Samsung 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 55

2013 SAMSUNG ELECTRONICS ANNUAL REPORT

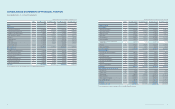

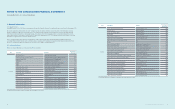

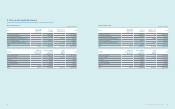

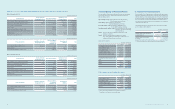

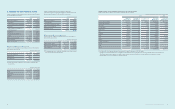

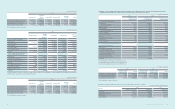

(C) Changes in scope for consolidation

(1) Subsidiaries newly included in the consolidation for the year ended December 31, 2013:

Area Subsidiaries Description

America

NeuroLogica Acquisition of shares

Intellectual Keystone Technology (IKT) Incorporation

Europe Samsung Electronics Switzerland GmbH (SESG) Incorporation

Asia

Samsung Electronics Vietnam THAINGUYEN (SEVT) Incorporation

Samsung Electronics New Zealand (SENZ) Incorporation

China

Samsung Network R&D Center China-Shenzhen (SRC-Shenzhen) Incorporation

Samsung R&D Institute China-Xian (SRC-Xian) Incorporation

SEMES (Xian) Incorporation

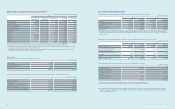

(2) Subsidiaries excluded from the consolidation for the year ended December 31, 2013:

Area Subsidiaries Description

Domestic

SECRON Merger

GES Merger

America

Newton Sub Merger

Samsung Medison America (SMUS) Liquidation

Deltapoint Cardiac Diagnostics (Deltapoint) Liquidation

Intellectual Keystone Technology (IKT) Disposal of shares

mSpot Merger

Samsung Electronics Corporativo (SEC) Merger

Samsung Medison Brasil (SMBR) Merger

Europe

Samsung Telecoms (UK) (STUK) Liquidation

Samsung LCD Netherlands R&D Center (SNRC) Disposal

Samsung LCD Netherlands R&D Center UK (SNRC (UK)) Disposal

General RF Modules Liquidation

Samsung Medison France (SMFR) Liquidation

Samsung Opto-Electronics GmbH (SOG) Liquidation

Samsung Medison Italia (SMIT) Liquidation

Asia

Samsung Electronics Philippines Manufacturing (SEPHIL) Disposal

Batino Realty Corporation (BRC) Disposal

TNP Small/Medium Size & Venture Enterprise Growth Promotion Investment

Limited Partnership (TSUNAMI) Reclassied into an associate from a subsidiary

China

Samsung LCD Netherlands R&D Center HK (SNRC (HK)) Disposal

Medison (Shanghai) (SMS2) Liquidation

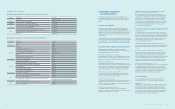

The principal accounting policies applied in the preparation of these

consolidated nancial statements are set out below. These policies have

been consistently applied to all the years presented, unless otherwise

stated.

2.1 Basis of Presentation

The Company has prepared the consolidated nancial statements in

accordance with Korean International Financial Reporting Standards

(“K-IFRS”). International Financial Reporting Standards (IFRS) have been

adopted by the Korean Accounting Standards Board as K-IFRS based on

standards and interpretations published by the International Accounting

Standards Board.

K-IFRS permits the use of critical accounting estimates in the preparation

of the nancial statements and requires management judgments in applying

accounting policies. Footnote 3 explains where more complex and higher

standards of judgment or critical assumptions and estimates are required.

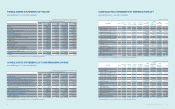

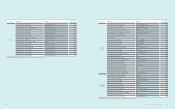

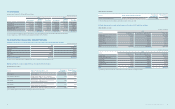

2.2 Changes in Accounting Policy and Disclosures

(A) New and amended standards adopted by the Company

The Company applied the following amended and enacted standards for

the annual period beginning on January 1, 2013:

K-IFRS 1110, ‘Consolidated Financial Statements’

The standard introduces a single control concept and provides a specic

guidance for the control. The adoption of this standard does not have an

impact on consolidation scope in the consolidated nancial statements.

K-IFRS 1111, ‘Joint Arrangements’

The standard reects the substance of joint arrangements and focuses on

the rights and obligations of the parties to the joint arrangements rather than

on the legal forms of the arrangements. Joint arrangements are classied

into joint operations or joint ventures. The adoption of this standard does

not have a material impact on the consolidated nancial statements.

K-IFRS 1112, ‘Disclosure of Interests in Other Entities’

The standard provides disclosure requirements for all types of equity

investments in other entities including subsidiaries, joint arrangements,

associates and unconsolidated structured entities.

K-IFRS 1113, ‘Fair Value Measurement’

The standard provides a precise denition of fair value, and a single source

of fair value measurement and disclosure requirements for use across

K-IFRS. The adoption of this standard does not have a material impact on

the consolidated nancial statements.

K-IFRS 1027, ‘Separate Financial Statements’

The standard contains accounting treatments and requirements for

investments in subsidiaries, associates, and joint ventures relating only to

separate nancial statements of the Company.

(B) New and amended standards early adopted by the Company

Amendment to K-IFRS 1036, ‘Impairment of Assets’

The amendment reects the change in disclosure requirement of

the recoverable amount for each cash-generating unit including goodwill

or intangible assets with indenite useful lives. The amendment requires

disclosure of the recoverable amount only if the entity has recognized

impairment losses or reversals of impairment losses. For consistency,

the amendment also requires additional disclosures when the recoverable

amount of impaired assets is based on fair value less costs of disposal.

The amendment to this standard does not have a material impact on

the consolidated nancial statements.

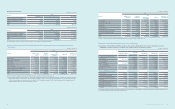

Amendments to K-IFRS 1110, ‘Consolidated Financial Statements’, K-IFRS

1112, ‘Disclosure of Interests in Other Entities’, and K-IFRS 1027, ‘Separate

Financial Statements’

The amendments dene an investment entity and require a parent that is

an investment entity to measure its investments in particular subsidiaries at

fair value through prot or loss instead of presenting consolidated nancial

statements. These amendments do not apply to a parent of an investment

entity if the parent itself is not an investment entity. The amendments to

K-IFRS 1110 and K-IFRS 1027 do not have a material impact on

the consolidated nancial statements.

(C) New and amended standards not adopted by the Company

New standards, amendments and interpretations issued but not effective for

the nancial year beginning January 1, 2013 and not early adopted are as

follows:

Amendment to K-IFRS 1032, ‘Financial Instruments: Presentation’

The standard provides that the right to offset must not be contingent on

a future event and must be legally enforceable in all of circumstances;

and if an entity can settle amounts in a manner such that outcome is,

in effect, equivalent to net settlement, the entity will meet the net settlement

criterion. This amendment is effective for annual periods beginning on

or after January 1, 2014, and the Company is assessing the impact of

application of this amendment on its consolidated nancial statements.

Enactment of K-IFRIC Interpretations 2121, ‘Levies’

The interpretation requires that the liability to pay a levy is recognized when

the activity that triggers the payment of the levy occurs, as identied by

the legislation (the obligating event). This interpretation is effective for

annual periods beginning on or after January 1, 2014, with early adoption

permitted. The Company is assessing the impact of application of

this interpretation on its consolidated nancial statements.

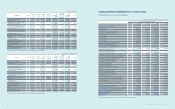

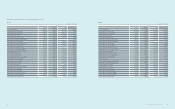

2.3 Consolidation

The Company prepares annual consolidated nancial statements in

accordance with K-IFRS 1110, ‘Consolidated Financial Statements’

(A) Subsidiaries

Subsidiaries are all entities (including special purpose entities) over which

the Company has control. The Company controls the corresponding

investee when it is exposed, or has rights, to variable returns from its

involvement with the investee and has the ability to affect those returns

through its power over the investee. Consolidation of a subsidiary begins

from the date the Company obtains control of a subsidiary and ceases

when the Company loses control of the subsidiary.

2. Summary of Signicant

Accounting Policies