Samsung 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

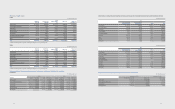

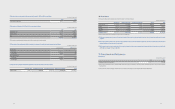

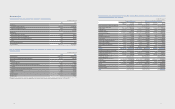

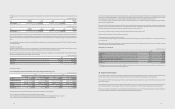

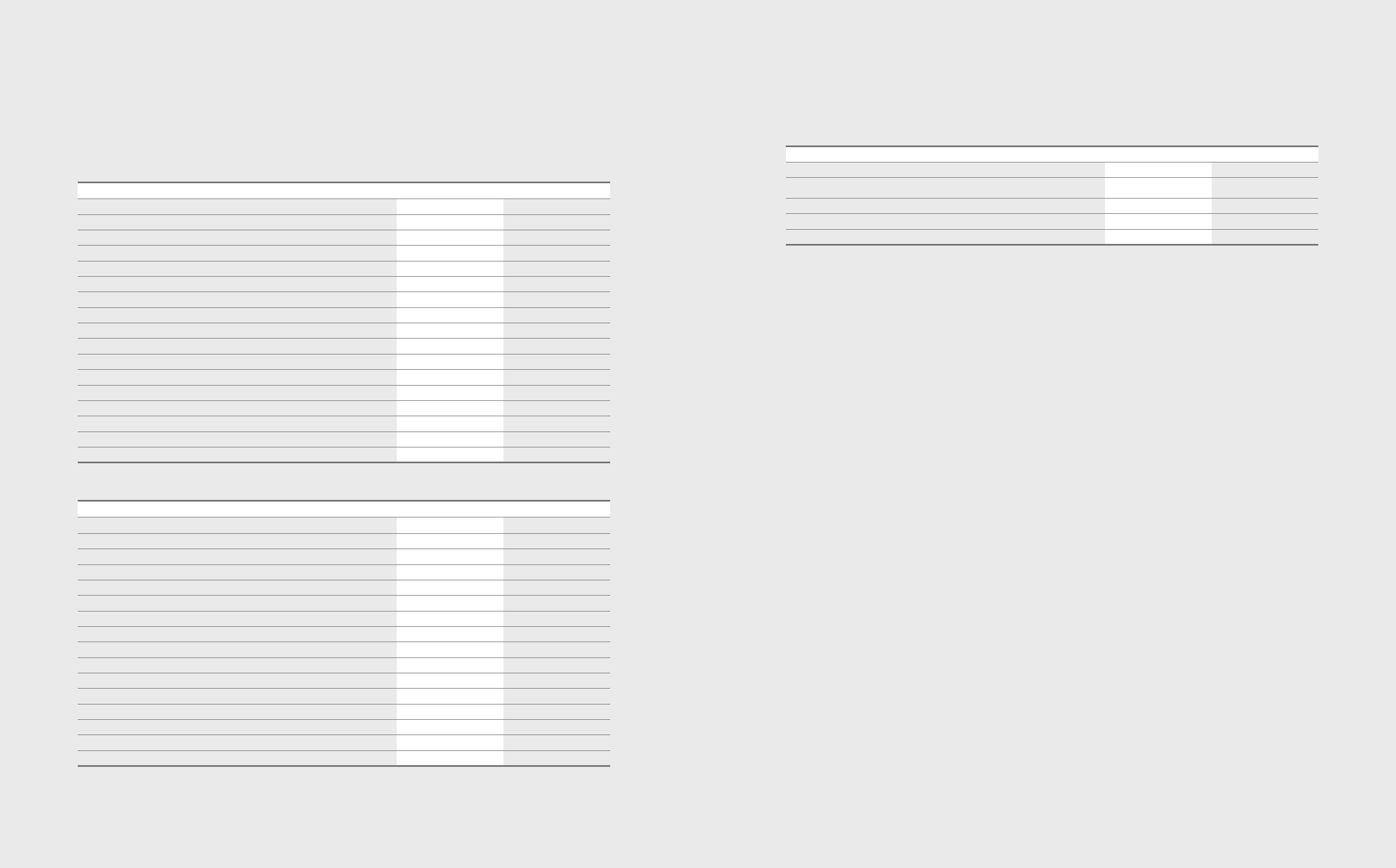

31. Cash Generated from Operations

(A) Cash flows from operating activities as of December 31, 2012 and 2011, consist of the following:

(In millions of Korean won)

2012 2011

Adjustments for:

Tax expense ₩6,069,732 ₩3,432,875

Finance income (2,068,888) (1,821,379)

Finance expense 1,755,715 1,661,180

Severance and retirement benets 768,423 584,096

Depreciation expenses 14,835,046 12,934,274

Amortization expenses 786,970 657,790

Bad debt expenses and etc. 205,424 93,801

Gain on valuation of equity method (986,611) (1,399,194)

Gain on disposal of property, plant and equipment (147,645) (113,690)

Loss on disposal of property, plant and equipment 324,993 109,338

Obsolescence and scrappage of inventories 1,212,222 1,353,320

Gain on disposal of investments (113,886) (223,535)

Gain on transfer of business - (1,062,793)

Impairment losses on intangible assets 216,790 186,759

Other income/expense (98,726) 57,787

Adjustments, total ₩22,759,559 ₩16,450,629

(In millions of Korean won)

2012 2011

Changes in assets and liabilities:

Increase in trade receivables ₩(2,032,126) ₩(2,015,177)

Increase in other receivables (536,202) (181,613)

Increase in advance payment (277,329) (147,387)

Increase in prepaid expenses (72,285) (27,432)

Increase in inventories (4,011,553) (3,919,683)

Increase in trade payables (465,450) 750,048

Increase in other payables (416,870) 375,478

Increase in advance received 88,152 548,416

(Decrease)/Increase in withholdings (663,733) 556,563

Increase in accrued expenses 2,183,846 508,657

Increase in utilization of provisions 1,824,693 722,421

Payment of severance benets (301,444) (256,261)

Increase in plan assets (440,420) (531,743)

Others (657,228) (439,632)

Changes in net working capital, total ₩(5,777,949) ₩(4,057,345)

101100

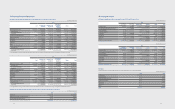

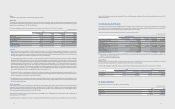

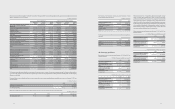

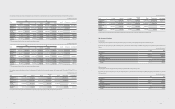

(B) Significant transactions not affecting cash flows for the years ended, 2012 and 2011, are as follows:

(In millions of Korean won)

2012 2011

Valuation of available-for-sale nancial assets ₩ 1,185,256 ₩(559,831)

Reclassication of construction-in-progress and machinery-in-transit to property,

plant and equipment 19,567,010 22,530,787

Increase in share of associates and joint ventures accumulated other comprehensive income (350,491) (113,898)

Net assets acquired from business combination (633,708) -

Net assets acquired in transfer of business - 788,454

(C) The Company reported on a net basis cash receipts and payments arising from transactions occurring frequently and short-term financial instruments,

loans, and borrowings.

(D) Among the net cash used in investing activities, cash outflows from business combination include the acquisition of assets and liabilities of CSR.

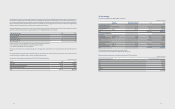

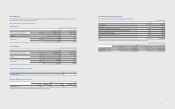

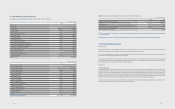

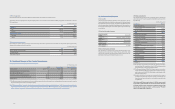

32. Financial Risk Management

Financial risk factors

The Company is exposed to credit risk, liquidity risk and market risk. Market risk arises from currency risk, interest rate risk and fair value risk associated with

investments. The Company has a risk management program in place to monitor and actively manage such risks.

Also, nancial risk management ocers are dispatched to the regional head quarters of each area including US, UK, Singapore, China, Japan, Brazil and Russia to run

and operate a local nancial center for global nancial risk management.

The Company’s nancial assets that are under nancial risk management are composed of cash and cash equivalents, short-term nancial instruments, available-

for-sale nancial assets, trade and other receivables and other nancial assets. The Company’s nancial liabilities under nancial risk management are composed of

trade and other payables, borrowings and debentures, and other nancial liabilities.

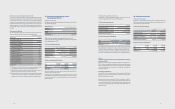

(A) Market risk

(1) Foreign exchange risk

The Company is exposed to foreign exchange risk arising from various currency exposures, primarily with respect to the United States of America, European Union,

Japan, other Asian countries and South America. Revenues and expenses arise from foreign currency transactions and exchange positions, and the most widely

used currencies are the US Dollar, EU’s EURO, Japanese Yen and Chinese Yuan. Foreign exchange risk management of the Company is carried out by both SEC and its

subsidiaries. To minimize foreign exchange risk arising from operating activities, the Company’s foreign exchange management policy requires all normal business

transactions to be in local currency, or cash-in currency be matched up with cash-out currency. The Company’s foreign risk management policy also denes foreign

exchange risk, measuring period, controlling responsibilities, management procedures, hedging period and hedge ratio very specically.

The Company limits all speculative foreign exchange transactions and operates a system to manage receivables and payables denominated in foreign currency. It

evaluates, manages and reports foreign currency exposures to receivables and payables.