Samsung 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 81

2013 SAMSUNG ELECTRONICS ANNUAL REPORT

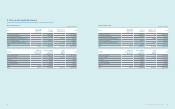

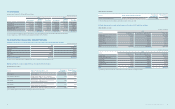

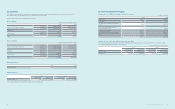

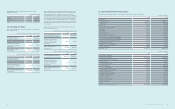

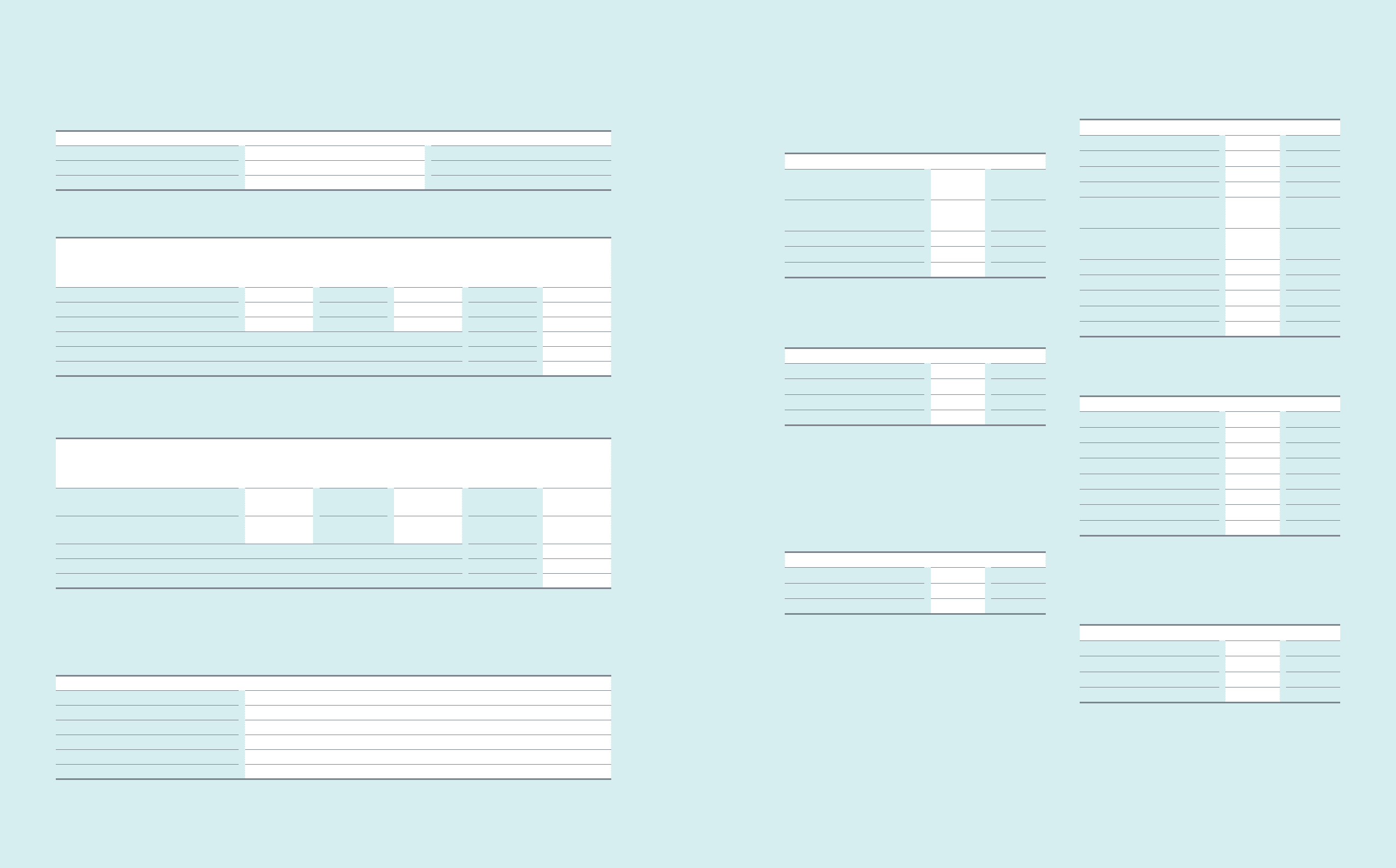

16. Debentures

Details of carrying amount of debentures as of December 31, 2013 and 2012, are as follows:

(In millions of Korean won)

2013 2012

Korean won denominated debentures (A) ₩198,566 ₩697,822

Foreign currency denominated debentures (B) 1,112,502 1,131,552

Total ₩1,311,068 ₩1,829,374

(A) Details of Korean won denominated debentures as of December 31, 2013 and 2012, are as follows:

(In millions of Korean won)

Issue Date Due Date

Annual Interest

Rates (%) as of

December 31,

2013

2013 2012

Unsecured debentures 2010.6.17 2013.6.17 - - 500,000

Unsecured debentures 2011.11.17 2014.11.17 4.1 500,000 500,000

Unsecured debentures 2011.11.17 2016.11.17 4.2 200,000 200,000

Less: Current portion (500,000) (500,000)

Less: Discounts (1,434) (2,178)

Total 198,566 697,822

All the above debentures have been issued by Samsung Display and will be repaid upon maturity.

(B) Details of foreign currency denominated debentures as of December 31, 2013 and 2012, are as follows:

(In millions of Korean won)

Issue Date Due Date

Annual Interest

Rates (%) as of

December 31,

2013

2013 2012

US dollar denominated straight bonds (*1) 1997.10.2 2027.10.1 7.7 ₩73,871

(US$70 million)

₩80,333

(US$75 million)

US dollar denominated unsecured bonds (*2) 2012.4.10 2017.4.10 1.8 1,055,300

(US$1,000 million)

1,071,100

(US$1,000 million)

Less: Current portion (5,277) (5,356)

Less: Discounts (11,392) (14,525)

Total ₩1,112,502 ₩1,131,552

(*1) US dollar straight bonds are repaid annually for twenty years after a ten-year grace period from the date of issuance. Interest is paid semi-annually.

(*2) Samsung Electronics America issued dollar denominated unsecured bonds. Repayment of these debentures is due on the date of maturity and interest is

paid semi-annually.

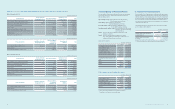

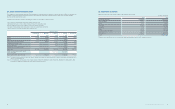

(C) Maturities of debentures outstanding as of December 31, 2013 are as follows:

(In millions of Korean won)

For the Years Ending December 31 Debentures

2014 ₩505,277

2015 5,277

2016 205,277

2017 1,060,577

2018 and thereafter 52,763

Total ₩1,829,171

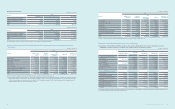

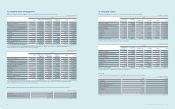

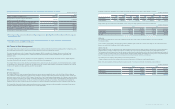

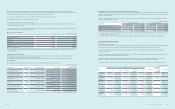

17. Net Dened Benet Liabilities

(A) Details of net dened benet liabilities recognized on the

statements of nancial position as of December 31, 2013 and 2012,

are as follows:

(In millions of Korean won)

2013 2012

Present value of funded dened benet

obligations ₩5,672,147 ₩4,593,284

Present value of unfunded dened

benet obligations 55,931 76,183

Subtotal 5,728,078 4,669,467

Fair value of plan assets (3,873,176) (2,939,528)

Total ₩1,854,902 ₩1,729,939

(B) The amounts recognized in the statements of income for the years

ended December 31, 2013 and 2012, are as follows:

(In millions of Korean won)

2013 2012

Current service cost ₩836,916 ₩670,123

Interest cost 82,487 58,591

Others 8,164 8,033

₩927,567 ₩736,747

(C) The amounts recognized as cost of dened contribution plan for the

years ended December 31, 2013 and 2012, are ₩44,430 million and

₩31,676 million, respectively.

(D) The pension expenses related to dened benet plans by line

item recognized on the statements of income for the years ended

December 31, 2013 and 2012, are as follows:

(In millions of Korean won)

2013 2012

Cost of sales ₩376,588 ₩291,355

Selling and administrative expenses, etc. 550,979 445,392

₩927,567 ₩736,747

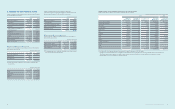

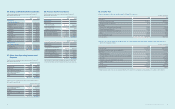

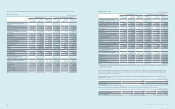

(E) Changes in the dened benet obligations for the years ended

December 31, 2013 and 2012, are as follows:

(In millions of Korean won)

2013 2012

Balance as of January 1 ₩4,669,467 ₩3,542,340

Current service cost 836,916 670,123

Interest cost 226,271 194,625

Remeasurement:

Actuarial gains or losses arising from

changes in demographic assumptions (38) 81,587

Actuarial gains or losses arising from

changes in nancial assumptions (22,870) 473,488

Others 257,724 55,396

Benets paid (244,186) (301,444)

Foreign exchange differences (18,128) (22,028)

Others 22,922 (24,620)

Balance as of December 31 ₩5,728,078 ₩4,669,467

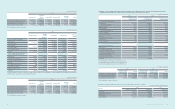

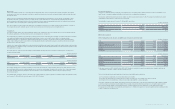

(F) Changes in the fair value of plan assets for the years ended

December 31, 2013 and 2012, are as follows:

(In millions of Korean won)

2013 2012

Balance as of January 1 ₩2,939,528 ₩2,423,152

Expected return on plan assets 143,784 136,034

Remeasurement factor of plan assets (37,343) (47,333)

Contributions by the employer 978,313 595,420

Benets paid (141,017) (155,000)

Foreign exchange differences (3,035) (8,812)

Others (7,054) (3,933)

Balance as of December 31 ₩3,873,176 ₩2,939,528

Expected contributions to post-employment benet plans for the year

ending December 31, 2014, are ₩1,176,458 million.

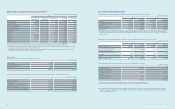

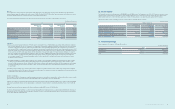

(G) Plan assets as of December 31, 2013 and 2012, consist of as

follows:

(In millions of Korean won)

2013 2012

Equity instruments ₩ -₩59,988

Debt instruments 3,851,102 2,859,415

Others 22,074 20,125

₩3,873,176 ₩2,939,528

(*) Plan assets are mostly invested in instruments which have a quoted

price in active market.