Samsung 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

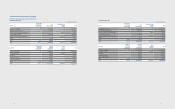

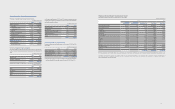

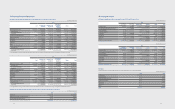

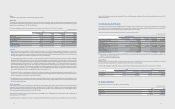

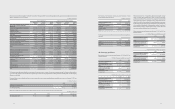

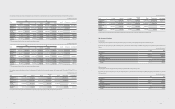

16. Debentures

Debentures as of December 31, 2012 and 2011, consist of the following:

(In millions of Korean won)

2012 2011

Korean won denominated debenture(A) ₩697,822 ₩1,197,079

Foreign currency denominated debenture(B) 1,131,552 83,045

Total ₩1,829,374 ₩1,280,124

(A) Korean won denominated debentures as of December 31, 2012 and 2011, consist of the following:

(In millions of Korean won)

Issue Date Due Date

Annual Interest

Rates (%)

as of December 31,

2011

2012 2011

Unsecured debentures 2010.6.17 2013.6.17 4.7 500,000 500,000

Unsecured debentures 2011.11.17 2014.11.17 4.1 500,000 500,000

Unsecured debentures 2011.11.17 2016.11.17 4.2 200,000 200,000

Less: Current portion (500,000) -

Less: Discounts (2,178) (2,921)

Total 697,822 1,197,079

Samsung Display, SEC’s domestic subsidiary, issued Korean won denominated debentures as above table.

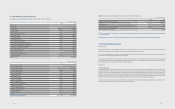

(B) Debentures denominated in foreign currencies as of December 31, 2012 and 2011, consist of the following:

(In millions of Korean won)

Issue Date Due Date

Annual Interest

Rates (%)

as of December 31,

2012

2012 2011

US dollar denominated straight bonds (*1) 1997.10.2 2027.10.1 7.7 80,333

(US$75 million)

92,264

(US$80 million)

US dollar denominated unsecured bonds (*2) 2012.4.10 2017.4.10 1.8 1,071,100

(US$ 1,000 million) -

Less: Current portion (5,150) (5,536)

Less: Discounts (14,731) (3,683)

Total ₩1,131,552 ₩83,045

(*1) US dollar straight bonds are repaid for twenty years after a ten-year grace period from the date of issuance. Interest is paid semiannually.

(*2)

Samsung Electronics America issued dollar denominated unsecured bonds. Repayment of these debentures is due on the date of maturity and interest is paid semi-

annually.

(C) Maturities of debentures outstanding as of December 31, 2012 are as follows:

(In millions of Korean won)

For the Years Ending December 31 Debentures

2013 ₩505,356

2014 505,356

2015 5,356

2016 205,356

Thereafter 1,130,009

Total ₩2,351,433

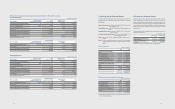

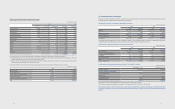

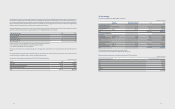

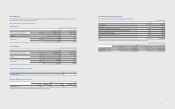

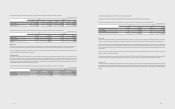

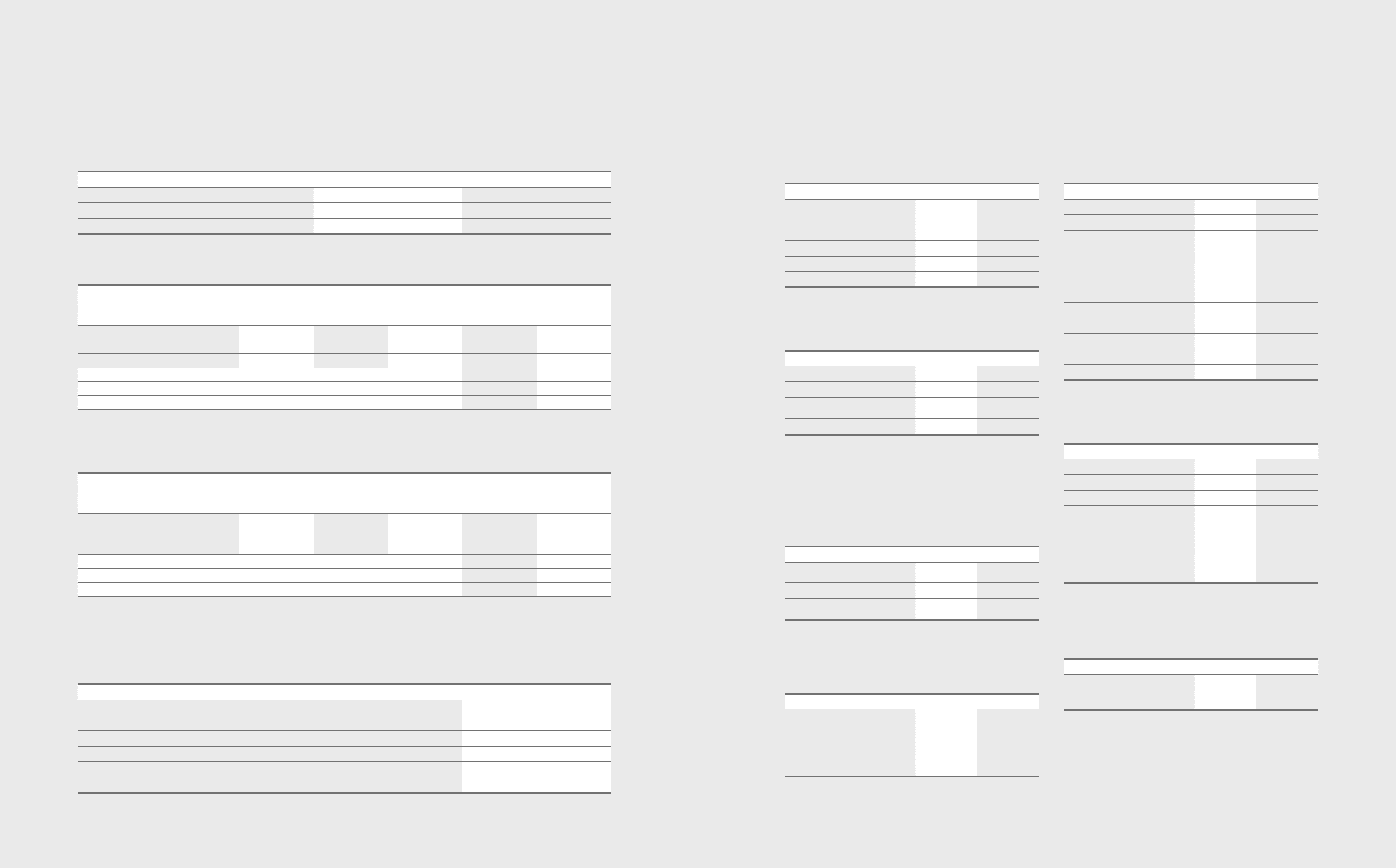

17. Retirement Benet Liabilities

(A) Defined benefit liability recognized on the statements of finance position

as of December 31, 2012 and 2011, is as follows:

(In millions of Korean won)

2012 2011

Present value of funded dened benet

obligation ₩4,593,284 ₩3,283,629

Present value of unfunded dened

benet 76,183 258,711

Subtotal 4,669,467 3,542,340

Fair value of plan assets (2,939,528) (2,423,152)

Total ₩1,729,939 ₩1,119,188

(B) The amounts recognized in the income statements for the years ended

December 31, 2012 and 2011, are as follows:

(In millions of Korean won)

2012 2011

Current service cost ₩670,123 ₩508,958

Interest cost 58,591 39,901

The eect of any settlement or

curtailment 8,033 11,941

₩736,747 ₩560,800

(C) The amounts recognized as cost of defined contribution plan for the

years ended December 31, 2012 and 2011, are ₩31,676 million and ₩23,296

million, respectively.

(D) Remeasurement impact recognized as other comprehensive income for

the years ended December 31, 2012 and 2011, are as follows:

(In millions of Korean won)

2012 2011

Remeasurement impact before income

tax ₩657,804 ₩508,928

Income tax eect (153,684) (123,714)

Remeasurement impact after income

tax ₩504,120 ₩385,214

(E) The pension expenses related to defined-benefit plans recognized in the

statement of income for the years ended December 31, 2012 and 2011, are

allocated to the following accounts:

(In millions of Korean won)

2012 2011

Cost of sales ₩291,355 ₩247,908

Selling, general and administrative

expenses 185,125 121,213

Research and development expenses 260,267 191,679

₩736,747 ₩560,800

8786

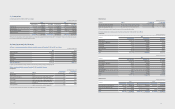

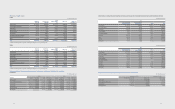

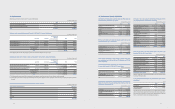

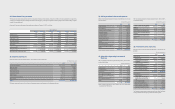

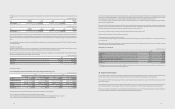

(F) Changes in the carrying amount of defined benefit obligations for the

years ended December 31, 2012 and 2011, are as follows:

(In millions of Korean won)

2012 2011

Balance at the beginning of the year ₩3,542,340 ₩2,621,192

Current service cost 670,123 508,958

Interest cost 194,625 160,605

Remeasurement :

- Loss from change in demographic

assumptions 81,587 -

- Loss from change in nancial

assumptions 473,488 291,946

- Others 55,396 176,829

Benets paid (301,444) (256,261)

Foreign exchange (22,028) 18,591

Others (24,620) 20,480

Balance at the end of the year ₩4,669,467 ₩3,542,340

(G) The movement in the fair value of plan assets for the years ended

December 31, 2012 and 2011, are as follows:

(In millions of Korean won)

2012 2011

Balance at the beginning of the year ₩2,423,152 ₩1,797,706

Expected return on plan assets 136,034 120,704

Remeasurement factor of plan assets (47,333) (40,153)

Contributions by the employer 595,420 555,815

Benets paid (155,000) (72,179)

Foreign exchange (8,812) (92)

Others (3,933) 61,351

Balance at the end of the year ₩2,939,528 ₩2,423,152

Expected contributions to retirement benet plans for the year ending December

31, 2013, are ₩947,072 million.

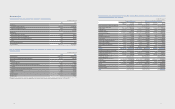

(H) The principal actuarial assumptions as of December 31, 2012 and 2011

are as follows:

(In %)

2012 2011

Discount rate 3.7 ~ 7.0 4.9 ~ 7.5

Future salary increases

(including ination) 2.5 ~ 9.0 2.6 ~ 9.9

The expected return on plan assets is based on the expected return multiplied

with the respective percentage weight of the market-related value of plan assets.

The expected return is dened on a uniform basis, reecting long-term historical

returns, current market conditions and strategic asset allocation.