Regions Bank 2009 Annual Report Download - page 141

Download and view the complete annual report

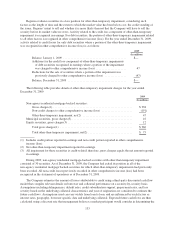

Please find page 141 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.accounted for as liabilities in the consolidated balance sheets. The cash settled RSUs are subject to a vesting

period ranging from two weeks to one year and, following the vesting period, are subject to transfer restrictions

and a delayed payment, which can range from six months to two years. The grant date fair value of the award is

determined in the same manner as other restricted stock awards and is charged to the statement of operations over

the vesting period. Changes in Regions’ stock price over the delayed payment period are charged to the statement

of operations.

REVENUE RECOGNITION

The largest source of revenue for Regions is interest income. Interest income is recognized on an accrual

basis driven by nondiscretionary formulas based on written contracts, such as loan agreements or securities

contracts. Credit-related fees, including letter of credit fees, are recognized in non-interest income when earned.

Regions recognizes commission revenue and brokerage, exchange and clearance fees on a trade-date basis. Other

types of non-interest revenues, such as service charges on deposits and trust revenues, are accrued and

recognized into income as services are provided and the amount of fees earned are reasonably determinable.

PER SHARE AMOUNTS

Earnings (loss) per common share computations are based upon the weighted-average number of shares

outstanding during the period. Diluted earnings (loss) per common share computations are based upon the

weighted- average number of shares outstanding during the period, plus the effect of outstanding stock options

and stock performance awards if dilutive. The diluted earnings (loss) per common share computation also

assumes conversion of convertible preferred stock and warrants, unless such an assumed conversion would be

antidilutive.

RECENT ACCOUNTING PRONOUNCEMENTS AND ACCOUNTING CHANGES

In September 2006, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial

Accounting Standards No. 157 “Fair Value Measurements”, codified in the “Fair Value Measurements and

Disclosures” Topic (“Fair Value Topic”) of the FASB Accounting Standards Codification (“ASC”), which

provides guidance for using fair value to measure assets and liabilities, but does not expand the use of fair value

in any circumstance. The guidance also requires expanded disclosures about the extent to which a company

measures assets and liabilities at fair value, the information used to measure fair value, and the effect of fair

value measurements on an entity’s financial statements. The provisions apply when other guidance requires or

permits assets and liabilities to be measured at fair value. The Fair Value Topic is effective for financial

statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal

years, with early adoption permitted. Regions adopted the provisions on January 1, 2008, and the effect of

adoption on the consolidated financial statements was not material. Additionally, in February 2008, the FASB

issued FSP 157-2, “Effective Date of FASB Statement No. 157”, also codified in the Fair Value Topic, which

delays the effective date for non-recurring, non-financial instruments to fiscal years beginning after

November 15, 2008. Regions implemented these provisions as of January 1, 2009. Refer to Note 22, “Fair Value

Measurements” for additional information about the impact of the adoption of the Fair Value Topic.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141 (revised 2007),

“Business Combinations”, codified in the “Business Combinations” Topic of the ASC. The guidance requires the

acquiring entity in a business combination to recognize all (and only) the assets acquired and liabilities assumed

in the transaction; establishes the acquisition-date fair value as the measurement objective for all assets acquired

and liabilities assumed; and requires the acquirer to disclose to investors and other users all of the information

needed to evaluate and understand the nature and financial effect of the business combination. The provisions are

effective for fiscal years beginning after December 15, 2008. Regions adopted these provisions as of January 1,

2009, and the adoption did not have a material impact on Regions’ consolidated financial statements. However,

the adoption of these provisions could have a material impact to the consolidated financial statements for

prospective business combinations.

127