Samsung 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

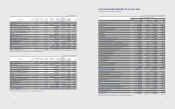

2. Summary of Signicant Accounting

Policies

2.1 Basis of Presentation

The Company first adopted International Financial Reporting Standards

as adopted by the Republic of Korea ("Korean IFRS") from January 1, 2010.

International Financial Reporting Standards (IFRS) have been adopted by the

Korean Accounting Standards Board as Korean IFRS based on standards and

interpretations published by the International Accounting Standards Board.

The Company has prepared the consolidated nancial statements in accordance

with Korean IFRS (“K-IFRS”). KIFRS permits the use of critical accounting estimates

in the preparation of the financial statements and requires management

judgments in applying accounting policies. Footnote 3 explains where more

complex and higher standards of judgment or critical assumptions and estimates

are required.

The principal accounting policies applied in the preparation of these consolidated

financial statements are set out below. These policies have been consistently

applied to all the years presented, unless otherwise stated. Changes in accounting

policies applied in the current scal year are presented in footnote 2.2.

2.2 Changes in Accounting Standards

(A) Amendments Adopted

K-IFRS 1001, ‘Presentation of nancial statements’

The amendment requires entities to present operating income after deducting

cost of sales, selling, and general and administrative expenses from revenue. The

amendment has been retroactively applied in the preparation of the consolidated

statement of income. Dividend income, profit on business transfer, gains and

losses on disposal of property, plant and equipment, donations, and impairment

losses on intangible assets which were previously classied as operating income

are now excluded from operating income. As a result, operating income has

increased by ₩23,036 million for the current financial year and decreased by

₩638,329 million for the prior financial years, relative to the figures under the

standard prior to the amendment. The amendment does not have an impact on

net income or earnings per share in the current or prior nancial years.

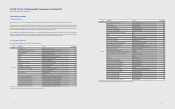

(B) Standards Early Adopted

New standards issued and effective for the financial year beginning January 1,

2013 and early adopted are set out below:

K-IFRS 1019, ‘Employee benets’

The main impacts on the Company will be that the corridor approach will no

longer be applied and instead all actuarial gains and losses will be recognized

in other comprehensive income as they occur; all past service costs will be

immediately recognized, and expected return on plan assets will be replaced with

a net interest amount calculated by applying the discount rate to the net dened

benet liability. The impacts of the amendment on the nancialstatements are as

follows:

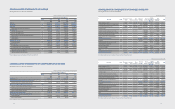

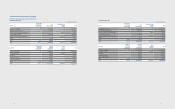

(1) Impacts on Financial Position

(In millions of Korean won)

December 31, 2011

Pre-amendment Post-amendment

Deferred income tax assets 1,614,077 1,783,086

Dened benet liability 418,486 1,119,188

Deferred income tax liability 2,333,442 2,333,442

Other components of equity (5,244,167) (5,833,896)

Retained earnings 97,542,525 97,622,872

Non-controlling interests 4,245,558 4,223,247

(In millions of Korean won)

January 1, 2011

Pre-amendment Post-amendment

Deferred income tax assets 1,124,009 1,144,068

Dened benet liability 597,829 823,486

Deferred income tax liability 1,652,667 1,618,523

Other components of equity (4,726,398) (4,931,290)

Retained earnings 85,014,550 85,071,444

Non-controlling interests 3,759,532 3,736,075

(2) Impacts on Business Performance

(In millions of Korean won)

2011

Pre-amendment Post-amendment

Operating income (*) 15,611,388 15,644,291

Income tax expense 3,424,948 3,432,875

Net income 13,734,067 13,759,043

Net income attributable to non-

controlling interests 374,875 376,398

Basic earnings per share

(in Korean won) 89,073 89,229

Diluted earnings per share

(in Korean won) 88,990 89,146

Other comprehensive income (502,271) (887,485)

(*) Operating income is calculated by retroactively applying the changes in the

calculation method of operating income and expenses.

K-IFRS 1001, ‘Presentation of nancial statements’

The amendment requires entities to group items presented in other

comprehensive income based on whether they are potentially reclassifiable

to profit or loss subsequently. The Company early adopted and applied the

amendment retroactively in the preparation of the nancial statements.

(C) Standards Not Eective or Early Adopted

New standards, amendments and interpretations issued but not eective for the

nancial year beginning January 1, 2012 and not early adopted are set out below:

6160

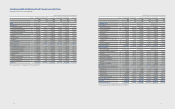

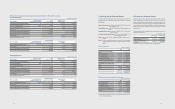

(C) Changes in scope of consolidation

(In millions of Korean won)

Area Subsidiaries Description

Domestic Samsung Display (SDC) Spin-o

Samsung Venture Capital Union #23 Acquisition of shares

America

mSpot Acquisition of shares

Nanoradio Acquisition of shares

Samsung LED America (SLA) Acquisition of shares

Samsung Electronics Panama (SEPA) Incorporation

Samsung Electronics Corporativo (SEC) Acquisition of shares

Samsung Electronics Digital appliance (SEDAM) Acquisition of shares

Nvelo Acquisition of shares

Newton Sub Incorporation

Europe

Samsung Nanoradio Design Center (SNDC) Acquisition of shares

Nanoradio Hellas Acquisition of shares

General RF Modules Acquisition of shares

Samsung LED Europe GmbH (SLEG) Acquisition of shares

Samsung Cambridge Solution Centre (SCSC) Incorporation

Samsung Denmark Research Center (SDRC) Incorporation

Samsung France Research Center (SFRC) Acquisition of shares

Middle East and

Africa

Samsung Electronics Egypt (SEEG) Incorporation

Samsung Electronics Tunisia (SETN) Incorporation

Samsung Electronics Israel (SEIL) Incorporation

Samsung Electronics Pakistan (SEPAK) Incorporation

China Tianjin Samsung LED (TSLED) Acquisition of shares

Samsung (China) Semiconductor (SCS) Incorporation

(D) Details of subsidiaries deconsolidated for the year ended December 31, 2012, are as follows:

(In millions of Korean won)

Area Subsidiaries Description

Domestic

Medison Healthcare Merger

Prosonic Merger

Samsung Mobile Display Merger

SLCD Merger

Samsung Venture Capital Union #7 Liquidation

SEHF Korea Merger

America

Samsung LED America (SLA) Liquidation

HX Diagnostics (HX) Liquidation

HX Reagents (HX Reagent) Liquidation

Nanoradio Liquidation

Europe Samsung LED Europe GmbH (SLEG) Merger

Asia Samsung Asia Private (SAPL) (*) Merger

Samsung Medison Japan (SMJP) Liquidation

(*) Samsung Asia Private merged with Samsung Electronics Asia Holding, and the resulting subsidiary is named Samsung Asia Private (Note 37).