768,855

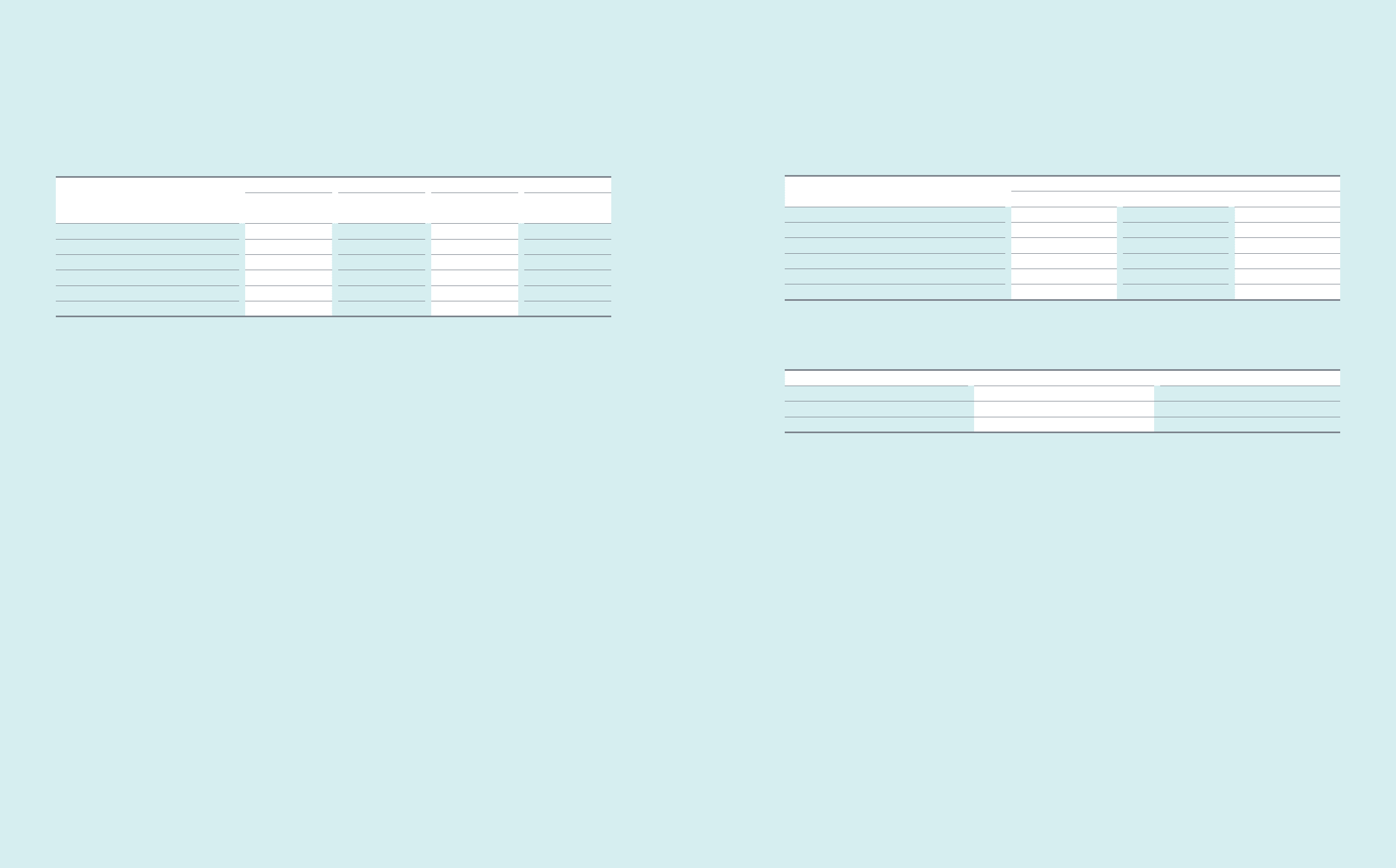

21. Retained Earnings

Retained earnings as of December 31, 2013 and 2012, consist of:

(In millions of Korean won)

2013 2012

Appropriated, etc. ₩104,175,235 ₩87,915,275

Unappropriated 44,425,047 32,070,414

Total 148,600,282 119,985,689

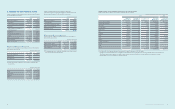

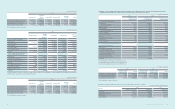

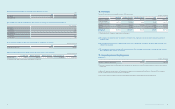

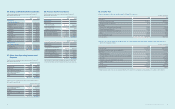

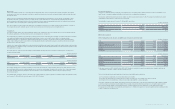

(B) Lease

The Company leases certain property, plant and equipment under various nance lease arrangements. Assets recorded under nance lease agreements are

included in property, plant and equipment with a net book value of ₩110,655 million (2012: ₩121,402 million). Depreciation expense for the nance lease assets

amounted to ₩10,587 million for the year ended December 31, 2013 (2012: ₩9,650 million).

The minimum lease payments under nance lease agreements and their present value as of December 31, 2013 and 2012, are as follows:

(In millions of Korean won)

2013 2013

Minimum Lease

payments

Present

values

Minimum Lease

payments

Present

values

Within one year ₩27,893 ₩19,811 ₩21,399 ₩13,293

From one year to ve years 57,508 28,213 70,310 40,216

More than ve years 95,192 54,189 108,865 61,555

Total ₩180,593 ₩102,213 ₩200,574 ₩115,064

Present value adjustment (78,380) (85,510)

Finance lease payables ₩102,213 ₩115,064

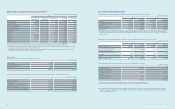

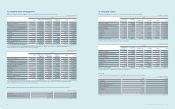

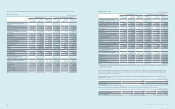

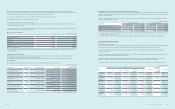

(C) Litigation

(1) Based on the agreement entered on August 24, 1999 with respect to Samsung Motor Inc.’s (“SMI”) bankruptcy proceedings, SMI’s creditors (the “Creditors”)

led a civil action against Mr. Kun Hee Lee, chairman of the Company, and 28 Samsung Group afliates including the Company under joint and several liability

for failing to comply with such agreement. Under the suit, the Creditors have sought ₩2,450 billion (approximately USD 2.32 billion) for loss of principal on

loans extended to SMI, a separate amount for breach of the agreement, and an amount for default interest. During the course of Samsung Life Insurance’s (“SLI”)

Initial Public Offering (“IPO”), its shares owned by the Creditors were disposed of, and the part of proceeds exceeding the par value of ₩70,000 was deposited

into an escrow account ₩877.6 billion, approximately USD 0.83 billion). Most of the claims with regards to the lawsuit have been withdrawn. On January 11,

2011, the Seoul High Court ordered Samsung Group afliates to pay to the Creditors ₩600 billion (approximately USD 0.57 billion) and penalties due to delay.

In accordance with the Seoul High Court order, ₩620.4 billion (which includes penalties and interest owed) was paid to the Creditors from the funds held

in escrow during January 2011. The Samsung Group afliates and the Creditors appealed the Seoul High Court’s ruling to the Korean Supreme Court and

the appeal is currently in progress.

(2) The litigation with Apple Inc. in multiple regions including the USA is ongoing as of the reporting date. Regarding the ongoing lawsuit in the USA, on August

24, 2012, the jury determined that the Company partially infringed Apple’s design and utility patent and should pay damages to Apple. On March 1, 2013,

however, the Judge ordered a new trial for a certain portion of the damages, ruling that it was originally miscalculated. As of the reporting date, the rst appeal

is still ongoing regarding the jury’s verdict on November 21, 2013. The nal conclusion and the effect of the patent lawsuits with Apple are uncertain as of

the reporting date.

(3) In addition, during the normal course of business with numerous companies, the Company has been involved in various claims, disputes, and investigations

conducted by regulatory bodies. Although, the outow of resources and timing of these matters are uncertain, the Company believes the outcome will not have

a material impact on the nancial condition of the Company.

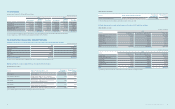

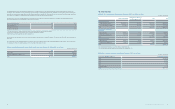

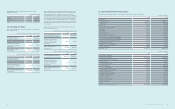

(D) Other commitments

As of December 31, 2013, the Company has a trade nancing agreement, trade notes receivable discounting facilities, and loan facilities with accounts receivable

pledged as collateral with 13 nancial institutions, including Woori Bank, with a combined limit of up to ₩13,309,900 million.

In addition, the Company has a trade nancing agreement with 19 nancial institutions, including Korea Exchange Bank, for up to US$3,723 million and ₩83,000

million, and has loan facilities with accounts receivable pledged as collateral with 6 nancial institutions, including Industrial Bank of Korea, for up to ₩288,600

million.

Samsung Display has a facility loan agreement with 3 nancial institutions including SMBC for up to JPY 60,700 million.

Two foreign subsidiaries including SEA have a contract for issuing ABS (Asset Backed Securities) backed by accounts receivable with BTMU and other nancial

institutions for up to US$1,169 million and other 3 subsidiaries including SSDG have a credit facility agreement with Bank of China and other nancial institutions

for up to CNY 3,400 million and EUR 30 million.