Samsung 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

income and expenses are translated at the rate on the dates of the transactions; and

all resulting exchange dierences are recognized in other comprehensive income.

On consolidation, exchange differences arising from the translation of the

net investment in foreign operations are recognized in other comprehensive

income. When a foreign operation is partially disposed of or sold, the exchange

dierences that were recorded in equity are reclassied as part of gains and losses

on disposition in the statement of income. When the Company loses control over

foreign subsidiaries, the exchange differences that were recorded in equity are

reclassified in the statement of income during the period when the gain or loss is

recognized in prot or loss.

Any goodwill arising on the acquisition of a foreign operation and any fair value

adjustments are treated as the foreign operation’s assets and liabilities. The goodwill

is expressed in the foreign operation’s functional currency and is translated at the

closing rate. Exchange differences should be recognized in other comprehensive

income.

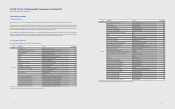

2.5 Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, deposits held at call with banks,

and other short-term highly liquid investments that are readily convertible to a

known amount of cash and are subject to an insignicant risk of change in value.

2.6 Financial Assets

(A) Classication

The Company classies its nancial assets in the following categories: at fair value

through prot or loss, loans and receivables, available-for-sale, and held-to-maturity

investments. The classification depends on the terms of the instruments and

purpose for which the nancial assets were acquired. Management determines the

classication of its nancial assets at initial recognition.

(1) Financial assets at fair value through prot or loss

Financial assets at fair value through prot or loss are nancial assets held for

trading. A nancial asset is classied in this category if acquired principally for the

purpose of selling in the short-term. Derivatives not subject to hedge accounting

and derivatives separated from financial instruments such as embedded

derivatives are also categorised as held for trading. Assets in this category are

classied as current assets.

(2) Loans and receivables

Loans and receivables are non-derivative financial assets with fixed or

determinable payments that are not quoted in an active market. They are

included in current assets, except for those with maturities greater than 12

months after the end of the reporting period which are classied as non-current

assets.

(3) Available-for-sale nancial assets

Available-for-sale nancial assets are non-derivatives that are either designated

in this category or not classied in any of the other categories. They are included

in non-current assets unless an investment matures or management intends to

dispose of it within 12 months of the end of the reporting period.

(B) Recognition and measurement

Regular purchases and sales of financial assets are recognized on the trade date.

Investments are initially recognized at fair value plus transaction costs for all nancial

assets not carried at fair value through prot or loss. Financial assets carried at fair

value through prot or loss are initially recognized at fair value, and transaction costs

are expensed in the statement of income. Available-for-sale financial assets and

financial assets at fair value through profit or loss are subsequently carried at fair

value. Loans and receivables and held-to-maturity investments are subsequently

carried at amortized cost using the eective interest method.

Gains or losses arising from changes in the fair value of the nancial assets at fair

value through profit or loss, including interest income, are presented as financial

income in the statement of income in the period in which they arise. Dividend

income from nancial assets at fair value through prot or loss is recognized as other

non-operating income in the statement of income when the Company’s right to

receive payments is established.

Changes in the fair value of monetary and non-monetary securities classified as

available-for-sale are recognized in other comprehensive income. When securities

classified as available-for-sale are sold or impaired, the accumulated fair value

adjustments previously recognized in equity are transferred to the statement of

income under other nonoperating income or other expense items.

Interest on available-for-sale financial assets and held-to-maturity financial assets

calculated using the effective interest method is recognized in the statement of

income as part of nance income. Dividends on available-for-sale nancial assets are

recognized in the statement of income as part of other non-operating income when

the Company’s right to receive payments is established.

(C) Osetting nancial instruments

Financial assets and liabilities are offset and the net amount reported in the

statement of nancial position when there is a legally enforceable right to oset the

recognized amounts and there is an intention to settle on a net basis, or realize the

asset and settle the liability simultaneously.

(D) Derecognition of nancial assets

Financial assets are derecognized when the contractual rights to the cash ows from

the financial asset expire, when the Company transfers the contractual rights to

receive the cash ows of the nancial asset and substantially all the risks and rewards

of ownership, or when the Company neither transfers nor retains substantially all the

risks and rewards of ownership of the nancial asset and has not retained control of

the nancial asset.

Financial liabilities that arise through a transfer of receivables in factoring

arrangements with recourse do not qualify for derecognition since the Company

retains substantially all the risks and rewards associated with the receivables.. Such

liabilities are classified as short-term borrowings in the consolidated statement of

nancial position.

2.7 Impairment of Financial Assets

(A) Assets carried at amortized cost

The Company assesses at the end of each reporting period whether there is objective

evidence that a financial asset or group of financial assets is impaired. A financial

asset or a group of nancial assets is impaired and impairment loss is recognized

only if there is objective evidence of impairment as a result of one or more events

that occurred after the initial recognition of the asset or group of nancial assets (a

‘loss event’) and that loss event (or events) has an impact on the estimated future

cash flows of the financial asset or group of financial assets that can be reliably

estimated.

The following represent some of the factors that could lead the Company to assess

that there is objective evidence that a nancial asset or group of assets is impaired:

- signicant nancial diculty of the issuer or obligor;

- delinquency in interest or principal payments;

- the lender, for economic or legal reasons relating to the borrower's financial

diculty, grants to the borrower a concession that the lender would not otherwise

consider;

- it becoming probable that the borrower will enter bankruptcy or other nancial

reorganisation;

- the disappearance of an active market for that nancial asset because of nancial

diculties; or

- observable data indicating that there is a measurable decrease in the

estimated future cash flows from a group of financial assets since the

initial recognition of those assets, although the decrease cannot yet

be identified with the individual financial assets in the group, including:

1) adverse changes in the payment status of borrowers in the group; or

2) national or local economic conditions that correlate with defaults on the assets

in the group.

The amount of the loss is measured as the dierence between the asset’s carrying

amount and the present value of estimated future cash flows (excluding future

credit losses that have not been incurred) discounted at the nancial asset’s original

eective interest rate. The carrying amount of the asset is reduced and the amount

of the loss is recognized in the consolidated statement of income. In cases of

floating rate financial assets, the amount of the loss will be computed using the

present eective interest rate determined by the contract. As a practical expedient,

the Company may measure impairment on the basis of an instrument’s fair value

using an observable market price.

If, in a subsequent period, the amount of the impairment loss decreases and the

decrease can be related objectively to an event occurring after the impairment

was recognized (such as an improvement in the debtor’s credit rating), the reversal

of the previously recognized impairment loss is recognized in the consolidated

statement of income.

(B) Financial Instruments Classied as Available-for-sale

The Company assesses at the end of each reporting period whether there is

objective evidence that a nancial asset or a group of nancial assets is impaired.

Debt instruments are accounted for using the provisions described in (1). In the

case of equity investments classied as available-for-sale, a 20% or greater decline

in the fair value of the security below its cost or a continuous decline for more than

6 months is also evidence of impairment. If any such evidence exists for available-

for-sale nancial assets, the cumulative loss – measured as the dierence between

the acquisition cost and the current fair value, less any impairment loss on that

financial asset previously recognized in profit or loss – is removed from equity

and recognized in the consolidated statement of income. Impairment losses on

equity instruments recognized in the consolidated statement of income are not

reversed through the consolidated statement of income. If, in a subsequent period,

the fair value of a debt instrument classied as available-for-sale increases and the

increase can be objectively related to an event occurring after the impairment

loss was recognized in prot or loss, the impairment loss is reversed through the

consolidated statement of income.

2.8 Trade Receivables

Trade receivables are amounts due from customers for merchandise sold or

services performed in the ordinary course of business. If collection is expected in

one year or less (or in the normal operating cycle of the Company if longer), they are

classied as current assets. If not, they are presented as non-current assets. Trade

receivables are recognized initially at fair value and subsequently measured at

amortized cost using the eective interest method, less provision for impairment.

2.9 Inventories

Inventories are stated at the lower of cost and net realizable value. Cost is

determined using the average cost method, except for materials-in-transit. The cost

of nished goods and work in progress comprises design costs, raw materials,

direct labor, other direct costs and related production overheads (based on

normal operating capacity). It excludes costs of idle plant and abnormal waste. Net

realizable value is the estimated selling price in the ordinary course of business, less

applicable variable selling expenses.

Inventories are reduced for the estimated losses arising from excess, obsolescence,

and decline in value. This reduction is determined by estimating market value based

on future customer demand. The losses on inventory obsolescence are recorded as

a part of cost of sales.

2.10 Disposal Groups Classied as Held for Sale

When the carrying amount of certain assets and liabilities are expected to be

recovered through sale and the sale of a disposable group is highly probable, such

assets and liabilities are classied as held for sale and measured at the lower of their

carrying amount and fair value.

2.11 Property, Plant and Equipment

Property, plant and equipment are stated at cost less accumulated depreciation

and accumulated impairment losses. Historical cost includes expenditures that are

directly attributable to the acquisition of the items. Subsequent costs are included

in the asset’s carrying amount or recognized as a separate asset, as appropriate,

only when it is probable that future economic benefits associated with the item

will ow to the Company and the cost of the item can be measured reliably. The

carrying amount of those parts that are replaced is derecognized and repairs

and maintenance expenses are recognized in prot or loss in the period they are

incurred.

Depreciation on tangible assets is calculated using the straight-line method to

allocate their cost to their residual values over their estimated useful lives. Land is

not depreciated. Costs that are directly attributable to the acquisition, construction

or production of a qualifying asset, including capitalized interest costs, form part of

the cost of that asset and are amortized over the estimated useful lives.

6564