Samsung 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5150

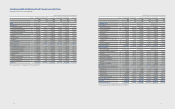

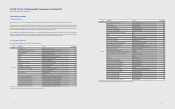

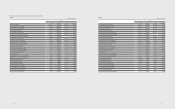

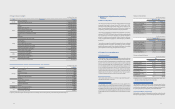

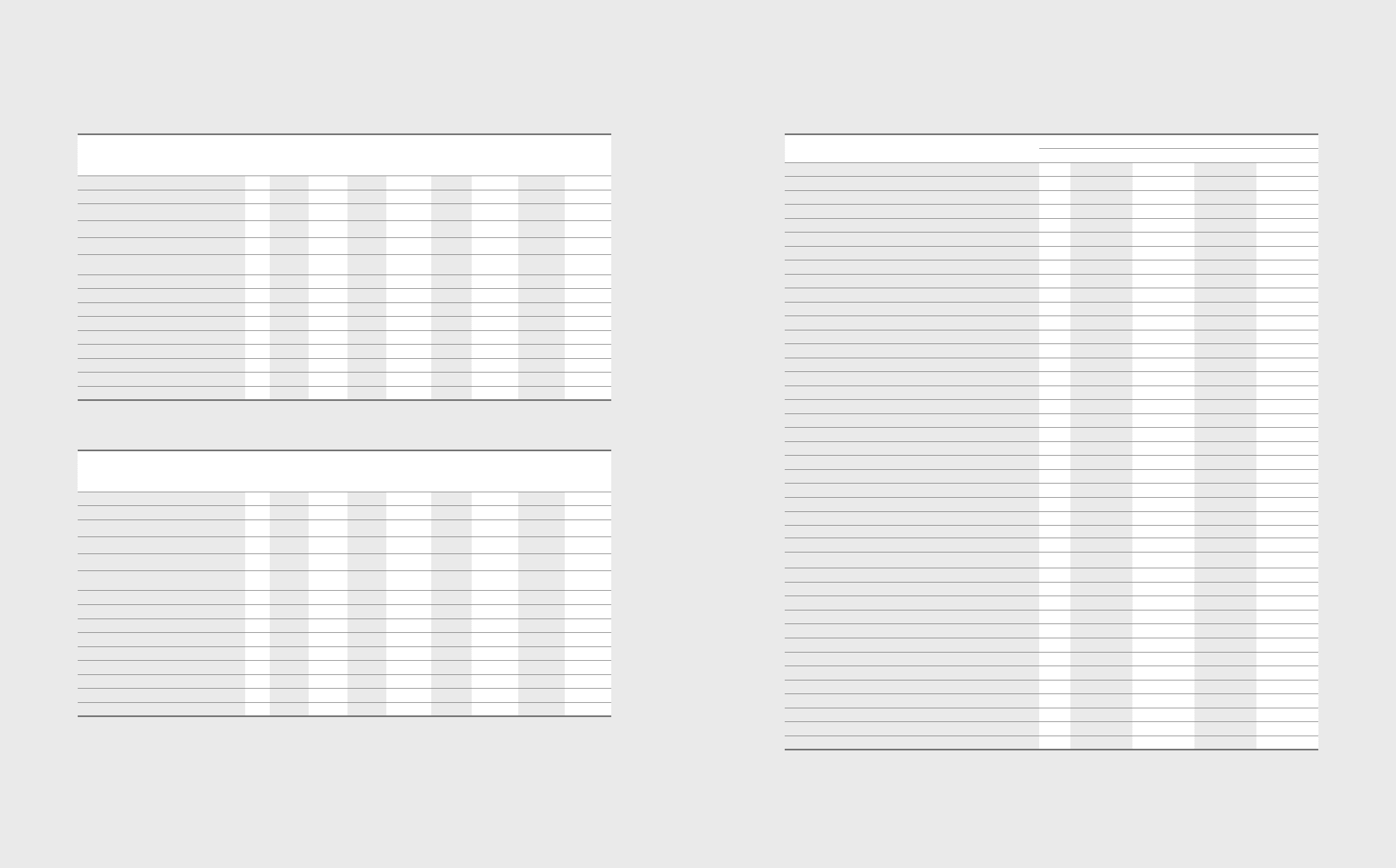

CONSOLIDATE STATEMENTS OF CASH FLOWS

Samsung Electronics Co., Ltd. and its subsidiaries

(In millions of Korean won, in thousands of U.S dollars (Note 2.28))

For the year ended December 31,

Notes 2012 2011 2012 2011

KRW KRW USD USD

Cash ows from operating activities

Prot for the year 23,845,285 13,759,043 22,262,426 12,845,713

Adjustments 31 22,759,559 16,450,629 21,248,771 15,358,630

Changes in operating assets and liabilities 31 (5,777,949) 4,057,345) (5,394,406) (3,788,017)

Cash ows from operating activities 40,826,895 26,152,327 38,116,791 24,416,326

Interest received 789,397 755,859 736,997 705,685

Interest paid (576,379) (641,462) (538,119) (598,882)

Dividend received 1,112,940 628,585 1,039,063 586,859

Income tax paid (4,180,044) 3,977,408) (3,902,572) (3,713,385)

Net cash generated from operating activities 37,972,809 22,917,901 35,452,160 21,396,603

Cash ows from investing activities

Net decrease (increase) in short-term nancial instruments (5,965,611) 75,666 (5,569,612) 70,643

Net decrease (increase) in short-term available-for-sale nancial assets (589,072) 518,479 (549,969) 484,062

Proceeds from disposal of long-term available-for-sale nancial assets 106,208 415,096 99,158 387,542

Acquisition of long-term available-for-sale nancial assets (870,249) (419,678) (812,482) (391,820)

Proceeds from disposal of associates and joint ventures 41,091 306,804 38,363 286,438

Acquisition of associates and joint ventures (279,022) (403,538) (260,500) (376,751)

Disposal of property and equipment 644,062 379,878 601,309 354,662

Purchases of property and equipment (22,965,271) (21,965,678) (21,440,828) (20,507,588)

Disposal of intangible assets 61,497 9,703 57,415 9,059

Purchases of intangible assets (650,884) (663,678) (607,678) (619,623)

Proceeds from deposits 313,043 461,454 292,263 430,823

Payment for deposits (347,746) (594,067) (324,662) (554,633)

Cash outows from business combination (464,279) (522,740) (433,460) (488,040)

Cash inows from disposal of business - 925,454 -864,022

Others (355,321) 364,281 (331,735) 340,10 0

Net cash used in investing activities (31,321,554) (21,112,564) (29,242,418) (19,711,104)

Cash ows from nancing activities

Net (repayment) proceeds from shortterm borrowings (800,579) 977,315 (747,436) 912,440

Disposal of treasury stock 88,473 160,827 82,600 150,151

Proceeds from long-term borrowings and debentures 1,862,256 3,925,406 1,738,639 3,664,836

Repayment of long-term borrowings and debentures (522,899) (1,145,167) (488,189) (1,069,150)

Payment of dividends (1,265,137) (874,608) (1,181,157) (816,551)

Net increase (decrease) in Non-controlling interests (1,200,134) 363,417 (1,120,469) 339,293

Others (26,488) (297,461) (24,729) (277,715)

Net cash provided by (used in) nancing activities (1,864,508) 3,109,729 (1,740,741) 2,903,304

Eect of exchange rate changes on cash and cash equivalents (687,048) (14,724) (641,442) (13,747)

Net increase (decrease) in cash and cash equivalents 4,099,699 4,900,342 3,827,559 4,575,056

Cash and cash equivalents

Beginning of the year 14,691,761 9,791,419 13,716,517 9,141,461

End of the year 18,791,460 14,691,761 17,544,076 13,716,517

The accompanying notes are an integral part of these consolidated financial statements.

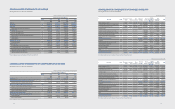

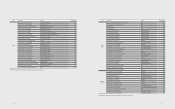

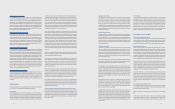

(In millions of Korean won)

2012 KRW Notes Preferred

stock

Common

stock

Share

premium

Retained

earnings

Other

reserves

Equity

attributable

to owners of

the parent

Non-

controlling

interests

Total

Balance at January 1, 2012 119,467 778,047 4,403,893 97,622,872 (5,833,896) 97,090,383 4,223,247 101,313,630

Prot for the year - - - 23,185,375 - 23,185,375 659,910 23,845,285

Available-for-sale nancial assets, net of tax 9, 23 - - - - 960,688 960,688 1,496 962,184

Share of associates and joint ventures, net of tax 12 - - - - (350,491) (350,491) - (350,491)

Foreign currency translation, net of tax - - - - (1,789,877) (1,789,877) (34,776) (1,824,653)

Remeasurement eect of employee benet,

net of tax 17 - - - - (506,351) (506,351) 2,231 (504,120)

Total comprehensive income - - - 23,185,375 (1,686,031) 21,499,344 628,861 22,128,205

Dividends 22 - - - (827,501) - (827,501) (373,632) (1,201,133)

Capital transaction under common control - - - - (1,089,835) (1,089,835) (104,395) (1,194,230)

Eect of business combination - - - - - - 12,844 12,844

Disposal of treasury stock 23 - - - - 455,377 455,377 - 455,377

Stock option activities 24 - - - - (33,071) (33,071) - (33,071)

Others - - - 4,943 (5,588) (645) (771) (1,416)

Total transactions with owners - - - (822,558) (673,117) (1,495,675) (465,954) (1,961,629)

Balance at December 31, 2012 119,467 778,047 4,403,893 119,985,689 (8,193,044) 117,094,052 4,386,154 121,480,206

The accompanying notes are an integral part of these consolidated financial statements.

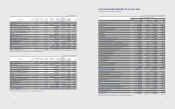

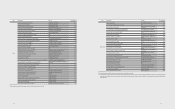

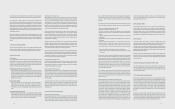

(In thousands of U.S dollars (Note 2.28))

2012 USD Notes Preferred

stock

Common

stock

Share

premium

Retained

earnings

Other

reserves

Equity

attributable

to owners of

the parent

Non-

controlling

interests

Total

Balance at January 1, 2012 111,537 726,400 4,111,561 91,142,630 (5,446,639) 90,645,489 3,942,906 94,588,395

Prot for the year - - - 21,646,322 - 21,646,322 616,104 22,262,426

Available-for-sale nancial assets, net of tax 9, 23 - - - - 896,917 896,917 1,397 898,314

Share of associates and joint ventures, net of tax 12 - - - - (327,225) (327,225) - (327,225)

Foreign currency translation, net of tax - - - - (1,671,064) (1,671,064) (32,468) (1,703,532)

Remeasurement eect of employee benet,

net of tax 17 - - - - (472,739) (472,739) 2,083 (470,656)

Total comprehensive income - - - 21,646,322 (1,574,111) 20,072,211 587,116 20,659,327

Dividends 22 - - - (772,571) - (772,571) (348,830) (1,121,401)

Capital transaction under common control - - - - (1,017,491) (1,017,491) (97,466) (1,114,957)

Eect of business combination - - - - - - 11,991 11,991

Disposal of treasury stock 23 - - - - 425,149 425,149 - 425,149

Stock option activities 24 - - - - (30,876) (30,876) - (30,876)

Others - - - 4,615 (5,217) (602) (720) (1,322)

Total transactions with owners - - - (767,956) (628,435) (1,396,391) (435,025) (1,831,416)

Balance at December 31, 2012 111,537 726,400 4,111,561 112,020,996 (7,649,185) 109,321,309 4,094,997 113,416,306

The accompanying notes are an integral part of these consolidated financial statements.