Regions Bank 2009 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

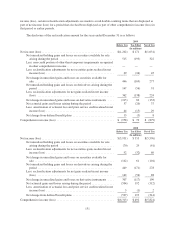

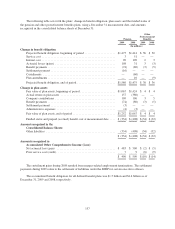

income (loss), certain reclassification adjustments are made to avoid double-counting items that are displayed as

part of net income (loss) for a period that also had been displayed as part of other comprehensive income (loss) in

that period or earlier periods.

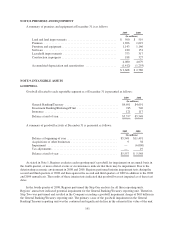

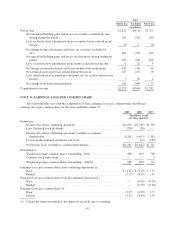

The disclosure of the reclassification amount for the years ended December 31 is as follows:

2009

Before Tax Tax Effect Net of Tax

(In millions)

Net income (loss) ................................................. $(1,202) $ 171 $(1,031)

Net unrealized holding gains and losses on securities available for sale

arising during the period ..................................... 515 (193) 322

Less: non-credit portion of other-than-temporary impairments recognized

in other comprehensive income ................................ — — —

Less: reclassification adjustments for net securities gains realized in net

income (loss) .............................................. 69 (24) 45

Net change in unrealized gains and losses on securities available for

sale ...................................................... 446 (169) 277

Net unrealized holding gains and losses on derivatives arising during the

period .................................................... 147 (56) 91

Less: reclassification adjustments for net gains realized in net income

(loss) .................................................... 362 (138) 224

Net change in unrealized gains and losses on derivative instruments .... (215) 82 (133)

Net actuarial gains and losses arising during the period ............... 57 (20) 37

Less: amortization of actuarial loss and prior service credit realized in net

income (loss) .............................................. 44 (15) 29

Net change from defined benefit plans ............................ 13 (5) 8

Comprehensive income (loss) ....................................... $ (958) $ 79 $ (879)

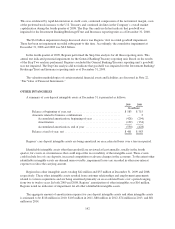

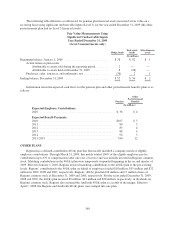

2008

Before Tax Tax Effect Net of Tax

(In millions)

Net income (loss) ................................................. $(5,951) $ 355 $(5,596)

Net unrealized holding gains and losses on securities available for sale

arising during the period ..................................... (70) 29 (41)

Less: reclassification adjustments for net securities gains realized in net

income (loss) .............................................. 92 (32) 60

Net change in unrealized gains and losses on securities available for

sale ...................................................... (162) 61 (101)

Net unrealized holding gains and losses on derivatives arising during the

period .................................................... 449 (171) 278

Less: reclassification adjustments for net gains realized in net income

(loss) .................................................... 142 (54) 88

Net change in unrealized gains and losses on derivative instruments .... 307 (117) 190

Net actuarial gains and losses arising during the period ............... (504) 192 (312)

Less: amortization of actuarial loss and prior service credit realized in net

income (loss) .............................................. 3 (1) 2

Net change from defined benefit plans ............................ (507) 193 (314)

Comprehensive income (loss) ....................................... $(6,313) $ 492 $(5,821)

151