Samsung 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

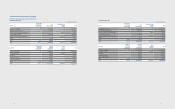

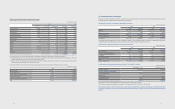

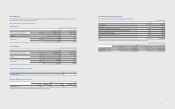

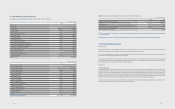

(I) The actual returns on plan assets for the years ended December 31, 2012 and 2011, are as follows:

(In millions of Korean won)

2012 2011

Actual return on plan assets ₩88,701 ₩80,551

(J) Plan assets as of December 31, 2012 and 2011, are comprised as follows:

(In millions of Korean won)

2012 2011

Equity instruments ₩59,988 ₩68,375

Debt instruments 2,859,415 2,325,392

Other 20,125 29,385

₩2,939,528 ₩2,423,152

(*) Plan assets are mostly invested in instruments which have a quoted price in active market.

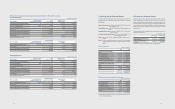

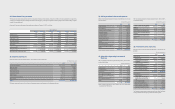

(K) The analysis of the overall pension liability's sensitivity to changes in the weighted principal assumptions is as follows :

(In millions of Korean won)

Change in value Rate of change

Discount rate

1% increases ₩4,201,001 90%

1% decreases 5,235,704 112%

Future salary increases

1% increases ₩5,220,723 112%

1% decreases 4,203,970 90%

(L) Expected maturity analysis of undiscounted pension benefits as of December 31, 2012, is as follows:

(In millions of Korean won)

Less than 1 year Between 1 and 2 years Between 2 and 5 years Between 5 and 10 years Total

Pension benets ₩250,111 ₩256,194 ₩1,081,159 ₩2,957,385 ₩4,544,849

8988

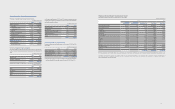

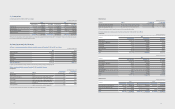

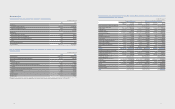

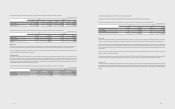

18. Provisions

The changes in the provisions during the year ended December 31, 2012, are as follows:

(In millions of Korean won)

Warranty (A) Royalty expenses (B) Long-term incentives (C) Others Total

January 1, 2012 ₩1,680,534 ₩1,590,079 ₩510,901 ₩96,245 ₩3,877,759

Increase 2,403,512 1,510,409 199,566 (9,936) 4,103,551

Decrease (1,970,017) (174,702) (134,138) - (2,278,857)

Others (*) (81,212) (152,590) - (5,269) (239,071)

December 31, 2012 ₩2,032,817 ₩2,773,196 ₩576,329 ₩81,040 ₩5,463,382

(*) Others include amounts from changes in foreign currency exchange rates.

(A) The Company accrues warranty reserves for estimated costs of future service, repairs and recalls, based on historical experience and terms of warranty

programs.

(B) The Company makes provisions for estimated royalty expenses related to technical assistance agreements that have not been settled. The amount of

payment depends on the settlement of the agreement.

(C) The Company has a long-term incentive plan for its executives based on a three-year management performance criteria and has made a provision for the

estimated incentive cost for the accrued period.

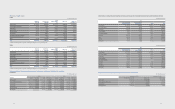

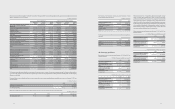

19. Commitments and Contingencies

(A) Guarantees

(In millions of Korean won)

2012 2011

Guarantees of debt for housing rental (*) ₩151,817 ₩153,989

(*) Represents the maximum amount of debt guarantee, which was provided for employees who took debt from nancial institutions in order to nance employee

housing rental.

As of December 31, 2012, the Company’s investments in Pusan Newport are pledged as collateral against the investee's debt (Note 9).