Samsung 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 93

2013 SAMSUNG ELECTRONICS ANNUAL REPORT

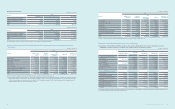

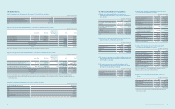

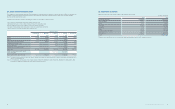

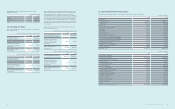

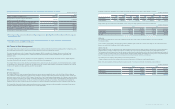

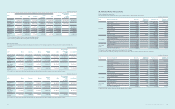

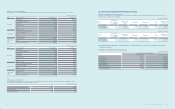

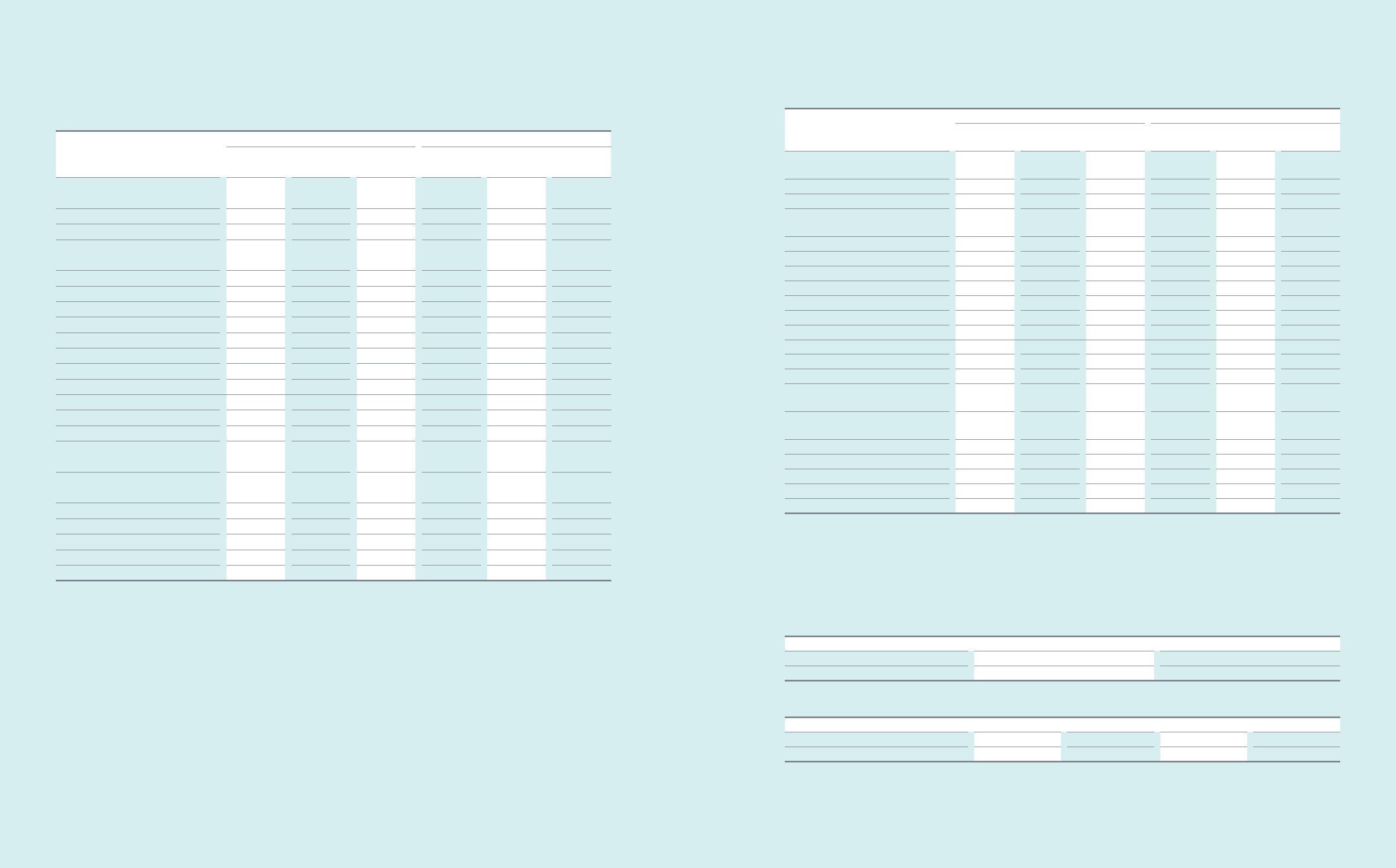

(2) As of December 31, 2012

(In millions of Korean won)

Temporary Differences Deferred Income Tax Assets (Liabilities)

Balance as of

January 1

Increase

(Decrease)

Balance as of

December 31

Balance as of

January 1

Increase

(Decrease)

Balance as of

December 31

Deferred tax arising from temporary

differences

Special reserves appropriated for tax purposes ₩(18,146) ₩(14,951) ₩(33,097) ₩(4,391) ₩(3,619) ₩(8,010)

Revaluation of land (4,017,316) 539,625 (3,477,691) (972,191) 130,590 (841,601)

Investments in subsidiaries, associates and

joint ventures (*) (13,450,537) (11,813,329) (25,263,866) (3,032,268) (650,000) (3,682,268)

Depreciation (13,547) 1,250,940 1,237,393 (62,124) 255,468 193,344

Accrued income (92,953) (31,224) (124,177) (21,337) (6,826) (28,163)

Provisions, accrued expenses and others 7,144,431 3,217,777 10,362,208 1,806,514 750,331 2,556,845

Foreign currency translation 150,908 (164,168) (13,260) 35,482 (41,449) (5,967)

Asset impairment losses 52,901 37,755 90,656 10,937 5,587 16,524

Others 779,626 (1,673,860) (894,234) 288,217 (459,967) (171,750)

Subtotal ₩(9,464,633) ₩(8,651,435) ₩(18,116,068) ₩(1,951,161) ₩(19,885) ₩(1,971,046)

Deferred tax arising from carryforwards

Undisposed accumulated decit ₩100,401 ₩30,591 ₩130,992 ₩26,961 ₩850 ₩27,811

Tax credit carryforwards 1,512,052 (195,543) 1,316,509 1,495,747 (235,640) 1,260,107

Deferred tax recognized in other

comprehensive income

Valuation of available-for-sale nancial

instruments ₩(1,316,863) ₩(1,264,765) ₩(2,581,628) ₩(318,052) ₩(262,040) ₩(580,092)

Actuarial valuation 813,514 657,804 1,471,318 196,149 153,684 349,833

Subtotal ₩(503,349) ₩(606,961) ₩(1,110,310) ₩(121,903) ₩(108,356) ₩(230,259)

Deferred tax assets ₩2,516,080

Deferred tax liabilities (3,429,467)

Total ₩(913,387)

(*) Deferred tax assets were not recognized if it is probable that the temporary differences will not reverse in the foreseeable future for investments in subsidiaries,

associates and joint ventures.

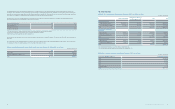

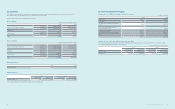

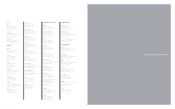

The Company periodically assesses its ability to recover deferred income tax assets. In the event of a signicant uncertainty regarding the Company’s ultimate

ability to recover such assets, deferred income tax assets are recognized only to the extent that it is probable that future taxable prot will be available against

which the temporary differences can be utilized.

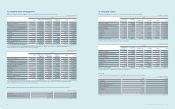

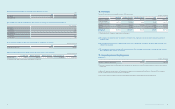

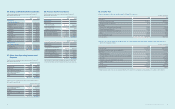

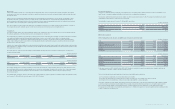

Temporary differences whose deferred tax effects were not recognized due to the uncertainty regarding ultimate realizability of such assets as of December 31,

2013 and 2012 are as follows:

(In millions of Korean won)

2013 2012

Unused tax losses ₩12,196 ₩ -

Unused tax credits 30,098 48,262

Expiry dates of unused tax losses and unused tax credits for which no deferred tax asset is recognized in the balance sheet are as follows:

(In millions of Korean won)

2014 2015 2016 2017 and after

Undisposed accumulated decit ₩ -₩ -₩ -₩12,196

Tax credit carryforwards 4,170 3,437 18,525 3,966

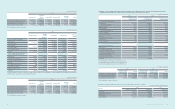

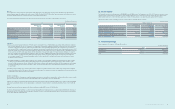

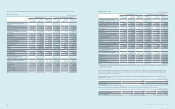

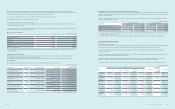

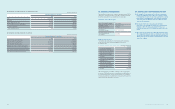

(C) Deferred income tax assets and liabilities resulting from the tax effect of temporary differences as of December 31, 2013 and 2012, are as follows:

(1) As of December 31, 2013

(In millions of Korean won)

Temporary Differences Deferred Income Tax Assets (Liabilities)

Balance as of

January 1

Increase

(Decrease)

Balance as of

December 31

Balance as of

January 1

Increase

(Decrease)

Balance as of

December 31

Deferred tax arising from temporary

differences

Special reserves appropriated for tax purposes ₩(33,097) ₩5,312 ₩(27,785) ₩(8,010) ₩1,286 ₩(6,724)

Revaluation of land (3,477,691) 1,587 (3,476,104) (841,601) 384 (841,217)

Investments in subsidiaries, associates and

joint ventures (*) (25,263,866) (2,555,796) (27,819,662) (3,682,268) (318,359) (4,000,627)

Depreciation 1,237,393 (402,647) 834,746 193,344 (57,968) 135,376

Accrued income (124,177) (179,613) (303,790) (28,163) (44,682) (72,845)

Provisions, accrued expenses and others 10,362,208 1,983,485 12,345,693 2,556,845 596,301 3,153,146

Foreign currency translation (13,260) (168,042) (181,302) (5,967) (38,058) (44,025)

Asset impairment losses 90,656 251,433 342,089 16,524 65,375 81,899

Assets held for sale - 7,527,869 7,527,869 - 1,821,744 1,821,744

Others (894,234) (10,818,680) (11,712,914) (171,750) (2,527,473) (2,699,223)

Subtotal ₩(18,116,068) ₩(4,355,092) ₩(22,471,160) ₩(1,971,046) ₩(501,450) ₩(2,472,496)

Deferred tax arising from carryforwards

Unused tax losses ₩130,992 ₩(23,764) ₩107,228 ₩27,811 ₩(2,805) ₩25,006

Unused tax credits 1,316,509 25,141 1,341,650 1,260,107 52,085 1,312,192

Deferred tax recognized in other

comprehensive income

Valuation of available-for-sale nancial

instruments ₩(2,581,628) ₩(306,252) ₩(2,887,880) ₩(580,092) ₩(84,080) ₩(664,172)

Actuarial valuation 1,471,318 247,136 1,718,454 349,833 59,046 408,879

Subtotal ₩(1,110,310) ₩(59,116) ₩(1,169,426) ₩(230,259) ₩(25,034) ₩(255,293)

Deferred tax assets ₩4,621,780

Deferred tax liabilities (6,012,371)

Total ₩(1,390,591)