Regions Bank 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

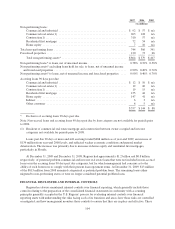

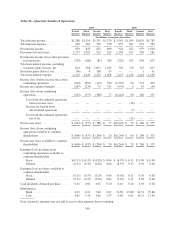

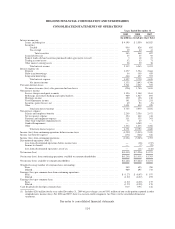

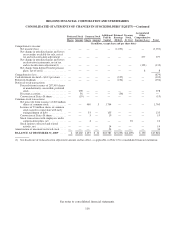

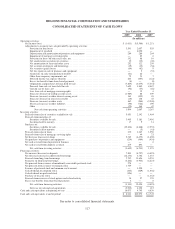

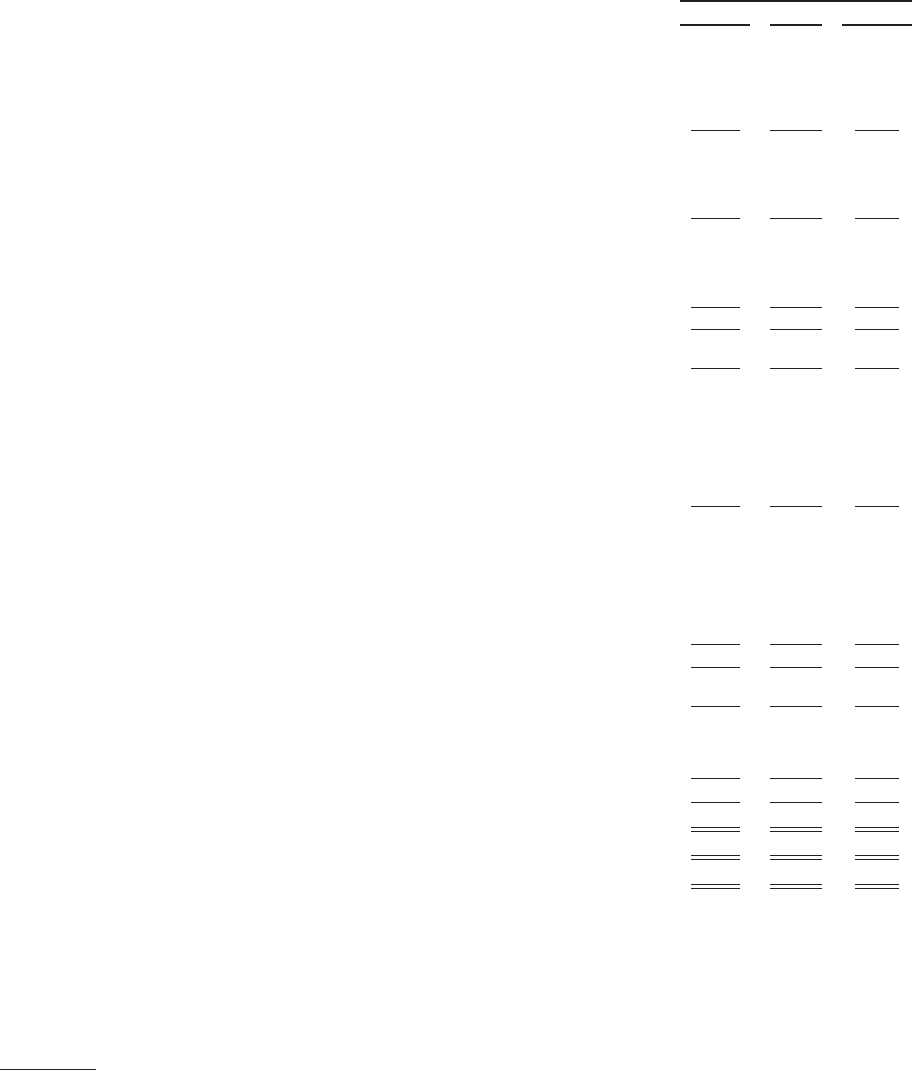

REGIONS FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

Years Ended December 31

2009 2008 2007

(In millions, except per share data)

Interest income on:

Loans, including fees ............................................................. $4,199 $ 5,550 $6,925

Securities:

Taxable .................................................................... 966 828 856

Tax-exempt ................................................................ 19 40 41

Total securities .......................................................... 985 868 897

Loans held for sale ............................................................... 55 35 92

Federal funds sold and securities purchased under agreements to resell ...................... 3 18 51

Trading account assets ............................................................ 62 63 71

Other interest-earning assets ....................................................... 28 29 38

Total interest income ......................................................... 5,332 6,563 8,074

Interest expense on:

Deposits ....................................................................... 1,277 1,724 2,664

Short-term borrowings ............................................................ 54 369 459

Long-term borrowings ............................................................ 666 627 553

Total interest expense ......................................................... 1,997 2,720 3,676

Net interest income .......................................................... 3,335 3,843 4,398

Provision for loan losses .............................................................. 3,541 2,057 555

Net interest income (loss) after provision for loan losses ................................. (206) 1,786 3,843

Non-interest income:

Service charges on deposit accounts ................................................. 1,156 1,148 1,163

Brokerage, investment banking and capital markets ..................................... 989 1,027 895

Mortgage income ................................................................ 259 138 136

Trust department income .......................................................... 191 234 251

Securities gains (losses), net ....................................................... 69 92 (9)

Other ......................................................................... 1,091 434 420

Total non-interest income ..................................................... 3,755 3,073 2,856

Non-interest expense:

Salaries and employee benefits ..................................................... 2,269 2,356 2,472

Net occupancy expense ........................................................... 454 442 414

Furniture and equipment expense ................................................... 311 335 301

Other-than-temporary impairments(1) ................................................ 75 23 7

Goodwill impairment ............................................................. — 6,000 —

Other ......................................................................... 1,642 1,636 1,466

Total non-interest expense ..................................................... 4,751 10,792 4,660

Income (loss) from continuing operations before income taxes ................................ (1,202) (5,933) 2,039

Income tax (benefit) expense ........................................................... (171) (348) 646

Income (loss) from continuing operations ................................................. (1,031) (5,585) 1,393

Discontinued operations (Note 3):

Loss from discontinued operations before income taxes .................................. — (18) (217)

Income tax benefit ............................................................... — (7) (75)

Loss from discontinued operations, net of tax .......................................... — (11) (142)

Net income (loss) .................................................................... $(1,031) $ (5,596) $1,251

Net income (loss) from continuing operations available to common shareholders .................. $(1,261) $ (5,611) $1,393

Net income (loss) available to common shareholders ........................................ $(1,261) $ (5,622) $1,251

Weighted-average number of common shares outstanding:

Basic .......................................................................... 989 695 708

Diluted ........................................................................ 989 695 713

Earnings (loss) per common share from continuing operations:

Basic .......................................................................... $ (1.27) $ (8.07) $ 1.97

Diluted ........................................................................ (1.27) (8.07) 1.95

Earnings (loss) per common share:

Basic .......................................................................... (1.27) (8.09) 1.77

Diluted ........................................................................ (1.27) (8.09) 1.76

Cash dividends declared per common share 0.13 0.96 1.46

(1) Includes $266 million for the year ended December 31, 2009 of gross charges, net of $191 million of non-credit portion reported in other

comprehensive income (loss). For 2008 and 2007, there was no non-credit component. See Note 4 to the consolidated financial

statements.

See notes to consolidated financial statements.

114