Regions Bank 2009 Annual Report Download - page 91

Download and view the complete annual report

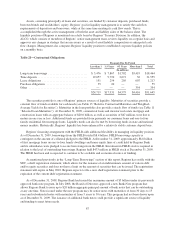

Please find page 91 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.with a seller-lessee transaction with continuing involvement compared to $63 million as of December 31, 2008.

See Note 24 “Commitments, Contingencies and Guarantees” to the consolidated financial statements for further

information.

In May 2007, Regions filed a shelf registration statement with the U.S. Securities and Exchange

Commission. This shelf registration does not have a capacity limit and can be utilized by Regions to issue

various debt and/or equity securities. The registration statement will expire in May 2010. Regions expects to file

a new shelf registration statement prior to the expiration of the current shelf registration statement.

At December 31, 2009, Regions Bank had issued the maximum amount of $5 billion under its previously

approved Bank Note program. In July 2008, the Board of Directors approved a new Bank Note program that

allows Regions Bank to issue up to $20 billion aggregate principal amount of bank notes that can be outstanding

at any one time. No issuances had been made under this program as of December 31, 2009. Notes issued under

the new program may be senior notes with maturities from 30 days to 15 years and subordinated notes with

maturities from 5 years to 30 years. These notes are not deposits and they are not insured or guaranteed by the

FDIC.

On October 19, 2009, the Federal Reserve Bank released a new collateral margin table for loans and

securities pledged to the discount window. These new margins significantly reduced the lendable collateral value

available to all participating banks. As a result of these margin reductions, Regions’ borrowing availability as of

December 31, 2009, based on assets available for collateral at that date, was $14.3 billion for terms of less than

29 days, or $11.5 billion with terms of greater than or equal to 29 days.

Regions may, from time to time, consider opportunistically retiring its outstanding issued securities,

including subordinated debt, trust preferred securities and preferred shares in privately negotiated or open market

transactions for cash or common shares. Regions would obtain concurrence from its banking regulators before

any such retirements.

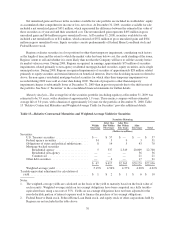

RATINGS

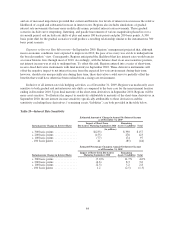

Table 18 “Credit Ratings” reflects the debt ratings of Regions Financial Corporation and Regions Bank by

Standard & Poor’s Corporation, Moody’s Investors Service, Fitch Ratings and Dominion Bond Rating Service.

A security rating is not a recommendation to buy, sell or hold securities, and the ratings are subject to

revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently

of any other rating.

77