Regions Bank 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

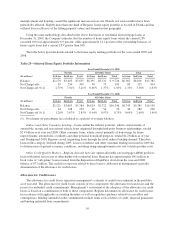

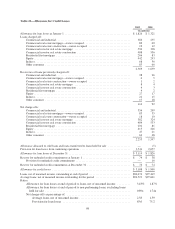

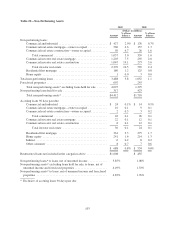

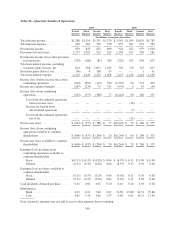

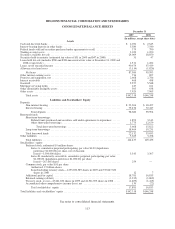

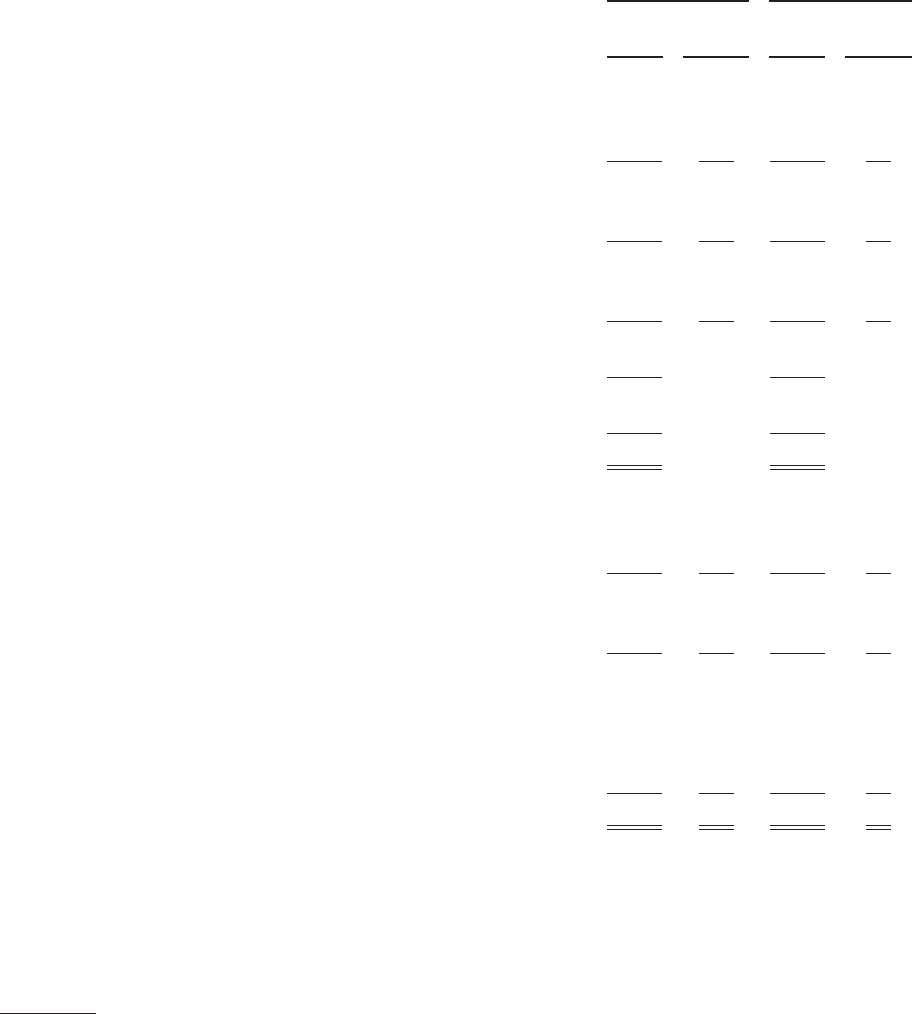

Table 29—Non-Performing Assets

2009 2008

(Dollars in millions)

Amount

% of loan

balance Amount

% of loan

balance

Non-performing loans:

Commercial and industrial ................................. $ 427 2.0% $ 176 0.7%

Commercial real estate mortgage—owner occupied ............. 560 4.6 157 1.3

Commercial real estate construction—owner occupied ........... 50 6.7 26 1.6

Total commercial .................................... 1,037 3.0 359 1.0

Commercial investor real estate mortgage ..................... 1,203 7.5 292 2.0

Commercial investor real estate construction .................. 1,067 19.1 273 3.0

Total investor real estate .............................. 2,270 10.5 565 2.4

Residential first mortgage ................................. 180 1.2 125 0.8

Home equity ............................................ 1 0.0 3 0.0

Total non-performing loans .................................... 3,488 3.8 1,052 1.1

Foreclosed properties ......................................... 607 243

Total non-performing assets* excluding loans held for sale ....... 4,095 1,295

Non-performing loans held for sale .............................. 317 423

Total non-performing assets* ............................... $4,412 $1,718

Accruing loans 90 days past due:

Commercial and industrial ................................. $ 24 0.1% $ 14 0.1%

Commercial real estate mortgage—owner occupied ............. 16 0.1 9 0.1

Commercial real estate construction—owner occupied ........... 2 0.3 3 0.2

Total commercial .................................... 42 0.1 26 0.1

Commercial investor real estate mortgage ..................... 22 0.1 12 0.1

Commercial investor real estate construction .................. 8 0.1 12 0.1

Total investor real estate .............................. 30 0.1 24 0.1

Residential first mortgage ................................. 361 2.3 275 1.7

Home equity ............................................ 241 1.6 214 1.3

Indirect ................................................ 6 0.2 8 0.2

Other consumer ......................................... 8 0.7 7 0.6

$ 688 0.8% $ 554 0.6%

Restructured loans not included in the categories above .............. $1,608 $ 455

Non-performing loans* to loans, net of unearned income ............. 3.85% 1.08%

Non-performing assets* excluding loans held for sale, to loans, net of

unearned income and foreclosed properties ...................... 4.49% 1.33%

Non-performing assets* to loans, net of unearned income and foreclosed

properties ................................................ 4.83% 1.76%

* Exclusive of accruing loans 90 days past due

103