Regions Bank 2009 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the Company is no longer subject to state and local income tax examinations by tax authorities for years before

2003, which would include audits of acquired entities. Certain states have proposed various adjustments to the

Company’s previously filed tax returns. Management is currently evaluating those proposed adjustments;

however, the Company does not anticipate the adjustments would result in a material change to its financial

position or results of operations.

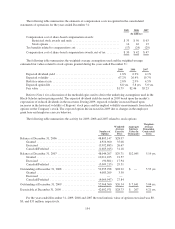

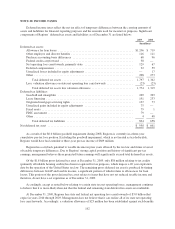

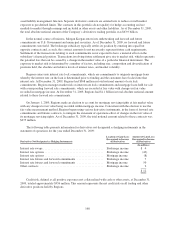

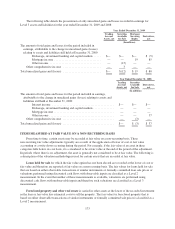

A reconciliation of the beginning and ending amount of gross unrecognized tax benefits is as follows:

2009 2008

(In millions)

Balance at beginning of year ....................................................... $55 $746

Additions based on tax positions taken in a prior period .............................. 14 2

Additions based on tax positions related to the current year ........................... 5 76

Settlements/releases .......................................................... (48) (769)

Balance at end of year ............................................................ $26 $ 55

Essentially all of the Company’s liability for gross unrecognized tax benefits would reduce the Company’s

effective tax rate, if recognized. As of December 31, 2009, Regions recognized a liability for interest on

uncertain tax positions of $5 million on a pre-tax basis. Additionally, during the year ended December 31, 2009,

Regions recognized interest expense on uncertain tax positions of $5 million, on a pre-tax basis. During 2009, the

Company filed amended state and local income tax returns to reflect the agreement reached with the IRS for tax

years 1999-2006. This accounted for a $52 million decrease in gross unrecognized tax benefits including interest,

and a $26 million decrease related to various other state audit settlements.

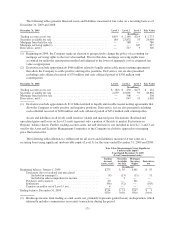

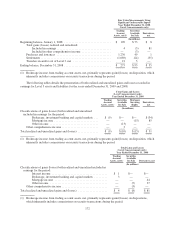

NOTE 21. DERIVATIVE FINANCIAL INSTRUMENTS AND HEDGING ACTIVITIES

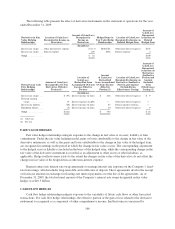

Regions enters into derivative financial instruments to manage interest rate risk, facilitate asset/liability

management strategies and manage other exposures. These derivative instruments primarily include interest rate

swaps, options on interest rate swaps, interest rate caps and floors, Eurodollar futures, forward rate contracts and

forward sale commitments. All derivative financial instruments are recognized on the consolidated balance sheets

as other assets or other liabilities, as applicable, at fair value. Regions enters into master netting agreements with

counterparties and/or requires collateral based on counterparty credit ratings to cover exposures.

Interest rate swaps are agreements to exchange interest payments based upon notional amounts. Interest rate

swaps subject Regions to market risk associated with changes in interest rates, as well as the credit risk that the

counterparty will fail to perform. Option contracts involve rights to buy or sell financial instruments on a

specified date or over a period at a specified price. These rights do not have to be exercised. Some option

contracts such as interest rate floors, involve the exchange of cash based on changes in specified indices. Interest

rate floors are contracts to hedge interest rate declines based on a notional amount. Interest rate floors subject

Regions to market risk associated with changes in interest rates, as well as the credit risk that the counterparty

will fail to perform. Forward rate contracts are commitments to buy or sell financial instruments at a future date

at a specified price or yield. Regions primarily enters into forward rate contracts on marketable instruments,

which expose Regions to market risk associated with changes in the value of the underlying financial instrument,

as well as the credit risk that the counterparty will fail to perform. Eurodollar futures are futures contracts on

Eurodollar deposits. Eurodollar futures subject Regions to market risk associated with changes in interest rates.

Because futures contracts are cash settled daily, there is minimal credit risk associated with Eurodollar futures.

164