Regions Bank 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Regions manages loan growth with a focus on risk management and risk adjusted return on capital. Regions

is continuing to make credit available to consumers, small businesses and commercial companies as intended by

Treasury and the Congress in establishing the government investment in banks (See “Stockholders’ Equity”

section found later in this report). However, loan balances have declined between years as a result of decreased

loan demand in response to economic pressures.

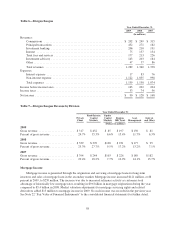

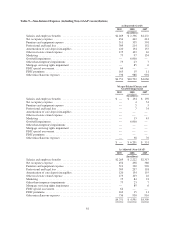

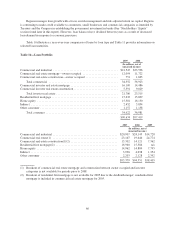

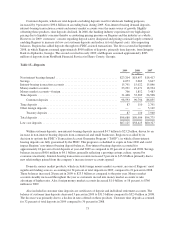

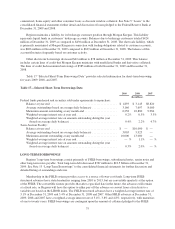

Table 10 illustrates a year-over-year comparison of loans by loan type and Table 11 provides information on

selected loan maturities.

Table 10—Loan Portfolio

2009 2008

(In millions, net of

unearned income)

Commercial and industrial ............................................ $21,547 $23,596

Commercial real estate mortgage—owner occupied ........................ 12,054 11,722

Commercial real estate construction—owner occupied ...................... 751 1,605

Total commercial ............................................... 34,352 36,923

Commercial investor real estate mortgage ................................ 16,109 14,486

Commercial investor real estate construction .............................. 5,591 9,029

Total investor real estate .......................................... 21,700 23,515

Residential first mortgage ............................................. 15,632 15,839

Home equity ....................................................... 15,381 16,130

Indirect ........................................................... 2,452 3,854

Other consumer ..................................................... 1,157 1,158

Total consumer ................................................. 34,622 36,981

$90,674 $97,419

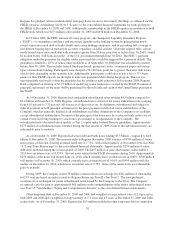

2007 2006 2005

(In millions, net of

unearned income)

Commercial and industrial ............................................ $20,907 $24,145 $14,728

Commercial real estate(1) ............................................ 23,107 19,646 24,774

Commercial real estate construction(1)(2) ................................ 13,302 14,121 7,362

Residential first mortgage(2) .......................................... 16,960 15,584 n/a

Home equity ....................................................... 14,962 14,889 7,795

Indirect ........................................................... 3,938 4,038 1,354

Other consumer .................................................... 2,203 2,128 2,392

$95,379 $94,551 $58,405

(1) Breakout of commercial real estate mortgage and construction between owner occupied and investor

categories is not available for periods prior to 2008.

(2) Breakout of residential first mortgage is not available for 2005 due to the AmSouth merger; residential first

mortgage is included in commercial real estate mortgage for 2005.

66