Samsung 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 95

2013 SAMSUNG ELECTRONICS ANNUAL REPORT

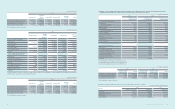

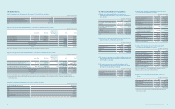

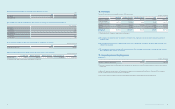

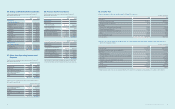

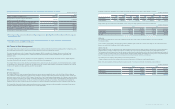

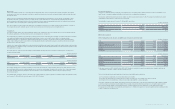

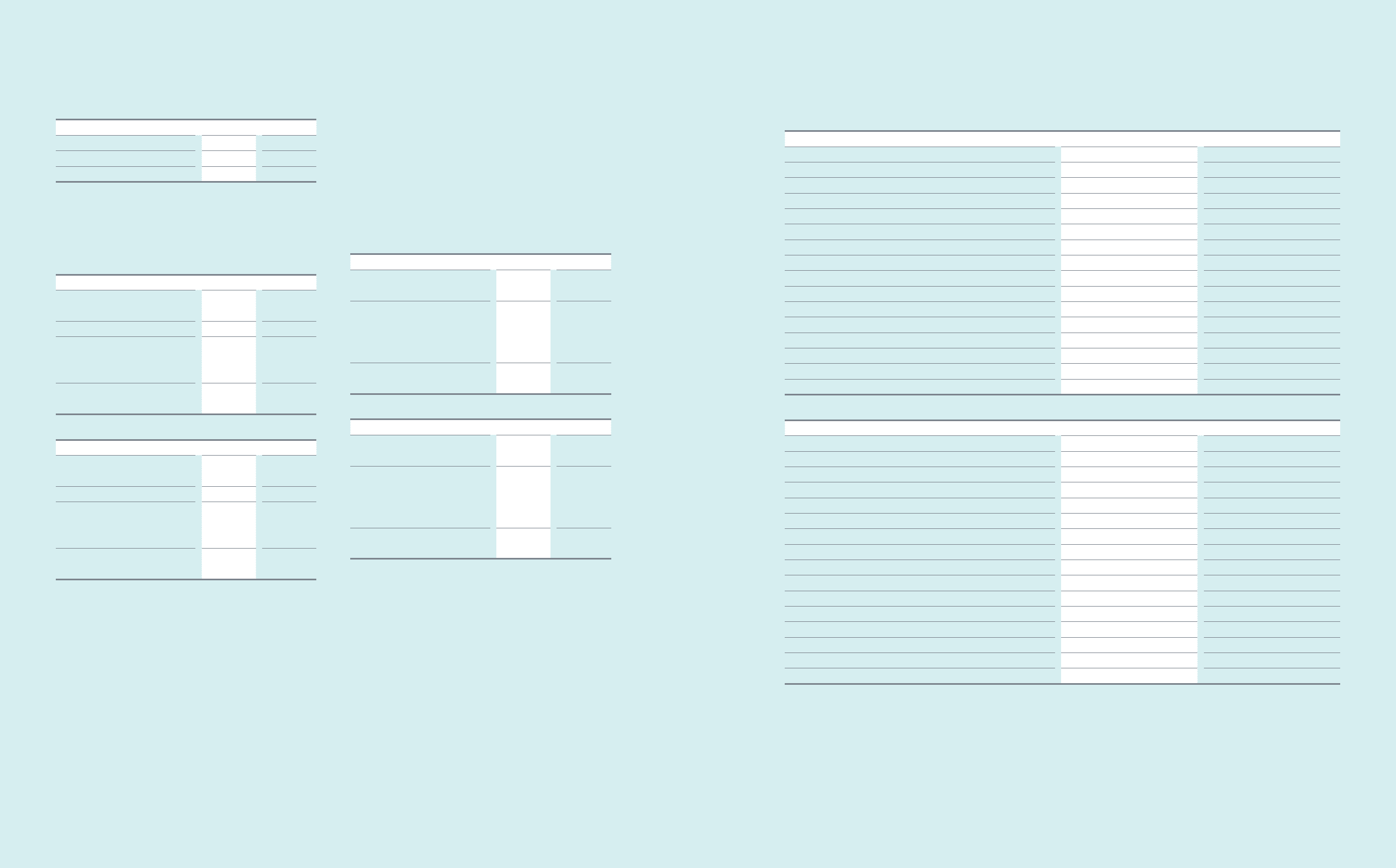

31. Cash Generated from Operations

(A) Cash ows from operating activities as of December 31, 2013 and 2012, consist of the following:

(In millions of Korean won)

2013 2012

Adjustments for:

Income tax expense ₩7,889,515 ₩6,069,732

Finance income (2,551,623) (2,068,888)

Finance costs 1,568,663 1,755,715

Severance and retirement benets 971,997 768,423

Depreciation 15,470,012 14,835,046

Amortization 975,401 786,970

Bad debt expenses, etc. 282,978 205,424

Gain on valuation of equity method (504,063) (986,611)

Gain on disposal of property, plant and equipment (110,638) (147,645)

Loss on disposal of property, plant and equipment 187,863 324,993

Obsolescence and scrapping of inventories, etc. 1,045,360 1,212,222

Gain on disposal of investments (1,117,029) (112,505)

Impairment losses on intangible assets 108,420 216,790

Other income/expense (412,024) (100,107)

Adjustments, total ₩23,804,832 ₩22,759,559

(In millions of Korean won)

2013 2012

Changes in assets and liabilities:

Increase in trade receivables ₩(1,993,705) ₩(2,032,126)

Decrease/(increase) in other receivables 192,054 (536,202)

Increase in advances (144,720) (277,329)

Increase in prepaid expenses (321,953) (72,285)

Increase in inventories (3,097,762) (4,011,553)

Decrease in trade payables (965,677) (465,450)

Increase/(decrease) in other payables 1,296,263 (416,870)

Increase in advances received 49,495 88,152

Increase/(decrease) in withholdings 323,874 (663,733)

Increase in accrued expenses 2,261,910 2,183,846

Increase in provisions 2,009,248 1,824,693

Payment of severance benets (244,186) (301,444)

Increase in plan assets (837,296) (440,420)

Others 159,210 (657,228)

Changes in net working capital, total ₩(1,313,245) ₩(5,777,949)

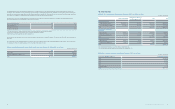

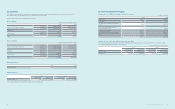

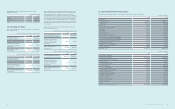

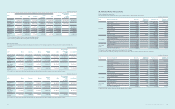

(D) The liquidity analysis of deferred tax assets and deferred tax

liabilities is as follows:

(In millions of Korean won)

2013 2012

Current ₩(107,699) ₩1,898,481

Non-current (1,282,892) (2,811,868)

Total ₩(1,390,591) ₩(913,387)

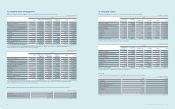

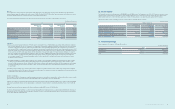

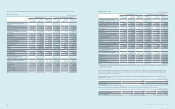

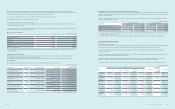

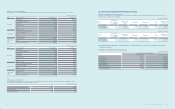

30. Earnings per Share

Basic earnings per share for the years ended December 31, 2013 and 2012,

are calculated as follows:

(In millions of Korean won and thousands of number of shares)

2013 2012

Net income as reported on

the statements of income ₩29,821,215 ₩23,185,375

Net income available for common stock 25,893,396 20,130,020

Weighted-average number of

common shares outstanding

(in thousands)

130,880 130,698

Basic earnings per share

(in Korean won) ₩197,841 ₩154,020

(In millions of Korean won and thousands of number of shares)

2013 2012

Net income as reported on

the statements of income ₩29,821,215 ₩23,185,375

Net income available for preferred stock 3,927,819 3,055,355

Weighted-average number of

preferred shares outstanding

(in thousands)

19,854 19,854

Basic earnings per preferred share

(in Korean won) ₩197,838 ₩153,893

Diluted earnings per share is calculated by adjusting the weighted average

number of ordinary shares outstanding to assume conversion of all dilutive

potential ordinary shares. The Company has one category of dilutive

potential ordinary shares: stock options. A calculation is done to determine

the number of shares that could have been acquired at fair value (determined

as the average annual market share price of the Company’s shares) based

on the monetary value of the subscription rights attached to outstanding

share options. The number of shares calculated as above is compared with

the number of shares that would have been issued assuming the exercise of

the share options.

Diluted earnings per share for the years ended December 31, 2013 and

2012, are calculated as follows:

(In millions of Korean won and thousands of number of shares)

2013 2012

Net income available for common

stock and common stock equivalents ₩25,894,151 ₩20,131,405

Weighted-average number of

shares of common stock and

common stock equivalents

(in thousands)

130,911 130,766

Diluted earnings per share

(in Korean won) ₩197,800 ₩153,950

(In millions of Korean won and thousands of number of shares)

2013 2012

Net income available for preferred

stock and preferred stock equivalents ₩3,927,064 ₩3,053,970

Weighted-average number of

shares of preferred stock and

preferred stock equivalents

(in thousands)

19,854 19,854

Diluted earnings per preferred share

(in Korean won) ₩197,800 ₩153,823