Samsung 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

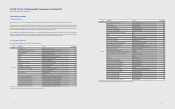

K-IFRS 1113, ‘Fair value measurement’

The standard aims to improve consistency and reduce complexity by providing

a precise definition of fair value and a single source of fair value measurement

and disclosure requirements for use across Financial Reporting Standards. The

requirements, which are largely aligned between IFRS and US GAAP, do not extend

the use of fair value accounting but provide guidance on how it should be applied

where its use is already required or permitted by other standards within IFRS or US

GAAP. The Company is still in the process of assessing the impact of the amendment

on the consolidated nancial statements and intends to adopt K-IFRS 1113 no later

than the accounting period beginning January 1, 2013.

K-IFRS 1110, ‘Consolidated nancial statements’

The standard explains the principle of control which is the basis for determining

which entities are consolidated in the consolidated nancial statements. An investor

controls an investee when it is exposed, or has rights, to variable returns from its

involvement with the investee and has the ability to aect those returns through its

power over the investee. The standard sets out further guidance where it is dicult

to determine control. The standard will be effective for the fiscal year beginning

January 1, 2013. The Company is in the process of assessing the impact of the

standard on the consolidated nancial statements.

K-IFRS 1111, ‘Joint arrangements Introduction’

The standard reects the essence of joint arrangements and focuses on the rights

and obligations of the parties to the joint arrangements rather than on the legal

forms of the arrangements. The standard classifies joint arrangements into joint

operations and joint ventures. A joint operation is a joint arrangement whereby the

parties that have joint control of the arrangement (i.e. joint operators) have rights

to the assets, and obligations for the liabilities, relating to the arrangement. A joint

operator accounts for the assets, liabilities, revenues and expenses in relation to

its interest in the arrangement. A joint venture is a joint arrangement whereby the

parties that have joint control of the arrangement (i.e. joint venturers) have rights

to the net assets of the arrangement. Joint venturers account for the investment

using the equity method. The standard will be eective for the scal year beginning

January 1, 2013. The Company is in the process of assessing the impact of the

standard on the consolidated nancial statements.

K-IFRS 1111, ‘Joint arrangements Introduction’

The standard provides disclosure requirements for all types of equity investments

in other entities including subsidiaries, joint arrangements, associates, consolidated

structured entities and unconsolidated structured entities. The standard will be

effective for the fiscal year beginning January 1, 2013. The Company is in the

process of assessing the impact of the standard on the consolidated financial

statements.

2.3 Consolidation

The Company prepares annual consolidated financial statements in accordance

with K-IFRS 1027, Consolidated and Separate Financial Statements.

(A) Subsidiaries

The consolidated financial statements include the accounts of SEC and its

controlled subsidiaries. Control over a subsidiary is presumed to exist when the

Company has the power to govern the nancial and operating policies of an entity

to obtain benefits from its activities generally accompanying a shareholding of

more than one half of the voting rights. The existence and eects of potential voting

rights that are exercisable or convertible at the end of the reporting period are

considered in determining whether the Company controls another entity. Moreover,

K-IFRS 1027 requires the evaluation of whether the Company holds control over the

nancial and operating policies of a subsidiary where the Company’s shareholding

is less than or equal to 50%. Control is presumed to exist when the Company is

considered to have control over the nancial and operating policies of a subsidiary

through its ownership relative to those of other shareholders. Subsidiaries are fully

consolidated from the date when control is transferred to the Company and de-

consolidated from the date which control ceases to exist.

The purchase method of accounting is used to account for the acquisition of

subsidiaries by the Company. The cost of an acquisition is measured at the fair value

of the assets given, equity instruments issued and liabilities incurred or assumed

at the date of exchange. Identiable assets acquired and liabilities and contingent

liabilities assumed in a business combination are measured initially at their fair

values at the acquisition date, irrespective of the extent of any non-controlling

interest. The excess of the cost of acquisition over the fair value of the Company’s

share of the identifiable net assets acquired is recorded as goodwill. If the cost of

acquisition is less than the fair value of the net assets of the subsidiary acquired,

the dierence is recognized directly in the statement of income. For each business

combination, the Company measures any non-controlling interest in the acquiree

at the non-controlling interest’s proportionate share of the acquiree’s identiable

net assets.

In a business combination achieved in stages, the acquisition date fair value of the

acquirer’s previously held equity interest in the acquiree is remeasured to fair value

at the acquisition date through prot or loss.

The Company recognizes the acquisition-date fair value of contingent

consideration. Changes in the fair value of contingent consideration classied as an

asset or a liability are recognized in profit or loss in accordance with K-IFRS 1039,

‘Financial Instruments: Recognition and Measurement’. Contingent consideration

classied as equity shall not be remeasured and its subsequent settlement shall be

accounted for within equity.

The Company recognizes goodwill as of the acquisition date measured as the

excess of (1) the aggregate of 1) the consideration transferred, 2) the amount of

any non-controlling interest in the acquiree and 3) the acquisition-date fair value

of the Company’s previously held equity interest in the acquiree over (2) the net

identiable assets acquired. If the aggregate amount in (1) is less than the fair value

of the acquiree’s net assets (2), the dierence is recognized in prot or loss.

Inter-company transactions, balances, income, expenses and unrealized gains

on inter-company transactions are eliminated. Unrealized losses are eliminated

upon assessing the impairment of the transferred assets. Accounting policies of

subsidiaries have been changed where necessary to ensure consistency with the

policies adopted by the Company.

(B) Changes in the ownership of a subsidiary without gain or loss of control

Transactions with non-controlling interests that do not result in loss of control are

accounted for as equity. transactions – that is, as transactions with the owners in

their capacity as owners. The dierence between fair value of any consideration paid

and the relevant share acquired of the carrying value of net assets of the subsidiary

is recorded in equity. Gains or losses on disposals to non-controlling interests are

also recorded in equity.

(C) Disposal of a subsidiary

When the Company ceases to have control, any retained interest in the entity is

re-measured to its fair value at the date when control is lost, with the change in

carrying amount recognized in profit or loss. The fair value is the initial carrying

amount for the purposes of subsequently accounting for the retained interest as

an associate, joint venture or nancial asset. In addition, any amounts previously

recognized in other comprehensive income in respect of that entity are accounted

for as if the Company had directly disposed of the related assets or liabilities. This

may mean that amounts previously recognized in other comprehensive income are

reclassied to prot or loss.

(D) Non-controlling interests

Prot or loss and each component of other comprehensive income are attributed to

the owners of the parent and to the non-controlling interests. Total comprehensive

income is attributed to the owners of the parent and to the noncontrolling interests

even if this results in the non-controlling interests having a deficit balance. Any

changes in a parent's ownership interest in a subsidiary that do not result in a loss of

control are accounted for as equity transactions (i.e. transactions among owners in

their capacity as owners).

(E) Associated companies

Investments in companies in which the Company does not have the ability to

directly or indirectly control the financial and operating decisions, but does

possess the ability to exercise significant influence, are accounted for using the

equity method. Generally, it is presumed that if at least 20% of the voting stock

and potential voting rights is owned, significant influence exists. The Company’s

investment in associates includes goodwill identified upon acquisition, net of any

accumulated impairment loss.

If the ownership in associated companies decreases to the extent that the Company

loses significant influence, the Company will reclassify the proportionate amount

previously recognized in other comprehensive income to prot or loss.

The Company’s share of post-acquisition prot or loss is recognized in the income

statement, and its share of post acquisition movements in other comprehensive

income is recognized in other comprehensive income with a corresponding

adjustment to the carrying amount of the investment. When the Company’s share

of losses in an associate equals or exceeds its interest in the associate, including

any other unsecured receivables, the Company does not recognize further losses,

unless it has incurred obligations or made payments on behalf of the associate or

joint venture.

The Company assesses at the end of each reporting period whether there is any

objective evidence that the investments in associates are impaired. If any such

evidence exists, the Company will recognize impairment loss as the difference

between the recoverable amount and the carrying amount of investments in

associates. The impairment loss will be separately disclosed in the statement of

income as an impairment loss on associates.

Unrealized gains on transactions between the Company and its associates are

eliminated to the extent of the parent company’s interest in the associates.

Unrealized losses are also eliminated unless the transaction provides evidence of

an impairment of the asset transferred. Accounting policies of associates have been

changed where necessary to ensure consistency with the policies adopted by the

Company. Decrease in the interest in associates is recognized in prot or loss where

the Company maintains signicant inuence over associates although its share has

been decreased.

(F) Joint ventures

Joint ventures are entities in which the Company holds joint control with other

participants based on an agreed upon contract. Investments in joint ventures

are initially recognized at cost and then accounted for using the equity method.

The Company’s investment in joint ventures includes goodwill identified upon

acquisition, net of any accumulated impairment loss. If the Company purchases

assets from joint ventures, the Company does not recognize its share of post-

acquisition profit until it disposes of the acquired assets to a third party. The

Company recognizes losses from these transactions where such losses provide

evidence of an impairment of the assets or decrease of net realizable value.

2.4 Foreign Currency Translation

(A) Functional and presentation currency

Items included in the financial statements of each of the Company’s entities are

measured using the currency of the primary economic environment in which each

entity operates (‘the functional currency’). The consolidated financial statements

are presented in Korean won, which is SEC’s functional and presentation currency.

(B) Transactions and balances

Foreign currency transactions are translated into the functional currency using the

exchange rates prevailing at the dates of the transactions or valuation where items

are remeasured. Foreign exchange gains and losses resulting from the settlement

of such transactions and from the translation at the exchange rate at the end of

the reporting period of monetary assets denominated in foreign currencies are

recognized as realized foreign exchange gains and losses under nance income and

expense in the statement of income, except when deferred in other comprehensive

income as qualifying cash ow hedges and qualifying net investment hedges.

Changes in the fair value of monetary securities denominated in foreign currency

classified as available-for-sale financial assets are analyzed between translation

dierences resulting from changes in the amortized cost of the security and other

changes in the carrying amount of the security. Translation dierences related to

changes in amortized cost are recognized in profit or loss, and other changes in

carrying amount are recognized in other comprehensive income.

Translation differences on non-monetary financial assets and liabilities are

recognized in profit or loss as part of the fair value gain or loss. Translation

differences on non-monetary financial assets such as equity instruments held at

fair value through profit or loss are recognized in profit or loss as part of the fair

value gain or loss. Translation differences on non-monetary financial assets, such

as equities classified as available-for-sales are included in other comprehensive

income.

(C) Translation into presentation currency

The results and financial position of all the foreign entities that have a functional

currency dierent from the presentation currency of the Company are translated

into the presentation currency as follows:

Assets and liabilities are translated at the closing rate at the end of the reporting

date.

Income and expenses for each statement of income are translated at average

exchange rates, unless this average is not a reasonable approximation of the

cumulative effect of the rates prevailing on the transaction dates, in which case

6362