Regions Bank 2009 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

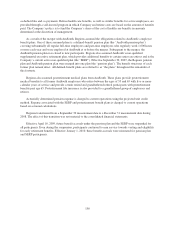

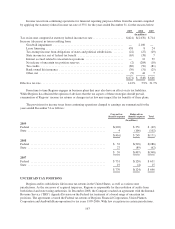

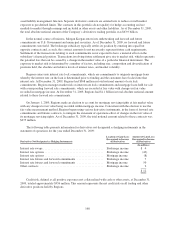

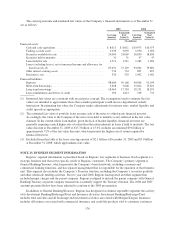

The following table presents the effect of derivative instruments on the statement of operations for the year

ended December 31, 2009:

Derivatives in Fair

Value Hedging

Relationships

Location of Gain(Loss)

Recognized in Income on

Derivatives

Amount of Gain(Loss)

Recognized in

Income on

Derivatives

Hedged Items in

Fair Value Hedge

Relationships

Location of Gain(Loss)

Recognized in Income on

Related Hedged Item

Amount of

Gain(Loss)

Recognized

in Income on

Related

Hedged Item

(In millions)

Interest rate swaps . . . Other non-interest expense $ (113) Debt/CDs Other non-interest expense $105

Interest rate swaps . . . Interest expense 169 Debt Interest expense 4

Total ............. $ 56 $109

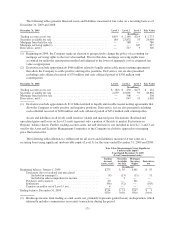

Derivatives in Cash

Flow Hedging

Relationships

Amount of Gain(Loss)

Recognized in OCI on

Derivatives (Effective

Portion)(1)

Location of

Gain(Loss)

Reclassified from

Accumulated OCI into

Income (Effective

Portion)

Amount

of Gain(Loss)

Reclassified

from Accumulated

OCI into Income

(Effective

Portion)(2)

Location of Gain(Loss)

Recognized in Income on

Derivatives (Ineffective

Portion and Amount

Excluded from

Effectiveness Testing)

Amount of

Gain(Loss)

Recognized

in Income on

Derivatives

(Ineffective

Portion and

Amount

Excluded

from

Effectiveness

Testing)(2)

(In millions)

Interest rate swaps . . . $ (97) Interest income on loans $ 238 Other non-interest expense $ 9

Forward starting

swaps ........... 10 Interest expense on debt — Other non-interest expense —

Interest rate options . . (29) Interest income on loans 85 Interest income on loans —

Eurodollar futures . . . (5) Interest income on loans 30 Other non-interest expense 9

Total ............. $(121) $ 353 $ 18

(1) After-tax

(2) Pre-tax

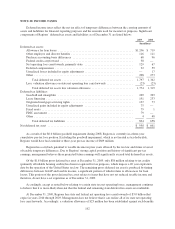

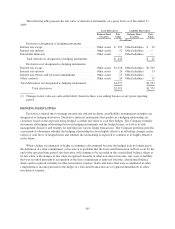

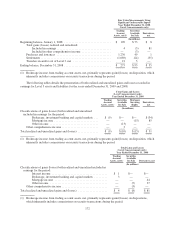

FAIR VALUE HEDGES

Fair value hedge relationships mitigate exposure to the change in fair value of an asset, liability or firm

commitment. Under the fair value hedging model, gains or losses attributable to the change in fair value of the

derivative instrument, as well as the gains and losses attributable to the change in fair value of the hedged item,

are recognized in earnings in the period in which the change in fair value occurs. The corresponding adjustment

to the hedged asset or liability is included in the basis of the hedged item, while the corresponding change in the

fair value of the derivative instrument is recorded as an adjustment to other assets or other liabilities, as

applicable. Hedge ineffectiveness exists to the extent the changes in fair value of the derivative do not offset the

changes in fair value of the hedged item as other non-interest expense.

Regions enters into interest rate swap agreements to manage interest rate exposure on the Company’s fixed-

rate borrowings, which includes long-term debt and certificates of deposit. These agreements involve the receipt

of fixed-rate amounts in exchange for floating-rate interest payments over the life of the agreements. As of

December 31, 2009, the total notional amount of the Company’s interest rate swaps designated in fair value

hedges was $10.3 billion.

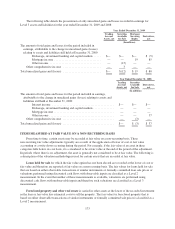

CASH FLOW HEDGES

Cash flow hedge relationships mitigate exposure to the variability of future cash flows or other forecasted

transactions. For cash flow hedge relationships, the effective portion of the gain or loss related to the derivative

instrument is recognized as a component of other comprehensive income. Ineffectiveness is measured by

166