Regions Bank 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

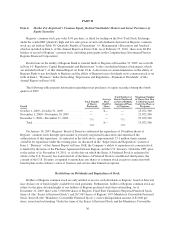

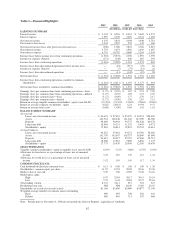

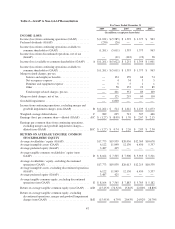

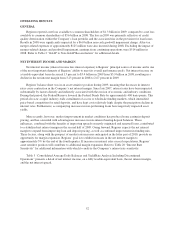

Table 1—Financial Highlights

2009 2008 2007 2006 2005

(In millions, except per share data)

EARNINGS SUMMARY

Interest income ................................................ $ 5,332 $ 6,563 $ 8,074 $ 5,649 $ 4,271

Interest expense ............................................... 1,997 2,720 3,676 2,341 1,490

Net interest income ............................................ 3,335 3,843 4,398 3,308 2,781

Provision for loan losses ........................................ 3,541 2,057 555 142 166

Net interest income (loss) after provision for loan losses ............... (206) 1,786 3,843 3,166 2,615

Non-interest income ............................................ 3,755 3,073 2,856 2,030 1,687

Non-interest expense ........................................... 4,751 10,792 4,660 3,204 2,943

Income (loss) before income taxes from continuing operations .......... (1,202) (5,933) 2,039 1,992 1,359

Income tax expense (benefit) ..................................... (171) (348) 646 619 396

Income (loss) from continuing operations ........................... (1,031) (5,585) 1,393 1,373 963

Income (loss) from discontinued operations before income taxes ........ — (18) (217) (32) 64

Income tax expense (benefit) ..................................... — (7) (75) (13) 26

Income (loss) from discontinued operations ......................... — (11) (142) (19) 38

Net income (loss) .............................................. $ (1,031) $ (5,596) $ 1,251 $ 1,354 $ 1,001

Income (loss) from continuing operations available to common

shareholders ................................................ $ (1,261) $ (5,611) $ 1,393 $ 1,373 $ 963

Net income (loss) available to common shareholders .................. $ (1,261) $ (5,622) $ 1,251 $ 1,354 $ 1,001

Earnings (loss) per common share from continuing operations—basic .... $ (1.27) $ (8.07) $ 1.97 $ 2.74 $ 2.09

Earnings (loss) per common share from continuing operations—diluted . . . (1.27) (8.07) 1.95 2.71 2.07

Earnings (loss) per common share—basic .......................... (1.27) (8.09) 1.77 2.70 2.17

Earnings (loss) per common share—diluted ......................... (1.27) (8.09) 1.76 2.67 2.15

Return on average tangible common stockholders’ equity (non-GAAP) . . . (15.45)% (74.32)% 15.82% 22.86% 18.80%

Return on average common stockholders’ equity ..................... (8.82) (28.81) 6.24 10.94 9.37

Return on average total assets .................................... (0.88) (3.90) 0.90 1.41 1.18

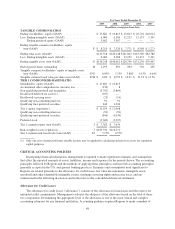

BALANCE SHEET SUMMARY

At year-end

Loans, net of unearned income ............................... $ 90,674 $ 97,419 $ 95,379 $ 94,551 $58,405

Assets ................................................... 142,318 146,248 141,042 143,369 84,786

Deposits ................................................. 98,680 90,904 94,775 101,228 60,378

Long-term debt ........................................... 18,464 19,231 11,325 8,643 6,972

Stockholders’ equity ....................................... 17,881 16,813 19,823 20,701 10,614

Average balances

Loans, net of unearned income ............................... 94,523 97,601 94,372 64,766 58,002

Assets ................................................... 142,759 143,947 138,757 95,800 85,096

Deposits ................................................. 94,612 90,077 95,725 67,466 59,713

Long-term debt ........................................... 18,588 13,510 9,698 6,856 7,175

Stockholders’ equity ....................................... 17,773 19,939 20,036 12,369 10,678

SELECTED RATIOS

Tangible common stockholders’ equity to tangible assets (non-GAAP) . . . 6.03% 5.23% 5.88% 6.53% 6.64%

Allowance for loan losses as a percentage of loans, net of unearned

income .................................................... 3.43 1.87 1.39 1.12 1.34

Allowance for credit losses as a percentage of loans, net of unearned

income .................................................... 3.52 1.95 1.45 1.17 1.34

COMMON STOCK DATA

Cash dividends declared per common share ......................... $ 0.13 $ 0.96 $ 1.46 $ 1.40 $ 1.36

Stockholders’ common equity per share ............................ 11.97 19.53 28.58 28.36 23.26

Market value at year end ........................................ 5.29 7.96 23.65 37.40 34.16

Market price range:

High .................................................... 9.07 25.84 38.17 39.15 35.54

Low .................................................... 2.35 6.41 22.84 32.37 29.16

Total trading volume ........................................... 8,747 3,411 912 301 227

Dividend payout ratio .......................................... NM NM 82.49 51.85 62.67

Shareholders of record at year-end (actual) .......................... 81,166 83,600 85,060 84,877 72,140

Weighted-average number of common shares outstanding

Basic ................................................... 989 695 708 502 461

Diluted .................................................. 989 695 713 507 466

Note: Periods prior to November 4, 2006 do not include the effect of Regions’ acquisition of AmSouth.

42