Regions Bank 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

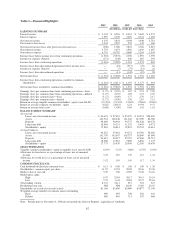

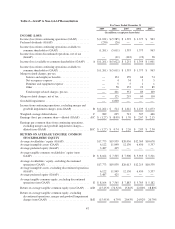

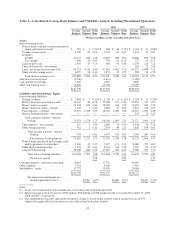

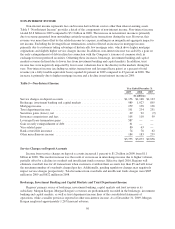

For Years Ended December 31

2009 2008 2007 2006 2005

(In millions, except per share data)

TANGIBLE COMMON RATIOS

Ending stockholders’ equity (GAAP) ................... $ 17,881 $ 16,813 $ 19,823 $ 20,701 $10,614

Less: Ending intangible assets (GAAP) ................. 6,060 6,186 12,252 12,133 5,341

Ending preferred equity (GAAP) ................. 3,602 3,307 — — —

Ending tangible common stockholders’ equity

(non-GAAP) .................................... F $ 8,219 $ 7,320 $ 7,571 $ 8,568 $ 5,273

Ending total assets (GAAP) .......................... $142,318 $146,248 $141,042 $143,369 $84,786

Less: Ending intangible assets (GAAP) ................. 6,060 6,186 12,252 12,133 5,341

Ending tangible assets (non-GAAP) .................... G $136,258 $140,062 $128,790 $131,236 $79,445

End of period shares outstanding ...................... H 1,193 691 694 730 456

Tangible common stockholders’ equity to tangible assets

(non-GAAP) .................................... F/G 6.03% 5.23% 5.88% 6.53% 6.64%

Tangible common book value per share (non-GAAP) ...... F/H $ 6.89 $ 10.59 $ 10.91 $ 11.74 $ 11.56

TIER 1 COMMON RISK-BASED RATIO

Stockholders’ equity (GAAP) ......................... $ 17,881 $ 16,813

Accumulated other comprehensive (income) loss ......... (130) 8

Non-qualifying goodwill and intangibles ................ (5,792) (5,864)

Disallowed deferred tax assets(1) ...................... (947) —

Disallowed servicing assets .......................... (25) (16)

Qualifying non-controlling interests .................... 91 91

Qualifying trust preferred securities .................... 846 1,036

Tier 1 capital (regulatory) ............................ $ 11,924 $ 12,068

Qualifying non-controlling interests .................... (91) (91)

Qualifying trust preferred securities .................... (846) (1,036)

Preferred stock .................................... (3,602) (3,307)

Tier 1 common equity (non-GAAP) .................... I $ 7,385 $ 7,634

Risk-weighted assets (regulatory) ...................... J $103,330 $116,251

Tier 1 common risk-based ratio (non-GAAP) ............ I/J 7.15% 6.57%

(1) Only one year of projected future taxable income may be applied in calculating deferred tax assets for regulatory

capital purposes.

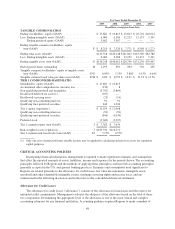

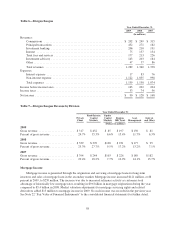

CRITICAL ACCOUNTING POLICIES

In preparing financial information, management is required to make significant estimates and assumptions

that affect the reported amounts of assets, liabilities, income and expenses for the periods shown. The accounting

principles followed by Regions and the methods of applying these principles conform with accounting principles

generally accepted in the U.S. and general banking practices. Estimates and assumptions most significant to

Regions are related primarily to the allowance for credit losses, fair value measurements, intangible assets

(goodwill and other identifiable intangible assets), mortgage servicing rights and income taxes, and are

summarized in the following discussion and in the notes to the consolidated financial statements.

Allowance for Credit Losses

The allowance for credit losses (“allowance”) consists of the allowance for loan losses and the reserve for

unfunded credit commitments. Management evaluates the adequacy of the allowance based on the total of these

two components. Determining the appropriate level of the allowance is one of the most critical and complex

accounting estimates for any financial institution. Accounting guidance requires Regions to make a number of

48