Samsung 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111110

(B) Mobile business of Cambridge Silicon Radio (“CSR”)

On October 4, 2012, the Company acquired tangible/intangible assets

including patents, R&D workforce and equity shares of 4.9% of the company

from UK-based semiconductor company CSR and its subsidiaries in attempt

to expand its connectivity business such as Bluetooth, GPS and WiFi, etc.

Consideration transferred amounts to $344 million and there could be

additional payment or refund of $10 million depending on the outcome of

an ongoing R&D project. Estimated fair value by weighted-average DCF is

$113,000.

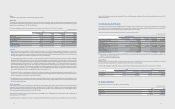

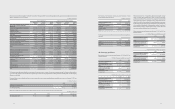

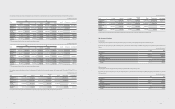

(1) Purchase price allocation

The following table summarizes the consideration paid for CSR and the

amounts of the assets acquired recognized at the acquisition date.

(In millions of Korean won)

Classication Amount

I. Considerations transferred

Cash and cash equivalents ₩383,498

II. Identiable assets and liabilities

Cash and cash equivalents 1,753

Trade and other receivables 304

Property, Plant & Equipment 3,714

Intangible assets (*1) 158,117

Available-for-sales (*2) 59,572

Long-term prepaid expenses 54,339

Other nancial assets 15,779

Trade and other payables 374

Other nancial liabilities 1,687

Total Identiable net assets ₩291,517

III. Goodwill (*3) ₩91,981

(*1) This figure includes ₩102,442 million of Connectivity Semiconductor

related patents and ₩55,675 million of other intangible assets.

(*2) Samsung Electronics Europe Holdings (SEEH) acquired a 4.9% share in

CSR plc according to the contract terms set by the Company.

(*3) Goodwill arising from the acquisition was recognized as this transaction

will allow faster response to changes in the domestic and international

business environments and strengthen manufacturing competitiveness.

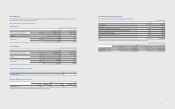

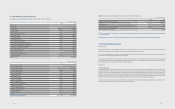

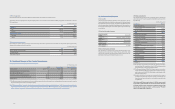

37. Business Restructuring within

Consolidated Entity

(A) Spin-o of LCD division

The Company established Samsung Display Corporation through a spin-o of the

LCD segment during the year.

Name of the new

company Samsung Display Corporation

Headquarters

location Giheung-gu, Yongin-si, Gyeonggi-do

Business LCD

Date of Spin-o April 1, 2012

(B) Merger of Samsung Display, Samsung Mobile Display and S-LCD

On July 1, 2012, Samsung Display, a subsidiary, merged with two other subsidiaries:

Samsung Mobile Display and S-LCD.

(1) Overview of merged companies

Samsung Mobile Display S-LCD

Headquarters location Yong-In, Gyeonggi-do Asan, Chung-Nam

Representative director Soo-in Cho Dong-geon Park

Classication of the

acquired company Unlisted company Unlisted company

Relationship with the

Company Associates Subsidiary

(2) Share exchange ratio and distribution

Type Acquiring

Company

Acquired

Company

Acquired

Company

Name Samsung Display Samsung Mobile

Display S-LCD

Merger Ratio 1 1.6487702 -

Samsung Display did not distribute common shares of Samsung Display as a

result of its 100% ownership of S-LCD.

Acquired assets and liabilities were recognized at book value in t he

consolidated nancial statements as the acquisition is a business combination

under common control. As a result, the Company does not recognize an

additional goodwill.

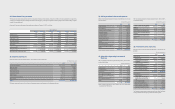

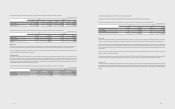

(C) Merger of Samsung Medison and Prosonic

On September 1, 2012, Samsung Medison merged with Prosonic. The merger

was between subsidiaries of the same controlling company.

(1) Overview of merged companies

Prosonic

Headquarters location Gyeong-ju, Gyeongsangbuk-do

Representative director Won Gil Son

Classication of the acquired company Unlisted company

Relationship with the Company Subsidiary

(2) Share exchange ratio and distribution

Type Acquiring Company Acquired Company

Name Samsung Medison Prosonic

Merger Ratio 1 17.5971363

The Company received 10,030,367 of newly issued common shares from

Samsung Medison in exchange for 570,000 common shares of Prosonic which

were previously owned by the Company. Acquired assets and liabilities were

recognized at book value in the consolidated financial statements as the

acquisition is a merger between subsidiaries. There is no additional goodwill.

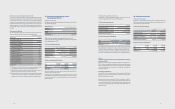

(D) Others

(1) Merger of Samsung Electronics Asia Holdings(‘SEAH’) and Samsung

Asia Private (‘SAPL’)

On July 1, 2012, SEAH merged with SAPL and changed the company name to

SAPL. The merger was between subsidiaries of the same controlling company

and the accounting treatment for the merger was based on the carrying value

in the consolidated financial statements. The merger did not result in the

recognition of goodwill.

(2) Acquisition of SEHF Korea

On August 13, 2012, the Company acquired 100% ownership of SEHF Korea,

previously a subsidiary of Samsung Electronics Hainan Fiberoptics (SEHF).

SEHF is a subsidiary of the Company.

Subsequently the Company merged SEHF Korea on December 1, 2012 to

maximize business synergies. Acquirsed assets and liabilities of SEHF Korea

were recognized at book value in the consolidated nancial statements as the

acquisition is a merger between parent company and subsidiary. There is no

additional goodwill.

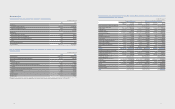

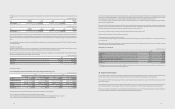

38. Subsequent Events

(A) Merger within Subsidiaries

On January 1, 2013, SEMES, a subsidiary of SEC, merged with SECRON and

GES in order to maximize synergies and enhance the competitiveness in the

semiconductor/LCD equipment business.

(1) Overview of the acquired company

SECRON GES

Headquarters location Cheonan-si,

Chungcheongnam-do

Hwaseong-si,

Gyeonggi-do

Representative director Jae-kyung Lee Min-seok Han

Classication of the acquired

company Unlisted company Unlisted company

Relationship with the Company Associates Associates

(2) Share exchange ratio and distribution

Type Acquiring

Company

Acquired

Company

Acquired

Company

Name SEMES SECRON GES

Merger Ratio 1 0.4473688 0.7684500