Regions Bank 2009 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

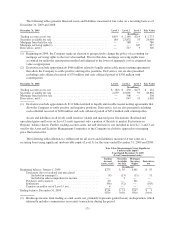

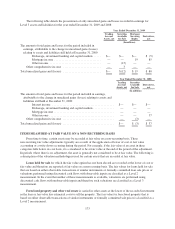

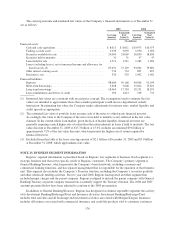

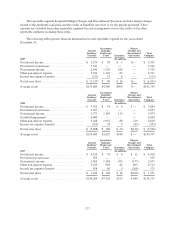

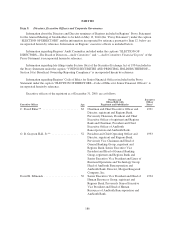

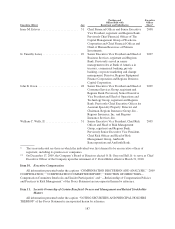

The reportable segment designated Merger Charges and Discontinued Operations includes merger charges

related to the AmSouth acquisition and the results of EquiFirst (see Note 3) for the periods presented. These

amounts are excluded from other reportable segments because management reviews the results of the other

reportable segments excluding these items.

The following tables present financial information for each reportable segment for the years ended

December 31:

General

Banking/

Treasury

Investment

Banking/

Brokerage/

Trust Insurance

Merger

Charges and

Discontinued

Operations

Total

Company

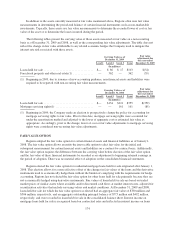

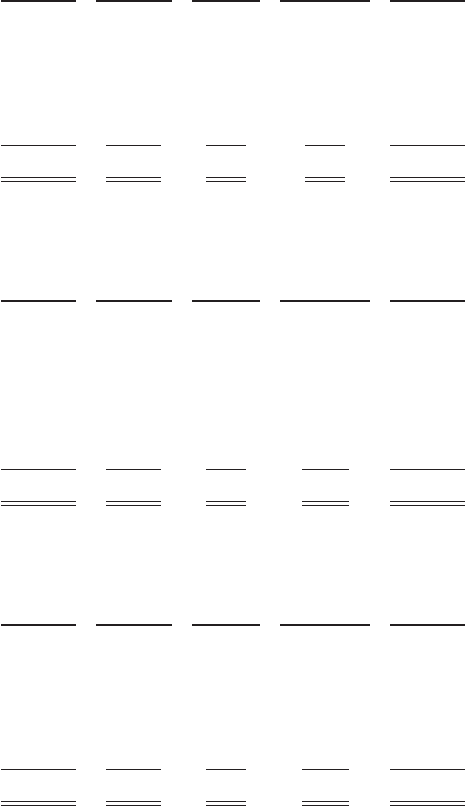

2009 (In millions)

Net interest income ........................... $ 3,274 $ 58 $ 3 $— $ 3,335

Provision for loan losses ....................... 3,541 — — — 3,541

Non-interest income .......................... 2,440 1,207 108 — 3,755

Other non-interest expense ..................... 3,542 1,122 87 — 4,751

Income tax expense (benefit) ................... (232) 53 8 — (171)

Net income (loss) ............................ $ (1,137) $ 90 $ 16 $— $ (1,031)

Average assets .............................. $137,683 $4,586 $490 $— $142,759

General

Banking/

Treasury

Investment

Banking/

Brokerage/

Trust Insurance

Merger

Charges and

Discontinued

Operations

Total

Company

2008 (In millions)

Net interest income ........................... $ 3,765 $ 74 $ 4 $ — $ 3,843

Provision for loan losses ....................... 2,057 — — — 2,057

Non-interest income .......................... 1,777 1,183 113 — 3,073

Goodwill impairment ......................... 6,000 — — — 6,000

Other non-interest expense ..................... 3,448 1,055 88 219 4,810

Income tax expense (benefit) ................... (355) 74 9 (83) (355)

Net income (loss) ............................ $ (5,608) $ 128 $ 20 $(136) $ (5,596)

Average assets .............................. $139,984 $3,623 $340 $ — $143,947

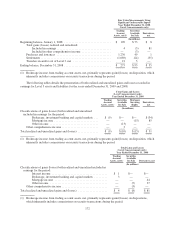

General

Banking/

Treasury

Investment

Banking/

Brokerage/

Trust Insurance

Merger

Charges and

Discontinued

Operations

Total

Company

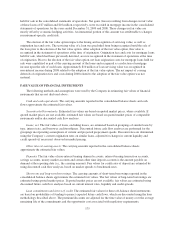

2007 (In millions)

Net interest income ........................... $ 4,314 $ 78 $ 6 $ 12 $ 4,410

Provision for loan losses ....................... 555 — — — 555

Non-interest income .......................... 1,569 1,184 103 (177) 2,679

Other non-interest expense ..................... 3,229 998 82 403 4,712

Income tax expense (benefit) ................... 674 96 9 (208) 571

Net income (loss) ............................ $ 1,425 $ 168 $ 18 $(360) $ 1,251

Average assets .............................. $134,284 $3,718 $275 $ 480 $138,757

177