Samsung 2012 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2012 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

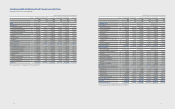

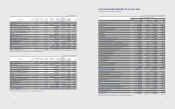

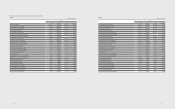

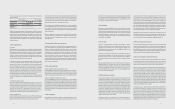

(In millions of Korean won, in thousands of U.S dollars (Note 2.28))

For the year ended December 31,

Notes 2012 2011 2012 2011

KRW KRW USD USD

Revenue 201,103,613 165,001,771 187,754,283 154,048,895

Cost of sales 25 126,651,931 112,145,120 118,244,730 104,700,887

Gross prot 74,451,682 52,856,651 69,509,553 49,348,008

Selling, general and administrative expenses 25, 26 45,402,344 37,212,360 42,388,520 34,742,191

Operating prot 29,049,338 15,644,291 27,121,033 14,605,817

Other non-operating income 27 1,552,989 2,251,019 1,449,901 2,101,596

Other non-operating expense 27 1,576,025 1,612,690 1,471,408 1,505,639

Share of prot or loss of associates and joint ventures 12 986,611 1,399,194 921,119 1,306,315

Finance income 28 7,836,554 7,403,525 7,316,361 6,912,076

Finance expense 28 7,934,450 7,893,421 7,407,758 7,369,453

Prot before income tax 29,915,017 17,191,918 27,929,248 16,050,712

Income tax expense 29 6,069,732 3,432,875 5,666,822 3,204,999

Prot for the year 23,845,285 13,759,043 22,262,426 12,845,713

Prot attributable to owners of the parent 23,185,375 13,382,645 21,646,322 12,494,300

Prot attributable to non-controlling interests 659,910 376,398 616,104 351,413

Earnings per share for prot attributable to the owners of the parent 30

- Basic (in Korean won and US dollars) 154,020 89,229 143.80 83.31

- Diluted (in Korean won and US dollars) 153,950 89,146 143.73 83.23

The accompanying notes are an integral part of these nancial statements.

CONSOLIDATED STATEMENTS OF INCOME

Samsung Electronics Co., Ltd. and its subsidiaries

(In millions of Korean won, in thousands of U.S dollars (Note 2.28))

For the year ended December 31,

Notes 2012 2011 2012 2011

KRW KRW USD USD

Prot for the year 23,845,285 13,759,043 22,262,426 12,845,713

Items not to be reclassied subsequently to prot or loss :

Remeasurement eect of employee benet, net of tax (504,120) (385,214) (470,656) (359,643)

Items to be reclassied subsequently to prot or loss : 17, 23

Changes in value of available-for-sale nancial assets, net of tax 23 962,184 (572,028) 898,314 (534,057)

Share of associates and joint ventures, net of tax 23 (350,491) (113,898) (327,225) (106,337)

Foreign currency translation, net of tax 23 (1,824,653) 183,655 (1,703,532) 171,463

Consolidated comprehensive income 22,128,205 12,871,558 20,659,327 12,017,139

Consolidated comprehensive income attributable to :

Owners of the parent 21,499,343 12,439,116 20,072,209 11,613,403

Non-controlling interests 628,862 432,442 587,118 403,736

The accompanying notes are an integral part of these nancial statements.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Samsung Electronics Co., Ltd. and its subsidiaries

4948

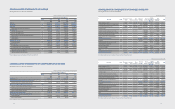

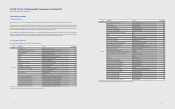

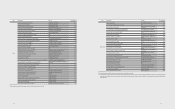

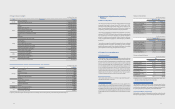

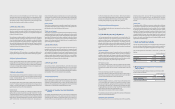

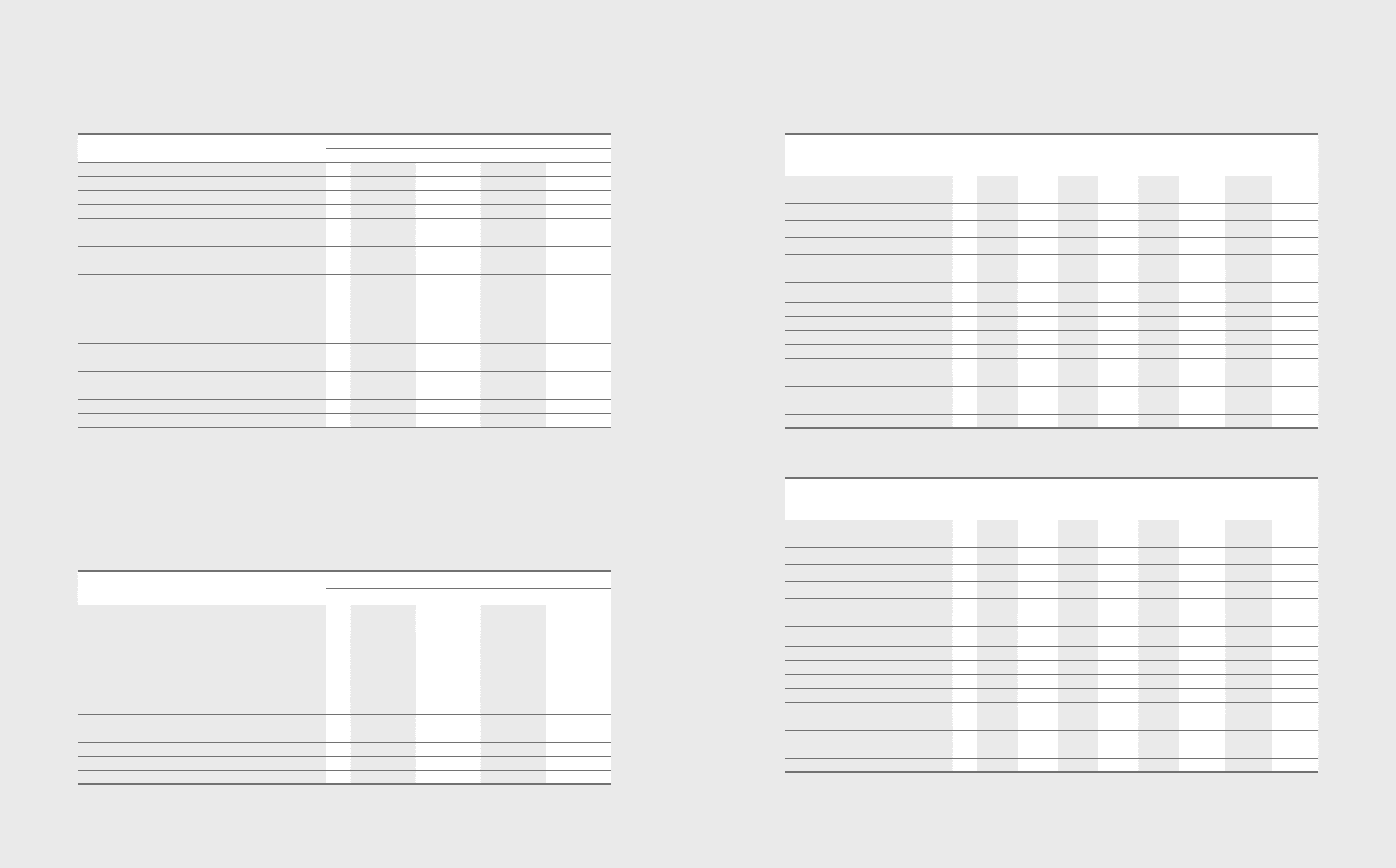

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

Samsung Electronics Co., Ltd. and its subsidiaries

(In millions of Korean won)

2011 KRW Notes Preferred

stock

Common

stock

Share

premium

Retained

earnings

Other

reserves

Equity

attributable

to owners of

the parent

Non-

controlling

interests

Total

Balance at January 1, 2011 119,467 778,047 4,403,893 85,014,550 (4,726,398) 85,589,559 3,759,532 89,349,091

Cumulative eect of change in accounting policy 2 - - - 56,894 (204,892) (147,998) (23,457) (171,455)

Revised balance at January 1, 2011 119,467 778,047 4,403,893 85,071,444 (4,931,290) 85,441,561 3,736,075 89,177,636

Prot for the year - - - 13,382,645 - 13,382,645 376,398 13,759,043

Available-for-sale nancial assets, net of tax, 9, 23 - - - - (567,186) (567,186) (4,842) (572,028)

Share of associates and joint ventures, net of tax 12 - - - - (113,898) (113,898) -(113,898)

Foreign currency translation, net of tax - - - - 123,434 123,434 60,221 183,655

Remeasurement eect of employee benet,

net of tax 17 - - - - (385,879) (385,879) 665 (385,214)

Total comprehensive income - - - 13,382,645 (943,529) 12,439,116 432,442 12,871,558

Dividends 22 - - - (824,478) - (824,478) (156,388) (980,866)

Capital transaction under common control - - - - (108,840) (108,840) 78,155 (30,685)

Eect of business combination - - - - - - 131,564 131,564

Disposal of treasury stock 23 - - - - 288,773 288,773 -288,773

Stock option activities 24 - - - - (73,008) (73,008) -(73,008)

Others - - - (6,739) (66,002) (72,741) 1,399 (71,342)

Total transactions with owners - - - (831,217) 40,923 (790,294) 54,730 (735,564)

Balance at December 31, 2011 119,467 778,047 4,403,893 97,622,872 (5,833,896) 97,090,383 4,223,247 101,313,630

The accompanying notes are an integral part of these consolidated financial statements.

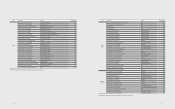

(In thousands of U.S dollars (Note 2.28))

2011 USD Notes Preferred

stock

Common

stock

Share

premium

Retained

earnings

Other

reserves

Equity

attributable

to owners of

the parent

Non-

controlling

interests

Total

Balance at January 1, 2011 111,537 726,400 4,111,561 79,371,254 (4,412,658) 79,908,094 3,509,972 83,418,066

Cumulative eect of change in accounting policy 2 - - - 53,117 (191,291) (138,174) (21,900) (160,074)

Revised balance at January 1, 2011 111,537 726,400 4,111,561 79,424,371 (4,603,949) 79,769,920 3,488,072 83,257,992

Prot for the year - - - 12,494,300 - 12,494,300 351,413 12,845,713

Available-for-sale nancial assets, net of tax, 9, 23 - - - - (529,536) (529,536) (4,521) (534,057)

Share of associates and joint ventures, net of tax 12 - - - - (106,337) (106,337) - (106,337)

Foreign currency translation, net of tax - - - - 115,240 115,240 56,224 171,464

Remeasurement eect of employee benet,

net of tax 17 - - - - (360,264) (360,264) 621 (359,643)

Total comprehensive income - - - 12,494,300 (880,897) 11,613,403 403,737 12,017,140

Dividends 22 - - - (769,749) - (769,749) (146,007) (915,756)

Capital transaction under common control - - - - (101,615) (101,615) 72,967 (28,648)

Eect of business combination - - - - - - 122,831 122,831

Disposal of treasury stock 23 - - - - 269,604 269,604 - 269,604

Stock option activities 24 - - - - (68,162) (68,162) - (68,162)

Others - - - (6,292) (61,620) (67,912) 1,306 (66,606)

Total transactions with owners - - - (776,041) 38,207 (737,834) 51,097 (686,737)

Balance at December 31, 2011 111,537 726,400 4,111,561 91,142,630 (5,446,639) 90,645,489 3,942,906 94,588,395

The accompanying notes are an integral part of these consolidated financial statements.