Regions Bank 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

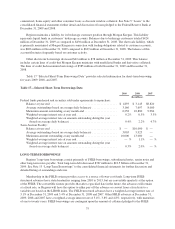

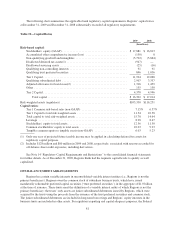

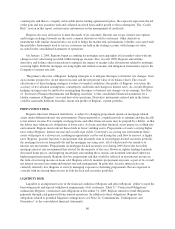

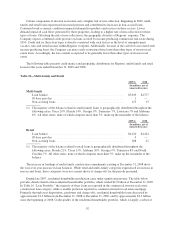

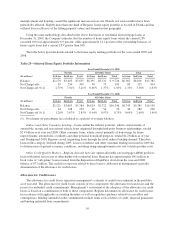

Estimated Amount of Change in Annual Net Interest Income

as of December 31, 2009

Gradual Change in Interest Rates

Impact of Short-Term Derivatives

Maturing September 2010

Remaining

Assets / Liabilities Total

(in millions)

+ 200 basis points ............... $(130) $263 $133

+ 100 basis points ............... (64) 152 88

- 100 basis points ............... 36 (74) (38)

Estimated Amount of Change in Annual Net Interest Income

as of December 31, 2009

Gradual Change in Interest Rates

Impact of Short-Term Derivatives

Maturing September 2010

Remaining

Assets / Liabilities Total

+ 200 basis points ............... (3.9)% 7.9% 3.9%

+ 100 basis points ............... (1.9) 4.6 2.6

- 100 basis points ............... 1.1 (2.2) (1.1)

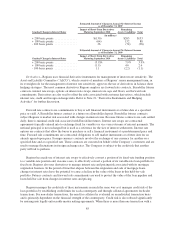

Derivatives—Regions uses financial derivative instruments for management of interest rate sensitivity. The

Asset and Liability Committee (“ALCO”), which consists of members of Regions’ senior management team, in

its oversight role for the management of interest rate sensitivity, approves the use of derivatives in balance sheet

hedging strategies. The most common derivatives Regions employs are forward rate contracts, Eurodollar futures

contracts, interest rate swaps, options on interest rate swaps, interest rate caps and floors, and forward sale

commitments. Derivatives are also used to offset the risks associated with customer derivatives, which include

interest rate, credit and foreign exchange risks. Refer to Note 21, “Derivative Instruments and Hedging

Activities” for further discussion.

Forward rate contracts are commitments to buy or sell financial instruments at a future date at a specified

price or yield. A Eurodollar futures contract is a future on a Eurodollar deposit. Eurodollar futures contracts

subject Regions to market risk associated with changes in interest rates. Because futures contracts are cash settled

daily, there is minimal credit risk associated with Eurodollar futures. Interest rate swaps are contractual

agreements typically entered into to exchange fixed for variable (or vice versa) streams of interest payments. The

notional principal is not exchanged but is used as a reference for the size of interest settlements. Interest rate

options are contracts that allow the buyer to purchase or sell a financial instrument at a predetermined price and

time. Forward sale commitments are contractual obligations to sell market instruments at a future date for an

already agreed-upon price. Foreign currency contracts involve the exchange of one currency for another on a

specified date and at a specified rate. These contracts are executed on behalf of the Company’s customers and are

used to manage fluctuations in foreign exchange rates. The Company is subject to the credit risk that another

party will fail to perform.

Regions has made use of interest rate swaps to effectively convert a portion of its fixed-rate funding position

to a variable-rate position and, in some cases, to effectively convert a portion of its variable-rate loan portfolio to

fixed-rate. Regions also uses derivatives to manage interest rate and pricing risk associated with its mortgage

origination business. In the period of time that elapses between the origination and sale of mortgage loans,

changes in interest rates have the potential to cause a decline in the value of the loans in this held-for-sale

portfolio. Futures contracts and forward sale commitments are used to protect the value of the loan pipeline and

loans held for sale from changes in interest rates and pricing.

Regions manages the credit risk of these instruments in much the same way as it manages credit risk of the

loan portfolios by establishing credit limits for each counterparty and through collateral agreements for dealer

transactions. For non-dealer transactions, the need for collateral is evaluated on an individual transaction basis

and is primarily dependent on the financial strength of the counterparty. Credit risk is also reduced significantly

by entering into legally enforceable master netting agreements. When there is more than one transaction with a

85