Regions Bank 2009 Annual Report Download - page 53

Download and view the complete annual report

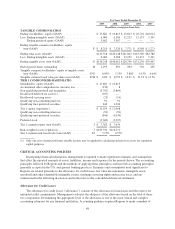

Please find page 53 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 6. Management’s Discussion and Analysis of Financial Condition and Results of Operation

Item 6A. Quantitative and Qualitative Disclosures about Market Risk

INTRODUCTION

GENERAL

The following discussion and financial information is presented to aid in understanding Regions Financial

Corporation’s (“Regions” or the “Company”) financial position and results of operations. The emphasis of this

discussion will be on the years 2009, 2008 and 2007; in addition, financial information for prior years will also

be presented when appropriate. Certain amounts in prior year presentations have been reclassified to conform to

the current year presentation, except as otherwise noted.

Regions’ profitability, like that of many other financial institutions, is dependent on its ability to generate

revenue from net interest income and non-interest income sources. Net interest income is the difference between

the interest income Regions receives on interest-earning assets, such as loans and securities, and the interest

expense Regions pays on interest-bearing liabilities, principally deposits and borrowings. Regions’ net interest

income is impacted by the size and mix of its balance sheet components and the interest rate spread between

interest earned on its assets and interest paid on its liabilities. Non-interest income includes fees from service

charges on deposit accounts, brokerage, investment banking, capital markets, and trust activities, mortgage

servicing and secondary marketing, insurance activities, and other customer services which Regions provides.

Results of operations are also affected by the provision for loan losses and non-interest expenses such as salaries

and employee benefits, occupancy, professional fees, FDIC insurance and other operating expenses, including

income taxes. In 2008, Regions’ non-interest expense was impacted by a non-cash goodwill impairment charge.

Economic conditions, competition, and the monetary and fiscal policies of the Federal government

significantly affect financial institutions, including Regions. Lending and deposit activities and fee income

generation are influenced by levels of business spending and investment, consumer income, consumer spending

and savings, capital market activities, and competition among financial institutions, as well as customer

preferences, interest rate conditions and prevailing market rates on competing products in Regions’ market areas.

Regions’ business strategy has been and continues to be focused on providing a competitive mix of products

and services, delivering quality customer service and maintaining a branch distribution network with offices in

convenient locations. Regions delivers this business with the personal attention and feel of a community bank

and with the service and product offerings of a large regional bank.

Acquisitions

The acquisitions of banks and other financial services companies have historically contributed significantly

to Regions’ growth. The acquisitions of other financial services companies have also allowed Regions to better

diversify its revenue stream and to offer additional products and services to its customers. From time to time,

Regions evaluates potential bank and non-bank acquisition candidates.

On February 6, 2009, Regions acquired from the Federal Deposit Insurance Corporation (“FDIC”)

approximately $285 million in total deposits from a failed bank headquartered in Henry County, Georgia. Under

the terms of the agreement with the FDIC, Regions assumed operations of the bank’s four branches and provides

banking services to its former customers.

In September, 2008, Regions acquired from the FDIC approximately $900 million of deposits, primarily

time deposits, from a failed bank headquartered in Alpharetta, Georgia. Under the terms of the agreement with

the FDIC, Regions assumed operations of the bank’s four branches and provides banking services to its former

customers.

39