Samsung 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

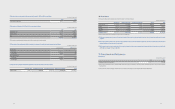

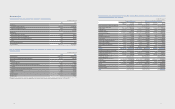

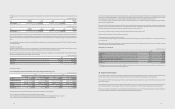

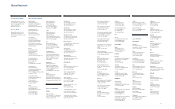

(C) Other related parties

Samsung Everland and other companies are dened as related parties for the Company as of December 31, 2012

Transactions with other related parties for the years ended December 31, 2012 and 2011, and the related receivables and payables as of December 31, 2012 and

2011, are as follows:

(In millions of Korean won)

2012 2011

Transactions

Sales ₩109,228 ₩85,907

Purchases 752,170 655,062

Receivables and Payables

Receivables 189,840 244,411

Payables 179,646 172,872

(D) Key management compensation

Key management includes directors (executive and non-executive) and members of the Executive Committee. The compensation paid or payable to key

management for employee services is shown below:

(In millions of Korean won)

2012 2011

Salaries and other short-term benets ₩10,062 ₩15,808

Termination benets 530 696

Other long-term benets 5,865 5,096

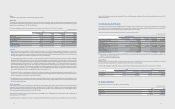

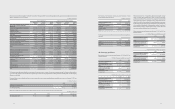

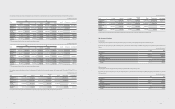

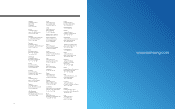

35. Significant Changes of Non-Controlling Interests

(A) Acquisition of non-controlling interests in 2012 are as follows:

(In millions of Korean won)

S-LCD Samsung Japan Samsung Asia Private

Date of acquisition January 19, 2012 April 27, 2012 April 27, 2012

Acquired percentage of non-controlling interests 50% 49% 30%

Ownership share after transaction 100% 100% 100%

Consideration paid to non-controlling interests 1,067,082 159,278 19,452

Carrying amount of non-controlling interests acquired 1,764,927 60,667 13,313

Capital Surplus (*) 697,845 (98,611) (6,139)

(*) The dierence between the carrying amount of non-controlling interests at the time of transaction and consideration paid has been accounted for as capital

surplus which belongs to the owner of consolidated company.

(B) In 2012 Samsung Display Corporation, the subsidiary, merged other subsidiaries, Samsung Mobile Display and S-LCD. This transaction resulted in the

reduced percentage of ownership of the Company of Samsung Display from 100% to 84.8% and increased non-controlling interests by ₩1,654,645

million, which was recognized as the decrease of the equity to the owner of consolidated company (Refer to Note 37 for further details).

109108

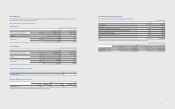

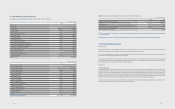

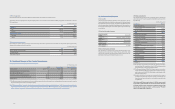

36. Business Combinations

(A) Samsung LED

The Company acquired Samsung LED with a closing date of April 1, 2012 to

improve shareholder value through the enhancement of business eciency

and maximization of business synergies. The approval of the Board of Directors

of the Company replaces shareholders’ meeting approval of the acquisition, as

the acquisition of Samsung LED is a small and simple merger as dened in the

commercial law.

(1) Overview of the acquired company

Name of the acquired

company Samsung LED

Headquarters

location Giheung-gu, Yongin-si, Gyeonggi-do

Representative

director Nam-seong Cho

Classication of the

acquired company Unlisted company

Former relationship

with the Company Associates

(2) Terms of the business combination

The shareholders of Samsung LED received 0.0134934 shares of the

Company’s common stock for each share of Samsung LED common stock

owned on the closing date. The Company transferred its treasury stock to the

shareholders of Samsung LED, instead of issuing new stock.

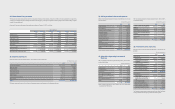

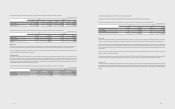

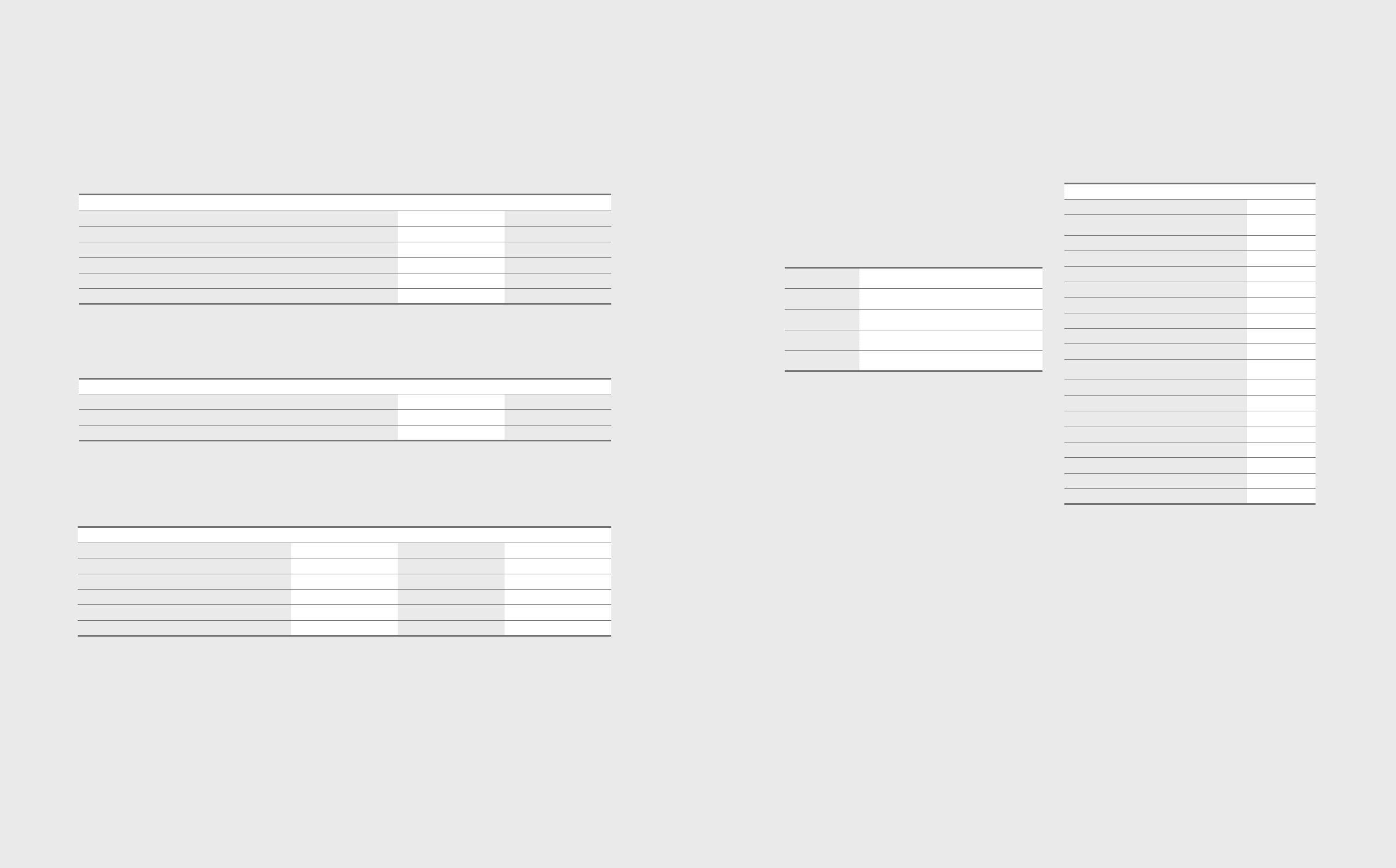

(3) Purchase price allocation

The following table summarizes the consideration paid for Samsung LED

and the amounts of the assets acquired and liabilities assumed as of the

acquisition date.

(In millions of Korean won)

Classication Amount

I. Consideration transferred

Fair value of equity interest held before the business

combination (*1) 344,082

Fair value of additional consideration transferred (*2) 344,082

Total 688,164

II. Identiable assets and liabilities

Cash and cash equivalents 54,454

Trade and other receivables 304,552

Inventories 146,141

Property, plant, and equipment 699,803

Intangible assets 59,512

Investments in Subsidiary, Associates and Joint

Ventures 68,839

Deferred income tax assets 62,733

Other nancial assets 47,370

Trade and other payables 157,571

Borrowings 584,338

Dened benet liability 30,108

Other nancial liabilities 62,500

Total 608,887

III. Goodwill (*3) 79,277

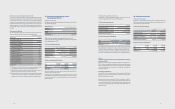

(*1) The Company re-estimated the fair value of its Samsung LED shares,

which represents 50% ownership, as of April 1, 2012 andrecognized gain

on disposal of shares in the amount of ₩28,684 million.

(*2) The Company distributed 269,867 of treasury shares to carry out the

merger with Samsung LED and recognized a gain on disposal of treasury

shares in the amount of ₩233,705 million based on the estimation of fair

value of the treasury shares.

(*3) Goodwill arising from the merger was recognized as the business

combination will allow faster response to changes in the domestic and

international business environments and strengthen manufacturing

competitiveness.

(4) Had Samsung LED been merged on January 1, 2012, the revenue would

be increased by ₩293,273 million and net income would be decreased

by ₩25,582 million. Revenue and net loss contributed by Samsung LED

division after the merger date of April 1, 2012 amount to ₩923,358

million and ₩10,527 million, respectively.