Samsung 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

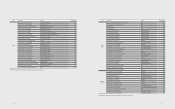

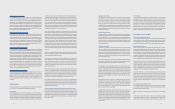

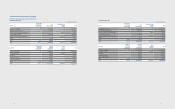

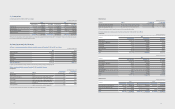

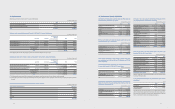

9. Available-for-Sale Financial Assets

The changes of available-for-sale nancial assets are as follows:

(In millions of Korean won)

2012 2011

Balance as of January 1 ₩3,879,567 ₩4,199,358

Acquisitions 2,630,247 2,309,143

- Increase from business

combinations 16,544 1,018

Disposals (1,171,666) (2,004,296)

Changes in value, net of tax 1,185,256 (559,831)

Impairment losses (28,009) (39)

Translation and exchange dierence (19,302) 1,007

Others 11,956 (65,775)

Balance as of December 31 ₩6,488,049 ₩3,879,567

A) Current portion 1,258,874 655,969

B) Non-current portion 5,229,175 3,223,598

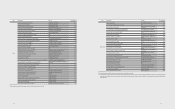

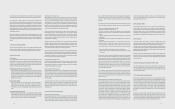

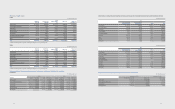

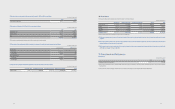

(A) Short-term available-for-sale nancial assets

Short-term available-for-sale nancial assets as of December 31, 2012 and 2011

consist of national bonds and beneciary certicates whose maturities are within

1 year.

(In millions of Korean won)

2012 2011

National bonds ₩1₩-

Beneciary certicates (*) 1,258,873 655,969

₩1,258,874 ₩655,969

(*) Beneciary certicates as of December 31, 2012 and 2011 consist of follows:

(In millions of Korean won)

2012 2011

Bonds ₩1,159,290 ₩647,379

Time deposits 238 715

Call loan 85,200 -

Others 14,145 7,875

₩1,258,873 ₩655,969

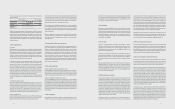

For the years ended December 31, 2012 and 2011, changes in valuation gain (loss)

recognized in equity (other comprehensive income) on short-term available-for-

sale nancial assets are as follows:

(In millions of Korean won)

2012 2011

Balance at January 1 ₩5,969 ₩9,144

Fair value gains 8,873 5,969

Net gains transferred from equity (5,969) (9,144)

Balance at December 31 8,873 5,969

Deferred income tax and minority

interest (2,147) (1,444)

₩6,726 ₩4,525

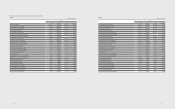

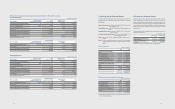

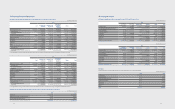

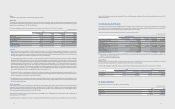

(B) Long-term available-for-sale nancial assets

Long-term available-for-sale nancial assets as of December 31, 2012 and 2011

are as follows:

(In millions of Korean won)

Detail 2012 2011

Equity securities-Listed (1) ₩4,435,856 ₩2,526,187

Equity securities-Unlisted (2) 667,325 623,739

Debt securities (*) 125,994 73,672

₩5,229,175 ₩3,223,598

(*) The maximum exposure to credit risk of debt securities that are available-for-

sale nancial assets is the carrying value as of December 31, 2012 and 2011.

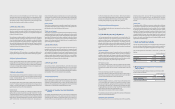

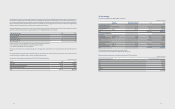

(1) Equity securities-Listed (Except for Associates and Joint Ventures)

Listed equity securities as of December 31, 2012 and 2011, are as follows:

(In millions of Korean won)

2012 2011

Number of

Shares Owned

Percentage

of Ownership(%) Acquisition Cost Book Value Book Value

Samsung Heavy Industries 40,675,641 17.6 ₩258,299 ₩1,568,046 ₩1,134,850

Samsung Fine Chemicals 2,164,970 8.4 45,678 132,063 132,063

Hotel Shilla 2,004,717 5.0 13,957 88,107 77,182

Cheil Worldwide 2,998,725 2.6 2,920 64,623 56,826

iMarket Korea 647,320 1.8 324 18,416 10,487

A-Tech Solution1 1,592,000 15.9 26,348 11,606 17,830

SFA 1,822,000 10.2 38,262 85,998 111,142

KT Skylife 240,000 0.5 3,000 8,028 6,576

ASML 12,595,575 3.0 726,024 856,253 -

CSR 9,925,000 4.9 59,612 58,765 -

Rambus1 4,788,125 4.3 92,682 24,976 41,692

Seagate Technology 45,239,490 12.0 788,454 1,474,032 855,665

Others (*) - - 35,809 44,943 81,874

₩2,091,369 ₩4,435,856 ₩2,526,187

(*) The impairment loss of ₩85,280 million is recognized relating to A-Tech Solution and Rambus,etc. as the fair value decreased steadily below the acquisition cost.

The dierence between the acquisition cost and the current fair value, after income tax eects, is recorded within other components of equity (unrealized gains or

losses on available-for-sale nancial assets).

7574