Samsung 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

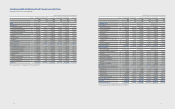

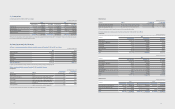

The Company policy is that assets should be depreciated over the following

estimated useful lives:

Estimated useful

lives

Estimated useful

lives

Buildings and

auxiliary facilities 15, 30 years Tools and xtures 5 years

Structures 15 years Vehicles 5 years

Machinery and

equipment 5 years

Tangible assets’ depreciation methods, residual values and useful lives are reviewed,

and adjusted if appropriate, at the end of each reporting period. An asset’s carrying

amount is written down immediately to its recoverable amount if the asset’s

carrying amount is greater than its estimated recoverable amount. Gains and losses

on disposals are determined by comparing the proceeds with the carrying amount

and are recognized within the statement of income as part of other non-operating

income and expenses.

2.12 Intangible Assets

(A) Goodwill

Goodwill represents the excess of the cost of an acquisition over the fair value of the

group’s share of the net identiable assets of the acquired subsidiary, associates,

joint ventures and businesses at the date of acquisition. Goodwill on acquisitions

of subsidiaries and businesses is included in intangible assets and goodwill on

acquisition of associates and joint ventures are included in the investments in

associates and joint ventures. Gains and losses on the disposal of an entity include

the carrying amount of goodwill relating to the entity sold.

For the purpose of impairment testing, goodwill acquired in a business combination

shall, from the acquisition date, be allocated to each of the acquirer’s cash-

generating units, or groups of cash-generating units, that is expected to benefit

from the synergies of the combination, and the allocation shall be determined

based on the operating segments. Goodwill is tested annually for impairment

and carried at cost less accumulated impairment losses. Goodwill is tested for

impairment annually or more frequently if there is any indication that it may be

impaired. Goodwill is tested for impairment by comparing the carrying amount of

the cash-generating units or groups of cash-generating units with the

recoverable amount, which is the higher of its fair value less costs to sell and its

value in use. An impairment loss is immediately recognized and is not subsequently

reversed.

(B) Capitalized development costs

The Company capitalizes certain development costs when the outcome of a

development plan is for practical enhancement, probability of technical and

commercial achievement for the development plans are high, and the necessary

cost is reliably estimable. Capitalized costs, comprising direct labor and related

overheads, are amortized on a straight-line basis over their useful lives. In

presentation, accumulated amortization and accumulated impairment amounts

are deducted from capitalized costs associated with development activities.

(C) Other intangible assets

Certain membership dues are regarded as having an indenite useful life because

there is no foreseeable limit to the period over which the asset is expected to

generate net cash inows for the entity, and such assets are not amortized.

Trademarks and licenses which are separately acquired are presented at historical

cost. Trademarks and licenses which are acquired in business combinations are

recorded at the fair value at the acquisition date. They have definite useful lives

and are measured at cost less any accumulated amortization and amortized on a

straight-line basis over their 5 or 10 year estimated useful lives.

The contractual customer relationships were acquired in a business combination

and are recognized at fair value at the acquisition date. The contractual relationships

have a definite useful life and are recorded at cost less any accumulated

amortization and amortized on a straight-line basis over the estimated period of the

customer relationship.

Software is capitalized and amortized using the straight-line method over their

useful lives, generally 5 to 10 years. Where an indication of impairment exists,

the carrying amount of an intangible asset is assessed and written down to its

recoverable amount.

2.13 Impairment of Non-Financial Assets

Intangible assets that have an indenite useful life, for example goodwill, are not

subject to amortization and are tested annually for impairment. Assets that are

subject to amortization are reviewed for impairment whenever events or changes

in circumstances indicate that the carrying amount may not be recoverable.

An impairment loss is recognized for the amount by which the asset’s carrying

amount exceeds its recoverable amount. The recoverable amount is the higher

of an asset’s fair value less costs to sell and value in use. For the purposes of

assessing impairment, assets are grouped at the lowest levels for which there are

separately identiable cash ows (cashgenerating units). Non-nancial assets other

than goodwill that suffered impairment are reviewed for possible reversal of the

impairment at each reporting date.

2.14 Financial Liabilities

(A) Financial liabilities at fair value through prot or loss

GFinancial liabilities are acquired or incurred principally for the purpose of selling or

repurchasing in the near term. Financial liabilities at fair value through prot or loss

of the Company consist of derivatives which are not subject to hedge accounting

and derivatives separated from nancial instruments such as embedded derivatives.

(B) Financial liabilities measured at amortized cost

Unless nancial liabilities arise when transfer of nancial assets or nancial liabilities

at fair value through prot or loss do not qualify for derecognition, all non-derivative

nancial liabilities are classied as nancial liabilities measured at amortized cost.

If a transfer does not result in derecognition, the Company continues to recognize

the transferred asset and a nancial liability for the consideration received. Financial

liabilities measured at amortized cost, due within twelve months after the balance

sheet date, are classied as current liabilities, otherwise, they are classied as non-

current liabilities.

2.15 Trade Payables

Trade payables are amounts due to suppliers for merchandise purchased or services

received in the ordinary course of business. If payment is expected in one year or

less (or in the normal operating cycle of the Company if longer), they are classied

as current liabilities. If not, they are presented as non-current liabilities. Non-current

trade payables are recognized initially at fair value and subsequently measured at

amortized cost using the eective interest method.

2.16 Borrowings

Borrowings are recognized initially at fair value, net of transaction costs and are

subsequently measured at amortized cost. Any dierence between cost and the

redemption value is recognized in the statement of income over the period of the

borrowings using the eective interest method. If the Company has an indenite

right to defer payment for a period longer than 12 months after the end of the

reporting date, such liabilities are recorded as non-current liabilities, otherwise, they

are recorded as current liabilities.

2.17 Provisions

A provision is recognized when the Company has a present legal or constructive

obligation as a result of a past event, it is probable that an outflow of resources

embodying economic benefits will be required to settle the obligation, and a

reliable estimate can be made of the amount of the obligation. Provisions are not

recognized for future operating losses.

Provisions are measured at the present value of the expenditures expected to be

required to settle the obligation using a pre-tax rate that reects current market

assessments of the time value of money and the risks specific to the obligation.

The increase in the provision due to the passage of time is recognized as interest

expense.

When it is probable that an outow of economic benets will occur due to a present

obligation resulting from a past event, and the amount is reasonably estimable, a

corresponding provision is recognized in the nancial statements. However, when

such outflow is dependent upon a future event, that is not certain to occur, or

cannot be reliably estimated, a disclosure regarding the contingent liability is made

in the notes to the nancial statements.

2.18 Dened Benet Liabilities

The Company has a variety of retirement pension plans including dened benet

or dened contribution plans. A dened contribution plan is a pension plan under

which the Company pays xed contributions into a separate entity. The Company

has no legal or constructive obligations to pay further contributions if the fund

does not hold sufficient assets to pay all employees the benefits relating to

employee service in the current and prior periods. For dened contribution plans,

the Company pays contributions to annuity plans that are managed either publicly

or privately on a mandatory, contractual or voluntary basis. The Company has no

further future payment obligations once the contributions have been paid. The

contributions are recognized as employee benefit expense when they are due.

Prepaid contributions are recognized as an asset to the extent that a cash refund or

a reduction in the future payments is available.

A defined benefit plan is a pension plan that is not a defined contribution plan.

Typically defined benefit plans define an amount of pension benefit that an

employee will receive on retirement, usually dependent on one or more factors

such as age, years of service and compensation. The liabilities recognized in the

statement financial position in respect of defined benefit pension plans are the

present values of the dened benet obligations at the end of the reporting period

less the fair value of plan assets. The dened benet obligation is calculated annually

by independent actuaries using the projected unit credit method. The present

value of the dened benet obligation is determined by discounting the estimated

future cash outows using interest rates of high-quality corporate bonds that are

denominated in the currency in which the benets will be paid and that have terms

to maturity approximating to the terms of the related pension liability.

Actuarial gains and losses resulting from the changes in actuarial assumptions, and

the dierences between the previous actuarial assumptions and what has actually

occurred, are recognized in other comprehensive income in the period in which it

was incurred. Past service costs are immediately recognized in prot and loss.

2.19 Financial Guarantee Contract

Financial guarantee contracts are contracts that require the issuer to make specied

payments to reimburse the holder for a loss it incurs because a specied debtor fails

to make payments when due. Financial guarantees are initially recognized in the

nancial statements at fair value on the date the guarantee was given. If the amount

measured in subsequent periods exceeds the unamortized balance of the amount

initially recognized, the excess is classied as another nancial liability.

2.20 Income Tax Expense and Deferred Taxes

The tax expense for the period comprises current and deferred tax. Tax is recognized

in the statement of income, except to the extent that it relates to items recognized

in other comprehensive income or directly in equity. In this case the tax is also

recognized in other comprehensive income or directly in equity as appropriate.

Deferred income tax is recognized on temporary dierences arising between the tax

bases of assets and liabilities and their carrying amounts in the consolidated nancial

statements; it is the future tax consequences of the future recovery or settlement

of the carrying amount. However, the deferred income tax is not accounted for if

it arises from initial recognition of an asset or liability in a transaction other than a

business combination that at the time of the transaction aects neither accounting

nor taxable profit or loss. Deferred income tax is determined using tax rates (and

laws) that have been enacted or substantively enacted by the balance sheet date

and are expected to apply when the related deferred income tax asset is realized or

the deferred income tax liability is settled. Deferred income tax assets are recognized

only to the extent that it is probable that future taxable prot will be available against

which the temporary dierences can be utilized.

An entity shall recognize a deferred tax liability for all taxable temporary dierences

associated with investments in subsidiaries, associates, and interests in joint

ventures, except to the extent that the parent company is able to control the timing

of the reversal of the temporary difference, and it is probable that the temporary

difference will not reverse in the foreseeable future. An entity shall recognize a

deferred tax asset for all deductible temporary dierences arising from investments

in subsidiaries and associates, and interests in joint ventures, to the extent that the

temporary dierence will reverse in the foreseeable future and taxable prots will be

available against which the temporary dierence can be utilized.

6766