Samsung 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 73

2013 SAMSUNG ELECTRONICS ANNUAL REPORT

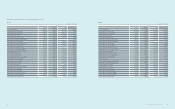

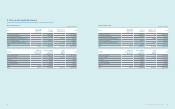

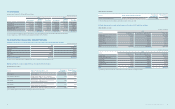

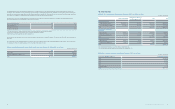

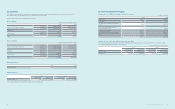

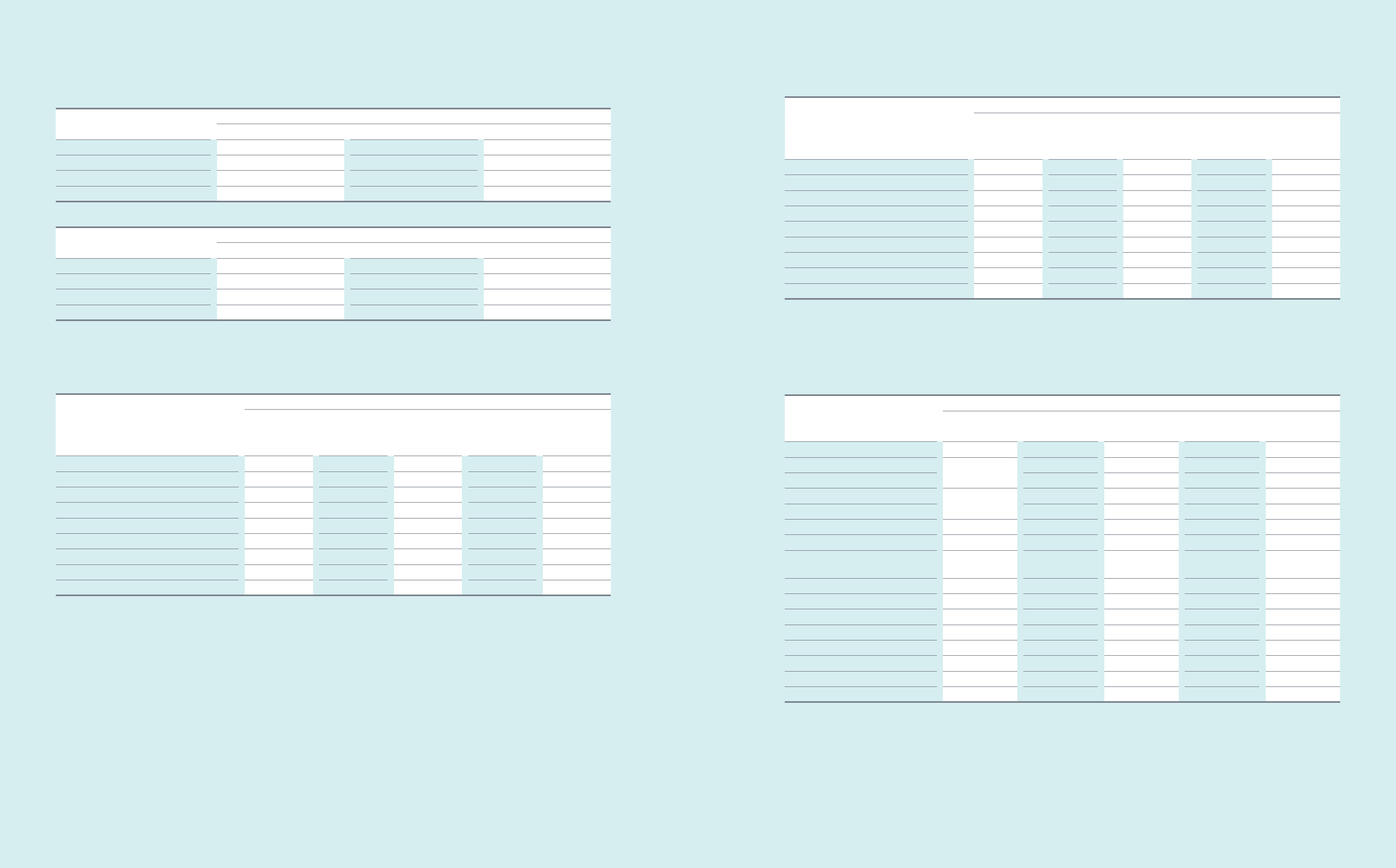

(2) Investments in joint ventures

(In millions of Korean won)

Investee

2013

Acquisition cost Net asset value of equity shares (*) Book value

Samsung Corning Precision Materials ₩ -₩ -₩ -

Samsung Corning Advanced Glass 115,000 111,961 111,961

Others 422,995 (16,357) 9,368

Total ₩537,995 ₩95,604 ₩121,329

(In millions of Korean won)

Investee

2012

Acquisition cost Net asset value of equity shares (*) Book value

Samsung Corning Precision Materials ₩297,165 ₩2,825,104 ₩2,794,617

Samsung Corning Advanced Glass 115,000 114,274 114,274

Others 419,461 64,193 54,319

Total ₩831,626 ₩3,003,571 ₩2,963,210

(*) Company’s portion of net asset value of associates based on the Company’s ownership percentage.

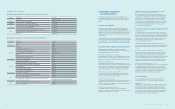

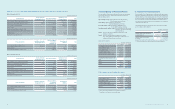

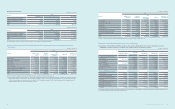

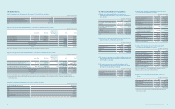

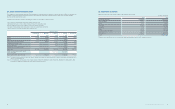

(D) Details of valuation of investments in associates and joint ventures under the equity method for the years ended December 31, 2013 and 2012,

are as follows:

(In millions of Korean won)

Investee

2013

Balance as of

January 1

Gain/loss

on valuation

Other

comprehensive

income/loss

Others (*1) Balance as of

December 31

Samsung Card ₩2,238,073 ₩102,361 ₩29,828 ₩(30,253) ₩2,340,009

Samsung Electro-Mechanics 890,460 75,565 6,354 (17,883) 954,496

Samsung SDI 1,174,183 25,760 (10,310) (14,429) 1,175,204

Samsung SDS 701,808 69,739 (17,838) 126,247 879,956

Samsung Techwin 360,739 39,554 9,021 (6,569) 402,745

Samsung Corning Precision Materials (*2) 2,794,617 347,981 (1,247) (3,141,351) -

Samsung Corning Advanced Glass 114,274 (2,302) (11) - 111,961

Others 511,335 (154,595) 4,959 196,222 557,921

Total ₩8,785,489 ₩504,063 ₩20,756 ₩(2,888,016) ₩6,422,292

(*1) Others consist of acquisitions, disposals, dividends, and effects of changes in foreign exchange rates, etc.

(*2) During the year ended December 31, 2013, the Company signed a framework agreement for comprehensive business cooperation with Corning Incorporated

and its related parties. As of December 31, 2013, the Company classied its share in Samsung Corning Precision Materials Co., Ltd (ownership percentage:

42.54%) as assets held-for-sale, and disposed of such shares for USD 1,902 million on January 15, 2014. Under the agreement, the Company will receive

additional dividends after the resolution of shareholders’ meeting.

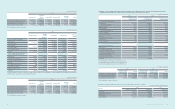

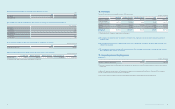

(In millions of Korean won)

Investee

2012

Balance as of

January 1

Gain/loss

on valuation

Other

comprehensive

income/loss

Others (*) Balance as of

December 31

Samsung Card ₩2,184,855 ₩264,688 ₩(181,217) ₩(30,253) ₩2,238,073

Samsung Electro-Mechanics 799,792 102,946 11,689 (23,967) 890,460

Samsung SDI 1,185,509 31,256 (30,531) (12,051) 1,174,183

Samsung SDS 632,593 89,157 (16,488) (3,454) 701,808

Samsung Techwin 370,379 39,356 (27,171) (21,825) 360,739

Samsung Corning Precision Materials 3,089,298 644,242 (10,300) (928,623) 2,794,617

Samsung Corning Advanced Glass - (726) - 115,000 114,274

Others 941,743 (184,308) (96,473) (149,627) 511,335

Total ₩9,204,169 ₩986,611 ₩(350,491) ₩(1,054,800) ₩8,785,489

(*) Others consist of acquisitions, disposals, dividends, and effects of changes in foreign exchange rates, etc.

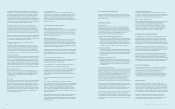

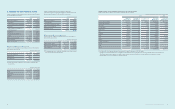

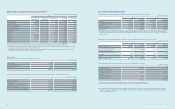

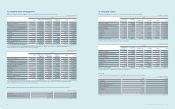

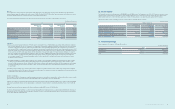

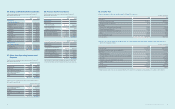

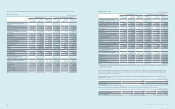

(E) Summary of condensed nancial information of major associates and joint ventures.

(1) A summary of condensed nancial information of major associates, details of adjustments from the book value of investments in associates,

and dividends received from associates as of and for the years ended December 31, 2013 and 2012, is as follows:

(In millions of Korean won)

2013

Samsung Card (*1) Samsung

Electro-Mechanics Samsung SDI Samsung SDS Samsung Techwin

1. Condensed nancial information

Current assets

₩16,560,926

₩2,650,765 ₩2,063,192 ₩2,928,998 ₩1,561,706

Non-current assets 4,534,578 8,492,479 2,371,102 1,872,518

Current liabilities

10,358,265

1,787,432 1,526,957 1,219,484 1,169,253

Non-current liabilities 1,139,884 1,486,297 197,222 560,191

Non-controlling interests - 83,966 164,323 80,644 1,628

Revenue 2,847,053 8,256,579 5,016,465 7,046,833 2,912,031

2. Details of adjustments from the book

value of investments in associates

Net assets (a) 6,202,661 4,174,061 7,378,094 3,802,750 1,703,152

Ownership percentage (*2)(b) 37.5% 22.8% 19.7% 22.6% 25.5%

Net assets of equity shares (a x b) 2,322,897 951,693 1,451,770 858,671 433,624

Goodwill 17,181 - - 26,801 -

Intercompany transactions, etc. (69) 2,803 (276,566) (5,516) (30,879)

Book value of associates 2,340,009 954,496 1,175,204 879,956 402,745

3. Dividends from associates

Dividends ₩30,375 ₩17,693 ₩13,924 ₩3,914 ₩6,763

(*1) Samsung Card does not present current and non-current assets, and current and non-current liabilities, as separate classications in its statement of nancial position.

(*2) Ownership percentage includes common and preferred stocks.