Samsung 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Deferred income tax assets and liabilities are offset when there is a legally

enforceable right to oset current tax assets against current tax liabilities and when

the deferred income taxes assets and liabilities relate to income taxes levied by the

same taxation authority on either the taxable entity or different taxable entities

where there is an intention to settle the balances on a net basis.

2.21 Derivative Instruments

All derivative instruments are accounted for at fair value with the resulting valuation

gain or loss recorded as an asset or liability. If the derivative instrument is not

designated as a hedging instrument, the gain or loss is recognized in the statement

of income in the period of change.

Fair value hedge accounting is applied to a derivative instrument with the purpose

of hedging the exposure to changes in the fair value of an asset or a liability or

a firm commitment (hedged item) that is attributable to a particular risk. Hedge

accounting is applied when the derivative instrument is designated as a hedging

instrument and the hedge accounting criteria have been met. The gain or loss, both

on the hedging derivative instrument and on the hedged item attributable to the

hedged risk, is reected in the statement of income.

2.22 Dividend Distribution

Dividend distribution to SEC’s shareholders is recognized as a liability in the

Company’s nancial statements in the period in which the dividends are approved.

2.23 Share Capital and Premium

Common shares and preferred shares with no repayment obligations are classied

as equity. When the Company purchases its common shares, the acquisition costs

including direct transaction costs are deducted from equity until the redemption

or reissuance of treasury shares. Consideration received on the subsequent sale or

issue of treasury shares is credited to equity.

2.24 Revenue Recognition

Revenue mainly comprises the fair value of the consideration received or receivable

for the sale of goods in the ordinary course of the Company’s activities. Revenue

is shown net of value-added tax, returns, sales incentives and discounts and after

eliminating intercompany transactions.

The Company recognizes revenue when specic recognition criteria have been met

for each of the Company’s activities as described below. The Company bases its

estimates on historical results, taking into consideration the type of customer, the

type of transaction and the specics of each arrangement.

(A) Sales of goods

Sales of products and merchandise are recognized upon delivery when the

signicant risks and rewards of ownership of goods have transferred to the buyer,

continuing managerial involvement usually associated with ownership and eective

control have ceased, the amount of revenue can be measured reliably, it is probable

that the economic benets associated with the transaction will ow to the Company

and the costs incurred or to be incurred in respect of the transaction can be

to US $1, the exchange rate in eect on December 31, 2012. Such presentation is

not in accordance with generally accepted accounting principles, and should not be

construed as a representation that the Won amounts shown could be readily

converted, realized or settled in U.S. dollars at this or at any other rate.

2.29 Approval of Financial Statements

These consolidated nancial statements were approved by the Board of Directors

on January 25, 2013.

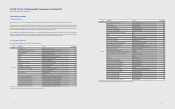

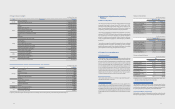

3. Critical Estimates and Judgments

The Company makes estimates and assumptions concerning the future. The

estimates and assumptions are continuously assessed, considering historical

experience and other factors, including expectations of future events that are

believed to be reasonable under the circumstances. The resulting accounting

estimates will, by denition, seldom equal the related actual results. The estimates

and assumptions that have a signicant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next nancial year are addressed

below.

(A) Revenue recognition

The Company uses the percentage-of-completion method in accounting for its

fixed-price contracts to deliver installation services. Use of the percentage-of-

completion method requires the Company to estimate the services performed to

date as a proportion of the total services to be performed. Revenues and earnings

are subject to significant change, effected by early steps in a long-term projects,

change in scope of a project, cost, period, and plans of the customers.

(B) Provision for warranty

The Company recognizes provision for warranty on products sold. The Company

accrues provision for warranty based on the best estimate of amounts necessary

to settle future and existing claims. The amounts are estimated based on historical

data.

(C) Fair value of derivatives and other nancial instruments

The fair value of financial instruments that are not traded in an active market is

determined by using a variety of methods and assumptions that are mainly based

on market conditions existing at the end of each reporting period.

(D) Pension benets

The pension obligations depend on a number of factors that are determined

on an actuarial basis using a number of assumptions. Any changes in these

assumptions will impact the carrying amount of pension obligations. The Company,

in consideration of the interest rates of high-quality corporate bonds, determines

the appropriate discount rate at the end of each year. This is the interest rate that is

used to determine the present value of estimated future cash

outows expected to be required to settle the pension obligations.

The principal actuarial assumptions associated with the dened benet liability are

based on the current market expectations.

(E) Estimated impairment of goodwill

The Company tests at the end of each reporting period whether goodwill has

suffered any impairment in accordance with the accounting policy described

in Note 2.12. The recoverable amounts of cash generating units have been

determined based on value-in-use calculations. These calculations are based on

estimates.

(F) Income taxes

The operating activities of SEC span across various countries in the world; likewise,

income taxes on the taxable income from operating activities are subject to

various tax laws and determinations of each tax authority. There is uncertainty

in determining the eventual tax effects on the taxable income from operating

activities. The Company has recognized current tax and deferred tax at the end

of the scal year based on the best estimation of future taxes payable as a result

of operating activities. However, the resulting deferred income tax assets and

liabilities may not equal the actual future taxes payable and such dierence may

impact on the current tax and deferred income tax assets and liabilities upon the

determination of eventual tax eects.

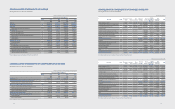

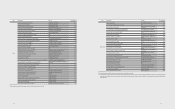

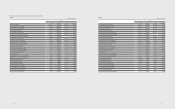

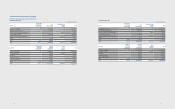

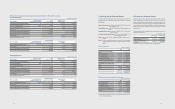

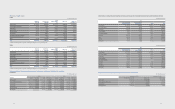

4. Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, deposits held at call with banks,

and other short-term highly liquid investments that are readily convertible to a

known amount of cash and are subject to an insignicant risk of change in value.

Cash and cash equivalents as of December 31, 2012 and 2011, consist of the

following:

(In millions of Korean won)

2012 2011

Cash on hand ₩12,900 ₩16,042

Bank deposits, etc. 18,778,560 14,675,719

Total ₩18,791,460 ₩14,691,761

5. Financial Assets Subject to Withdrawal

Restrictions

Financial instruments subject to withdrawal restrictions as of December 31, 2012

and 2011, consist of the following:

(In millions of Korean won)

2012 2011

Short-term nancial instruments

Other non-current assets ₩46,489 ₩39,770

- Long-term nancial instruments 29 21

6968

measured reliably. The Company records reductions to revenue for special pricing

arrangements, price protection and other volume based discounts. If product sales

are subject to customer acceptance, revenue is not recognized until customer

acceptance occurs.

(B) Sales of services

Revenues from rendering services are generally recognized using the percentage-

of-completion method, based on the percentage of costs to date compared to the

total estimated costs, contractual milestones or performance.

(C) Other sources of revenue

Interest income is recognized using the eective interest method. When a loan and

receivable is impaired, the Company reduces the carrying amount to its recoverable

amount, being the estimated future cash ow discounted at the original eective

interest rate of the instrument, and continues unwinding the discount as interest

income. Royalty income is recognized on an accruals basis in accordance with the

substance of the relevant agreements. Dividend income is recognized when the

right to receive payment is established.

2.25 Government Grants

Grants from the government are recognized at their fair value where there is a

reasonable assurance that the grant will be received and the Company will comply

with the conditions attached. Government grants relating to income are deferred

and recognized in the statement of income over the period necessary to match

them with the income that they are intended to compensate. Government grants

relating to property, plant and equipment are included in non-current liabilities

as deferred government grants and are credited to the statement of income on a

straight-line basis over the expected lives of the related assets.

2.26 Earnings per Share

Basic earnings per share is calculated by dividing net prot for the period available

to common shareholders by the weighted-average number of common shares

outstanding during the year. Diluted earnings per share is calculated using the

weighted-average number of common shares outstanding adjusted to include the

potentially dilutive eect of common equivalent shares outstanding.

2.27 Operating Segments

Operating segments are disclosed in the manner reported to the chief operating

decision-maker (please see footnote 33). The chief operating decision-maker is

responsible for making strategic decisions on resource allocation and performance

assessment of the operating segments. The management committee which makes

strategic decisions is regarded as the chief operating decision-maker.

2.28 Convenience Translation into United States Dollar

Amounts

The Company operates primarily in Korean won and its ocial accounting records

are maintained in Korean won. The U.S. dollar amounts provided in the financial

statements represent supplementary information solely for the convenience of

the reader. All Won amounts are expressed in U.S. dollars at the rate of ₩1,171.10